Chainlink (LINK) has caught the attention of large investors once again, with on-chain data revealing that whales scooped up more than 800,000 LINK during the recent price dip.

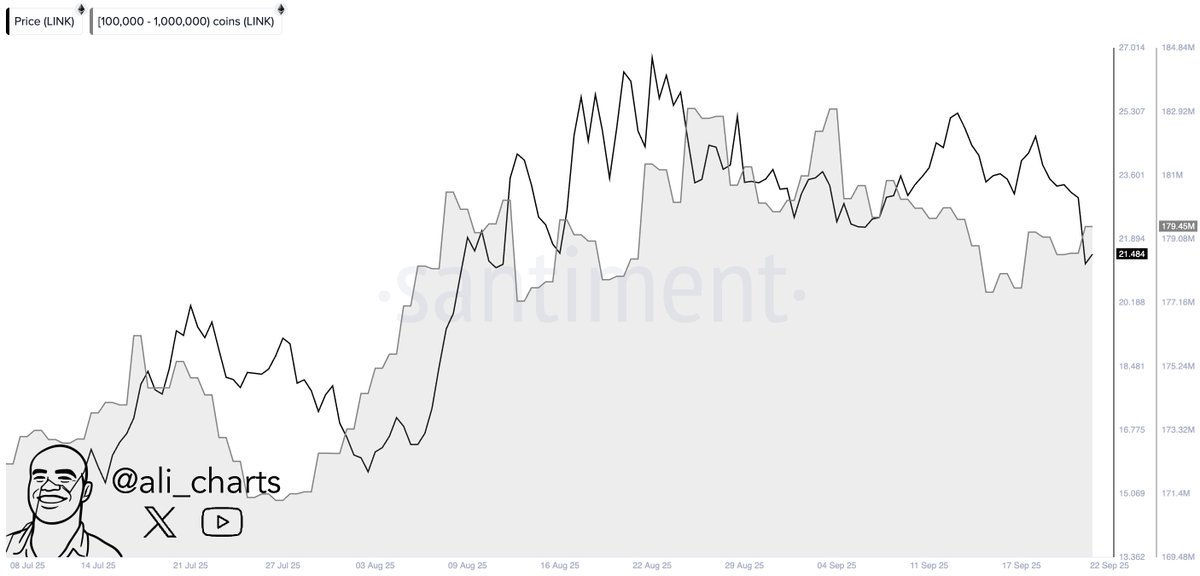

Market analyst Ali highlighted the move, noting that addresses holding between 100,000 and 1 million LINK significantly increased their balances in the past few days.

The buying spree comes as LINK managed to stabilize around the $21–$22 range, even after facing selling pressure earlier this week. According to TradingView data, LINK is currently trading at $21.93, marking a slight daily gain of 1.29%. Despite the rebound, the Relative Strength Index ( RSI ) shows mixed signals, sitting at 51.74 on the daily chart, suggesting a neutral momentum after briefly dipping toward oversold levels.

Chainlink’s price has seen repeated tests of the $20 support zone, an area that whales appear keen to defend with their recent accumulation.

Historically, large-scale buying from whales has often acted as a cushion against further downside, potentially laying the groundwork for a stronger recovery if market sentiment improves.

While LINK still trades below its recent September highs near $25, the consistent inflows into whale wallets could be a sign of confidence in the project’s long-term outlook. Traders are now watching whether LINK can reclaim the $23–$25 range, which has proven to be a key resistance area in recent months.

With volatility expected to persist across the crypto market, Chainlink’s resilience near $21 and notable whale activity may set the stage for its next big move.