Bitcoin Drops Below $109K as Profit-Taking and ETF Slowdown Weigh on Market

Bitcoin’s rally is showing signs of fatigue after a sharp sell-off pushed prices under $109,000. Long-term holders have realized billions in profits while exchange-traded fund inflows slow, raising concerns that the market may be entering a cooling phase similar to past cycle tops.

In brief

- Bitcoin drops to $108,700, breaking key support levels as long-term holders take profits.

- Glassnode reports 3.4M BTC in realized profits, mirroring patterns seen at previous cycle tops.

- Short-term holders under stress as SOPR nears 1 and NUPL approaches zero, raising risk of liquidations.

- Analysts warn BTC must reclaim $115K to restore bullish momentum as sentiment stays in fear zone.

Profit-Taking Signals Cycle Exhaustion For Bitcoin

Bitcoin dropped to $108,700 on Coinbase late Thursday, its lowest in three weeks, slipping past key support around $112,000. Even though the asset has yet to retest $107,500, the low from September 1, momentum remains weak.

According to Glassnode, long-term holders have realized 3.4 million Bitcoin in profit—levels consistent with previous market peaks. Profit-taking exceeded 90% of coins moved three times this cycle, a pattern that has historically marked cycle tops.

Analysts caution that this level of realized gains points to market exhaustion after the Federal Reserve’s recent rate cut failed to boost sustained demand. More so, Markus Thielen, head of research at 10x Research, warned that prices hovering near this zone could trigger another wave of stop-loss selling.

Short-Term Holders Face Rising Pressure

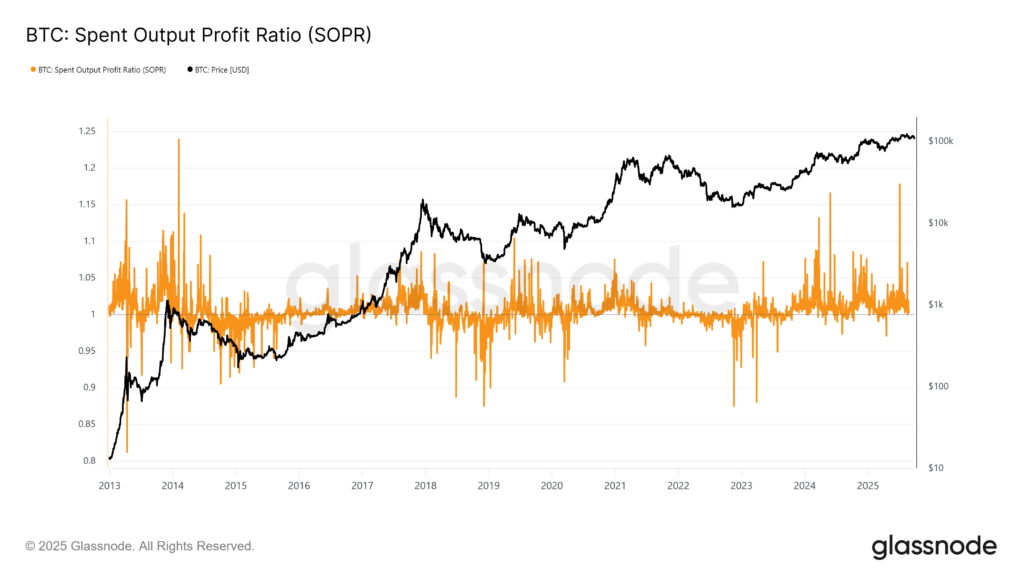

Indicators suggest growing stress among short-term market participants. Glassnode data shows the Spent Output Profit Ratio (SOPR) at 1.01, meaning some investors are already selling at a loss.

Historically, this ratio can mark key turning points, as dips below 1 during bull markets often signal seller exhaustion and rebounds. At the same time, rejections around 1 in bearish conditions can lead to further downside.

Meanwhile, the Short-Term Holder Net Unrealized Profit/Loss (NUPL) is nearing zero. Thielen noted this raises the risk of liquidations as newer investors move quickly to cut losses. Without renewed demand from institutions and retail buyers, Glassnode said the chance of a deeper correction remains high.

Outlook: Neutral to Cautious

At the time of writing, Bitcoin was trading at $109,178, down over 5% in the last seven days.

Other notable market data include:

- Bitcoin sentiment stays bearish, with the Fear & Greed Index holding at 33.

- Over the past year, the asset has surged 67%, showing strong upside momentum.

- BTC outperformed 87% of the top 100 coins

- Still, the coin was outpaced by Ethereum during the same period.

- It trades above the 200-day simple moving average—signaling a positive long-term signal.

- In the last month, the asset posted 16 green days.

For now, some analysts remain cautious about the OG coin’s future trajectory. Thielen suggested that Bitcoin would need to reclaim $115,000 to restore a convincing bullish case. Glassnode echoed that the current structure resembles “exhaustion” and favors a cooling phase.

Still, not all sentiment is bearish. MicroStrategy’s Michael Saylor voiced optimism earlier this week. He predicted Bitcoin could strengthen in the fourth quarter as macroeconomic pressures ease.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.