Tether Dominance (USDT.D) Hits 2-Month High — Why This Is Concerning

Tether Dominance’s rise to a two-month peak is raising alarms for traders. Analysts caution that a push above 5% could confirm a bearish shift, though some see room for a rebound in Q4.

Tether Dominance (USDT.D) is one of the metrics closely correlated with Bitcoin’s price and overall market capitalization. Yet it is often overlooked in many market analyses. Now, this data has confirmed warning signals worth paying attention to.

USDT.D represents Tether’s share of the total crypto market capitalization. Changes in USDT.D can help measure how actively traders spend USDT, providing a basis for predicting possible scenarios.

Analysts Warn as Tether Dominance (USDT.D) Reaches 2-Month High

Tether (USDT) remains the leading stablecoin in terms of both market share and liquidity. A decline in USDT.D usually means traders spend more USDT to buy Bitcoin and altcoins, driving higher prices.

On the other hand, a rise in USDT.D indicates that traders are selling assets and moving back into USDT. This reflects cautious sentiment toward volatility and often signals potential downside risk.

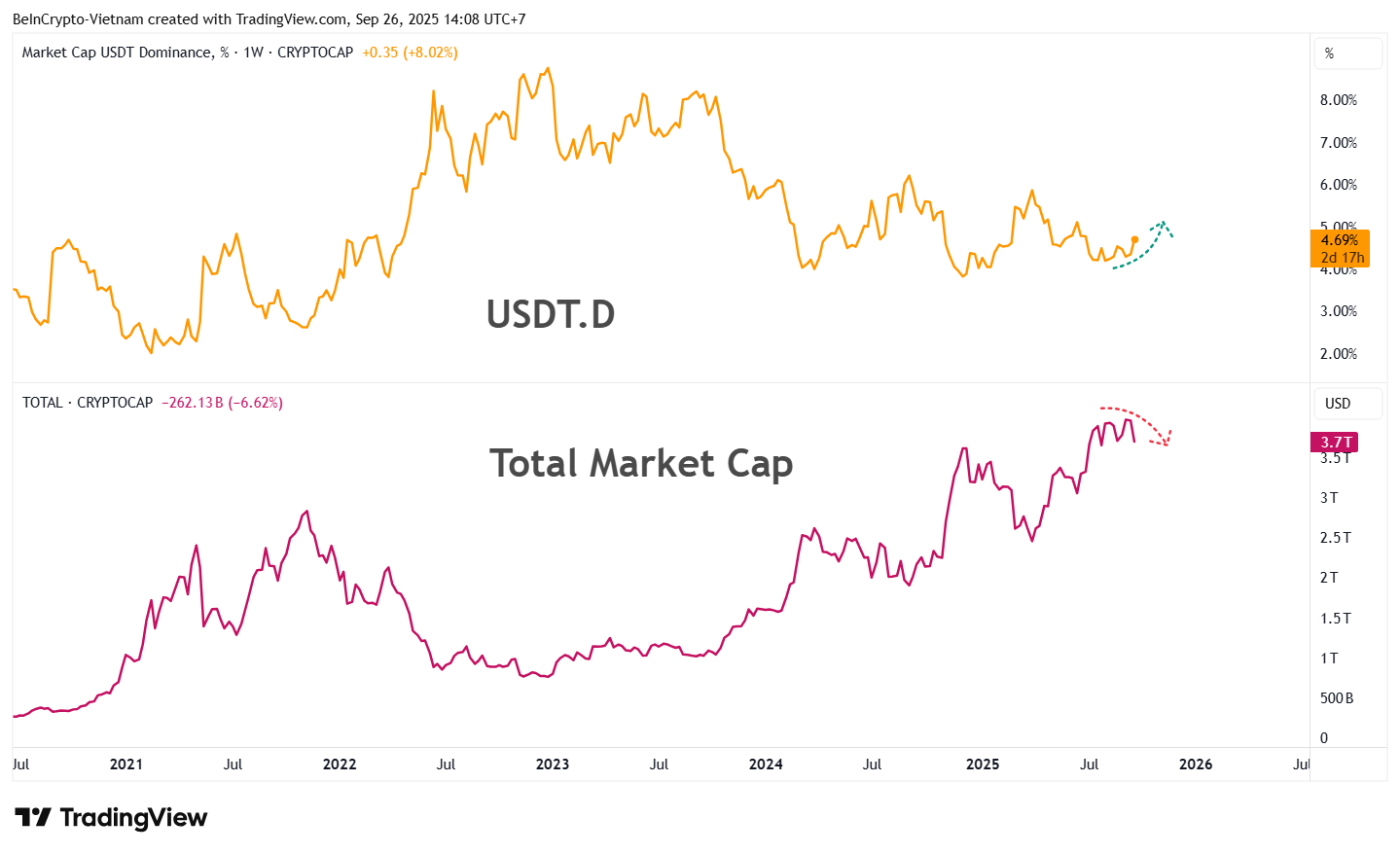

TradingView data shows that the inverse correlation between USDT.D and total crypto market capitalization has been observed repeatedly over the years.

Total Market Capitalization And USDT.D. Source:

TradingView

Total Market Capitalization And USDT.D. Source:

TradingView

During the final week of September, USDT.D climbed to 4.69%, its highest level in two months. Analysts see this breakout as a move that could push it even higher, raising concerns about a prolonged bearish outlook in the days ahead.

Market analyst Jason Pizzino remains hopeful that USDT.D will soon correct. However, he does not rule out a breakout above 5% as a troubling confirmation.

“Here’s the breakout no crypto bull wants to see. The good news is that USDT dominance is now testing the macro 50% level. However, above ~5% and the trend could be changing for the bulls. Hopefully, it’s a test and rejection. Otherwise, be prepared,” Pizzino commented.

Technical vs. Fundamental Considerations

At this stage, most negative analyses based on USDT.D rely heavily on technical signals, where trendlines and resistance levels play a central role. This limits reliability when broader fundamental factors are added to the picture.

Those fundamental factors include record-high USDT reserves on exchanges, new peaks in USDT netflows, and rising demand from traders reflected in Tether’s recent surge in USDT minting. This setup acts like gunpowder ready to be deployed.

“Now, given the perfect negative correlation between USDT.D and $TOTAL, this would imply ‘one more sweep of the lows’… But TA isn’t always perfect. It doesn’t make much sense to unload bags here just to maybe buy them back slightly lower. We are likely close to finalizing our high time-frame swing low for a bullish Q4,” Max, founder of BecauseBitcoin, said.

The late-September market decline has intensified doubts. Debate continues over whether this is a bear trap or the start of a broader downtrend. As a result, every new signal is being closely examined.

USDT.D is part of those signals. It should not be viewed in isolation but rather in combination with other indicators to minimize risk as much as possible.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano News Update: Cardano Bets $70M in ADA—Will Infrastructure Improvements Drive Expansion?

- Cardano's stakeholders seek 70M ADA from Treasury to fund 2026 growth via infrastructure upgrades, led by IOG, EMURGO, and key foundations. - Proposed upgrades focus on stablecoin integration, cross-chain bridges, and institutional tools to attract capital and scale DeFi, addressing TVL stagnation at $190M. - Milestone-based funding aims to ensure accountability, aligning with institutional demands for secure custody and analytics while avoiding speculative ventures. - Market analysis shows cautious opti

Tech's $96B Bet on AI: Borrowing Spree Could Spark Another Bubble

- Tech sector's AI debt surged to $96B as firms like OpenAI, Oracle , and CoreWeave secure massive loans to expand infrastructure. - Oracle's 9.17% stock drop highlights risks of overreliance on OpenAI, with DA Davidson cutting its price target due to "fake it 'till you make it" concerns. - CoreWeave's $7.5B credit facility and tripled interest costs mirror 2008 crisis-era CDO risks, raising sustainability questions for AI-driven growth. - xAI's $15B funding round and OpenAI's $40B private raise underscore

Philanthropist MacKenzie Scott Tackles Educational Disparities Using a Blended Loan Approach

- Philanthropist MacKenzie Scott invests in Funding U, a startup offering merit-based student loans without co-signers, inspired by her own $1,000 college loan. - The hybrid model combines Scott's "junior debt" with bank funding, using algorithms to assess academic potential rather than credit scores. - This approach targets low-income students, blending philanthropy with market incentives to address educational inequity and systemic barriers. - The investment reflects growing trends in impact investing, w

Tokenized Stocks Gain Momentum as Crypto Meets TradFi