US Shutdown Risk at 66% — Crypto Faces Turbulence as Deadline Nears

The rising U.S. government shutdown risk threatens short-term crypto volatility and regulatory delays, but experts see strong rebound potential once liquidity returns.

The risk of a US government shutdown before October 1 looms over the global financial markets, including crypto.

The probability of a shutdown has risen to 66% on Polymarket, reflecting investors’ growing concerns. In this context, experts suggest that the market could see both short-term selloffs and strong recovery opportunities once liquidity returns.

66% Probability of a US Government Shutdown

The likelihood of a U.S. government shutdown before October 1 is drawing increasing attention as budget disagreements between Congress and the White House remain unresolved. Historically, the US has faced multiple shutdowns, with the longest lasting 35 days from late 2018 to early 2019.

Forecasts of a government shutdown on Polymarket. Source:

Polymarket

Forecasts of a government shutdown on Polymarket. Source:

Polymarket

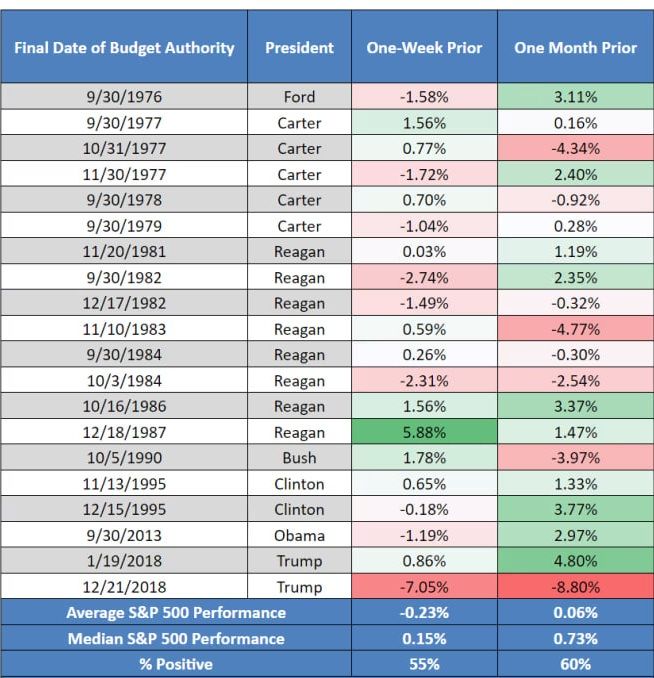

Each time, shutdowns have negatively impacted market sentiment and the economy. The current situation is notable because inflation remains elevated and the Federal Reserve has yet to loosen monetary policy, meaning a shutdown could exacerbate economic uncertainty.

When the budget isn’t passed, many federal agencies are forced to temporarily halt operations, disrupting government activity and amplifying political risk. This factor typically pressures risk assets, from equities to crypto. For crypto investors, a shutdown affects asset prices in the short term and delays regulatory reviews and decision-making. In other words, while Congress and the government focus on budget issues, crypto-related policy initiatives will likely remain “on hold.”

News on the U.S. government shutdown impacting the S&P 500. Source:

Ted

News on the U.S. government shutdown impacting the S&P 500. Source:

Ted

Market Scenarios Anticipated

Experts and market observers have outlined multiple scenarios from this picture. In the short term, a potential shutdown could trigger selloffs across crypto. Analysts have described a “crypto rout” where fear drives capital into safe-haven assets such as stablecoins or Bitcoin, leading to sharp price swings among altcoins.

One frequently mentioned scenario is that risk assets will continue to sell off if a shutdown occurs. However, once the budget issue is resolved, the “liquidity floodgates” could reopen, helping markets recover quickly. Some analysts argue that Bitcoin may benefit by serving as a haven during turmoil and rallying when liquidity returns.

Beyond price action, a government shutdown would temporarily halt agencies like the SEC and CFTC, slowing progress on crypto projects and ETF/ETN approvals. Congress would also face delays in advancing crypto-related legislation. Still, Chainlink’s Head of Public Policy remains relatively optimistic about the medium-term outlook.

“A late October market structure markup remains in the cards, but it gets a little tougher to achieve with a shutdown,” Adam Minehardt commented.

The forecast for the probability of a government shutdown is declining. Source:

X

The forecast for the probability of a government shutdown is declining. Source:

X

While there is a history of shutdowns, last-minute deals have often been reached in the US. Moreover, the probability of a shutdown has declined from 78% to 66%, suggesting that the market still holds some confidence that a resolution can be found.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens