Solana emerges as institutional hub for RWAs: RedStone Report

A report by RedStone highlights how Solana is becoming the backbone of the blockchain infrastructure for capital markets.

- Solana holds $700 million in RWAs and $13.5 billion including stablecoins

- Network performance is a key driver of Solana’s growing dominance in the sector

- BlackRock, Apollo Global, Janus Henderson, and VanEck are among the big-name adopters

Solana ( SOL ) is emerging as the blockchain backbone of capital markets, capturing a major share of real-world asset tokenization. On Monday, September 29, blockchain oracle network RedStone published a report detailing Solana’s increasing dominance in RWAs.

According to the report, Solana hosts $700 million in RWA assets, and over $13.5 billion if including stablecoins. The RWA figure grew by more than 500% year over year, making Solana one of the largest networks for tokenized assets.

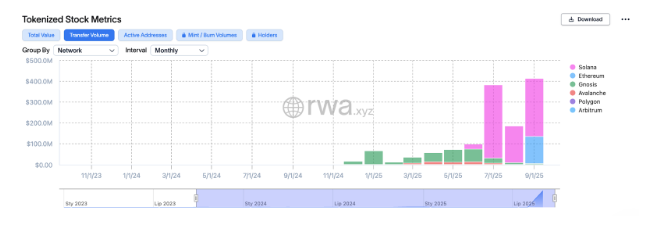

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

For instance, following the xStocks integration with the network, Solana (SOL) trading volumes for tokenized equities quickly surpassed those for Ethereum. This acceleration benefited from partnerships with exchanges such as Kraken , which aim to enable fast and low-cost transfers for their users.

Solana dominates through performance

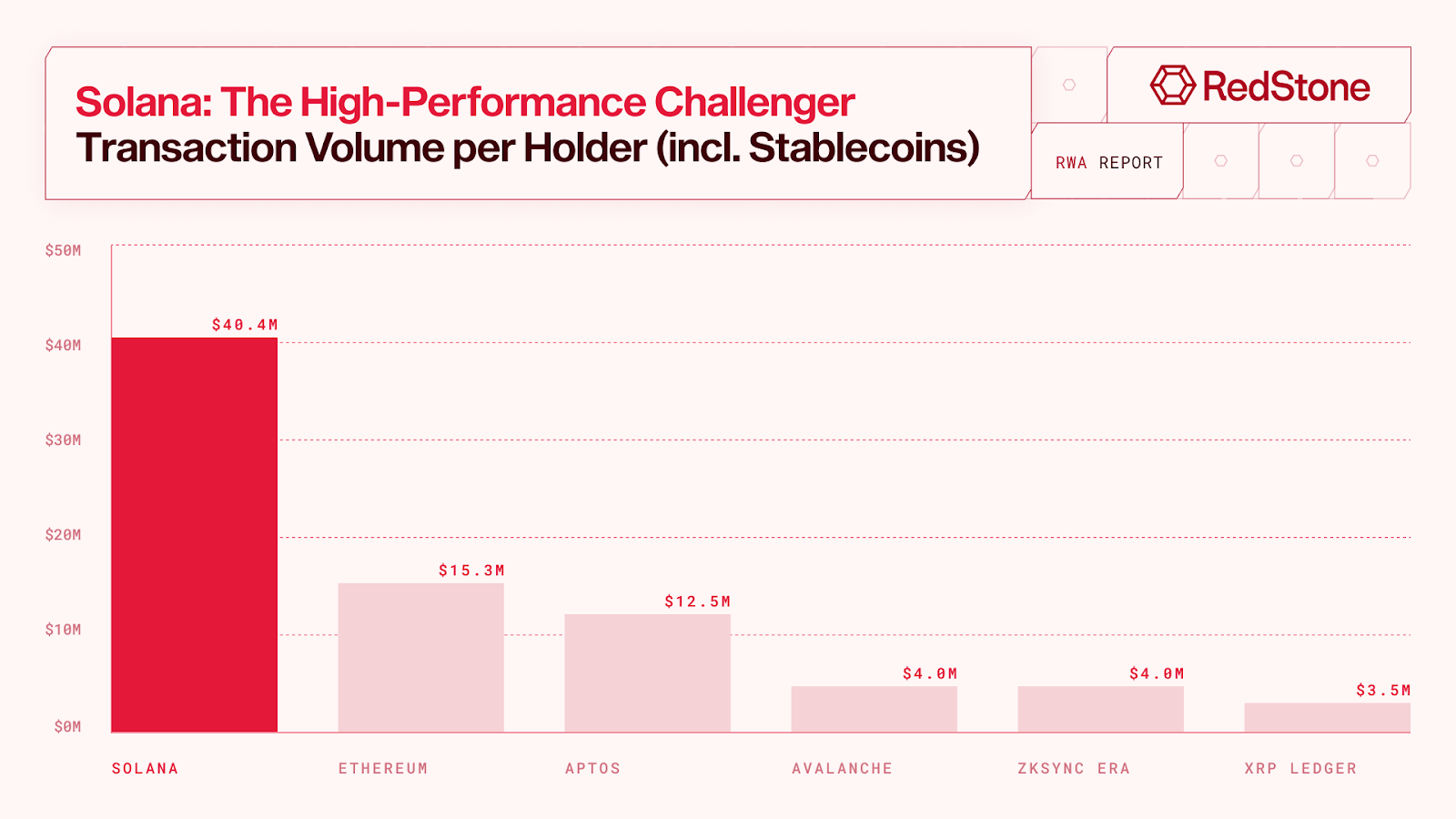

RedStone’s report highlights Solana’s performance as one of the main reasons for its dominance in asset tokenization. According to the report, institutional investors rely on high throughput for their RWA applications. Solana, which boasts a capacity to handle up to 100,000 TPS, is a natural choice for many.

Transaction volume per RWA address on major chains as of June 2025 | Source: RedStone

Transaction volume per RWA address on major chains as of June 2025 | Source: RedStone

“For RWAs, there are really only 2 places: It’s either Ethereum or Solana,” said Robert Leshner, CEO of the tokenization platforms Superstate.

This performance has attracted big names to the network, including BlackRock, Apollo Global, Janus Henderson, and VanEck. Moreover, Solana also hosts popular applications like Phantom, Raydium, Jupiter, and Pump.fun, demonstrating its appeal among retail users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB News Today: BNB Faces Crucial $870 Threshold—Will Bulls Ignite a Rally Toward $1,000?

- BNB rebounds above $860, with technical indicators and Binance's $51.1B stablecoin liquidity supporting a potential $989 rally. - Analysts predict $950–$1,000 by December 2025 if RSI hits oversold levels and a Golden Cross forms. - However, a breakdown below $790.79 risks a decline to $700–750 amid broader crypto market fragility. - Binance's dominance in stablecoin inflows and Ethereum volatility could amplify BNB's movements during uncertainty.

XRP News Update: Reasons XRP Value May Skyrocket: ETFs Drive Significant Increase in Structural Demand

- U.S. SEC approval of spot XRP ETFs in November 2025 triggered $85M in first-week inflows, with Bitwise and 21Shares attracting $168M and $150M in assets. - Whale accumulation of $7.7B in XRP over three months, combined with ETF demand, fuels speculation of a price rebound to $22.5 or higher. - Analyst models predict ETFs could absorb 3B XRP annually, creating structural demand that may drive prices to $220 within two years if 15 ETFs collectively absorb 150M XRP daily. - Institutional adoption in cross-b

Ethereum News Today: Ethereum's Scaling Dilemma: Increasing Gas Capacity While Managing Financial Risks

- Ethereum doubled its block gas limit to 60 million, enhancing scalability through coordinated upgrades like EIP-4844 and future danksharding. - Vitalik Buterin emphasized targeted cost adjustments for operations like SSTORE to balance throughput and network security as scaling progresses. - The expansion aims to compete with Solana and Layer 2 solutions while preparing for the Fusaka upgrade, which could strengthen ETH's value proposition. - Despite technical improvements, Ethereum faces bearish market d

Bitcoin Updates Today: Bitcoin Rallies Amid Fed Optimism, Yet Caution as Bearish Indicators Suggest Potential Volatility

- Bitcoin surged above $91,000 on Nov. 27, 2025, driven by rising Fed rate-cut expectations and SpaceX's $105M BTC transfer. - Bearish technical signals persist as Bitcoin breaks below 50-week EMA and key trendlines, with critical resistance at $90,822–$101,000. - Institutional confidence remains strong despite volatility, with SpaceX consolidating BTC holdings and a whale selling $18.35M profit. - Fed's potential 67.1% chance of 25-basis-point cut could weaken the dollar but risks delayed easing if inflat