Grayscale Ranks The Top 20 Tokens That Offered The Best Returns In Q3

Grayscale’s Q3 2025 index revealed altcoins outperformed Bitcoin, with BNB Chain, Prometeus, and Avalanche emerging as top risk-adjusted performers.

Grayscale revealed in an index that altcoins provided the best returns in the third quarter of 2025. Bitcoin’s underperformance became the quarter’s most defining characteristic, while BNB Chain, Prometheus, and Avalanche led the ranking for top risk-adjusted performers.

The index was generally dominated by tokens used for financial applications and smart contract platforms. Thematic narratives centered on stablecoin adoption, exchange volume, and Digital Asset Treasuries (DATs) overwhelmingly drove this outperformance.

Altcoins Dominated Q3 Performance

The third quarter of 2025 proved to be a period of broad-based strength in the digital asset market. According to an index developed by Grayscale Research, some distinct winners generated the best volatility-adjusted price returns.

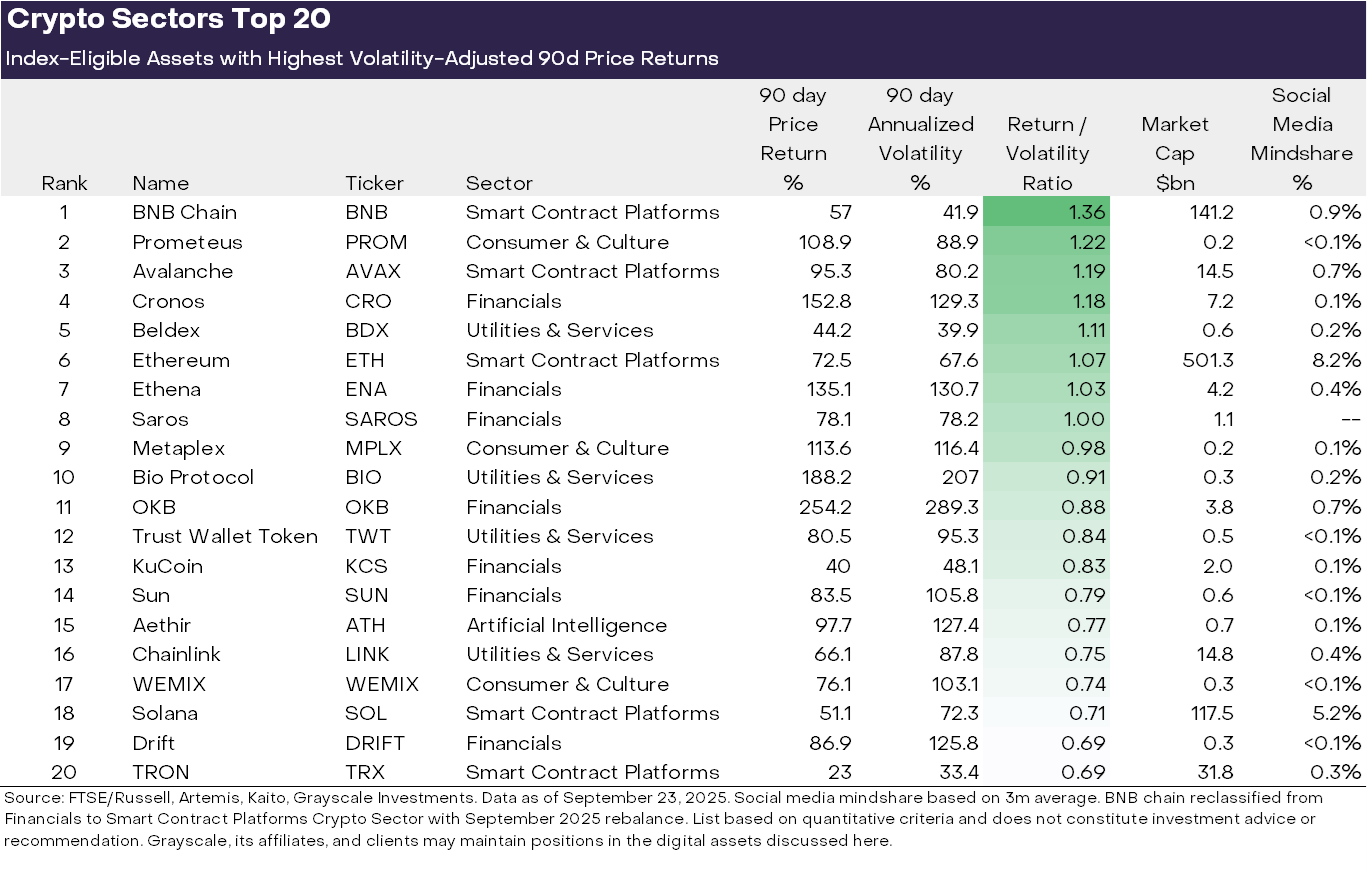

In a ranking of the top 20 best-performing tokens, BNB Chain took the lead, delivering the most favorable returns with relative stability compared to those whose gains were outweighed by excessive risk.

Prometeus, Avalanche, Cronos, Beldex, and Ethereum followed behind it.

Top 20 Performing Tokens. Source:

Grayscale Research.

Top 20 Performing Tokens. Source:

Grayscale Research.

Grayscale organizes the digital asset market into six segments based on the protocol’s core function and use case: Currencies, Smart Contract Platforms, Financials, Consumer and Culture, Utilities and Services, and Artificial Intelligence.

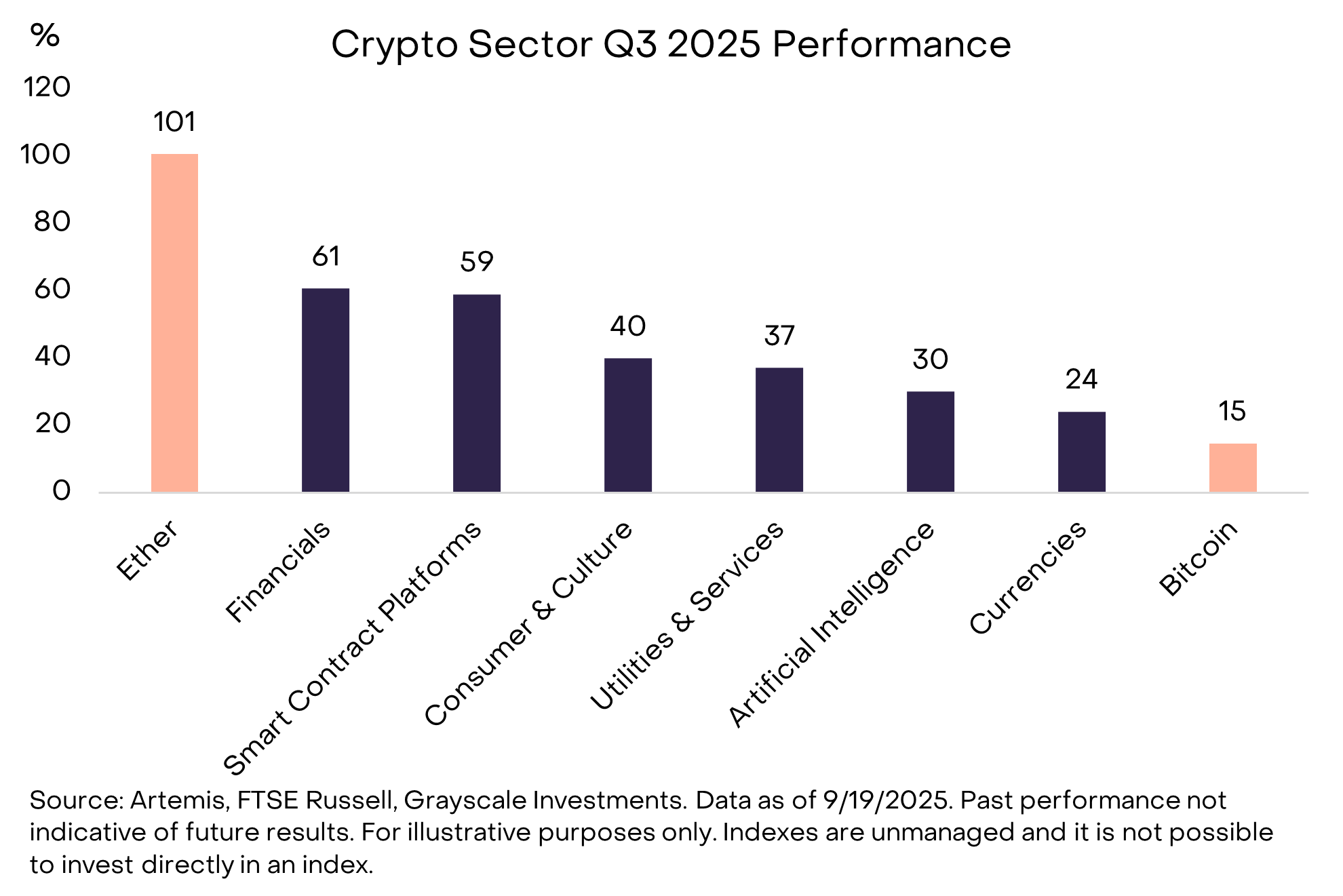

Seven top-performing tokens formed part of the Financials segment, while five came from Smart Contract Platforms. These results effectively quantified the shift away from Currencies. Most notably, Bitcoin did not make the cut.

Why Bitcoin Lagged Behind

The most telling data point of Grayscale’s research was not so much who made the list as who was conspicuously absent: Bitcoin.

While all six sectors produced positive returns, Currencies notably lagged, reflecting Bitcoin’s relatively modest price gain compared to other segments. When measuring performance by risk, Bitcoin did not offer a compelling profile.

Crypto Sector Q3 2025 Performance: Source:

Grayscale Research.

Crypto Sector Q3 2025 Performance: Source:

Grayscale Research.

The assets that made the list were overwhelmingly driven by thematic narratives related to new utility and regulatory clarity. These narratives specifically centered on stablecoin adoption, exchange volume, and DATs.

According to Grayscale Research, the rising volume on centralized exchanges benefited tokens like BNB and CRO. Meanwhile, increasing DATs and widespread stablecoin adoption fueled demand for platforms like Ethereum, Solana, and Avalanche.

Specific decentralized finance (DeFi) categories also showed strength, such as decentralized perpetual futures exchanges like Hyperliquid and Drift, which contributed to the strength of the Financials sector.

Bitcoin was less exposed to these specific catalysts as a peer-to-peer electronic cash and store-of-value asset. This lack of exposure allowed altcoins tied to functional platforms and financial services to surge in risk-adjusted performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Do Kwon Asks Court for 5-Year Prison Cap in Terra Fraud Case

BTC Black Friday: Bitcoin Pumps to $93,000 Before Sharp Pullback

Harmonizing Progress, Earnings, and Environmental Responsibility: Redefining the Modern Corporate Sustainability Formula

- Global corporations are embedding sustainability into operations to meet environmental goals, driven by regulations and investor demands. - HP Inc. and Tesla highlight AI integration and EV cost savings as strategies to balance profitability with carbon reduction. - Energy firms like Eco Wave Power and Core Scientific are advancing renewables and energy-efficient infrastructure amid decarbonization trends. - Challenges persist, including economic pressures and regulatory hurdles, but innovations in finan

Bitcoin Updates: Derivatives Market Confidence Faces Off Against ETF Outflows—Will Bitcoin Reach New All-Time Highs?

- Bitcoin surged to $126,296 in October 2025 via ETF inflows but retreated to $80k amid waning institutional demand and higher rates. - Derivatives activity shows 40x YTD open interest growth, with traders betting on a $120k rebound if $83.5k support holds. - Technical indicators remain mixed: price below 50-day MA and thin order books risk further volatility, but OTC accumulation persists. - Fed policy and ETF flows will determine Bitcoin's path—stabilization near $83.5k or a test of 2025 highs—amid signi