Will Bitcoin Crash? ETFs Outflows vs Gold Breakout Hype

Will Bitcoin Crash? The Question on Every Trader’s Mind

The crypto market is at a crossroads , and Bitcoin is once again at the center of debate. On one side, BlackRock, Fidelity, and other ETFs offloaded $363 million worth of Bitcoin, sparking fears of a major correction. On the other, analysts point to gold’s recent breakout as a bullish preview of what Bitcoin might do next.

So, will Bitcoin crash, or is this simply another setup for the next rally?

By TradingView -

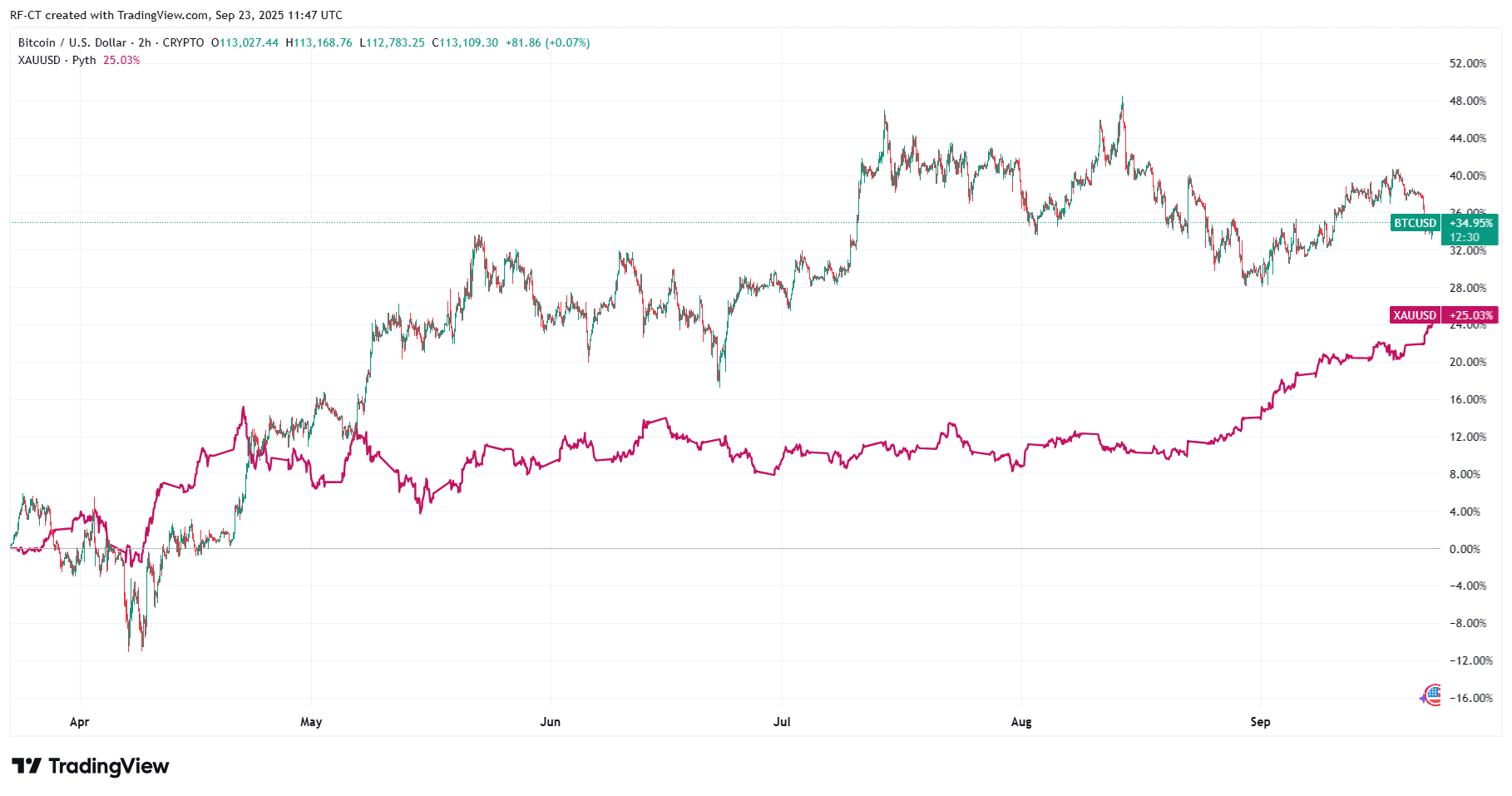

BTCUSD vs XAUUSD _2025-09-23 (6M)

By TradingView -

BTCUSD vs XAUUSD _2025-09-23 (6M)

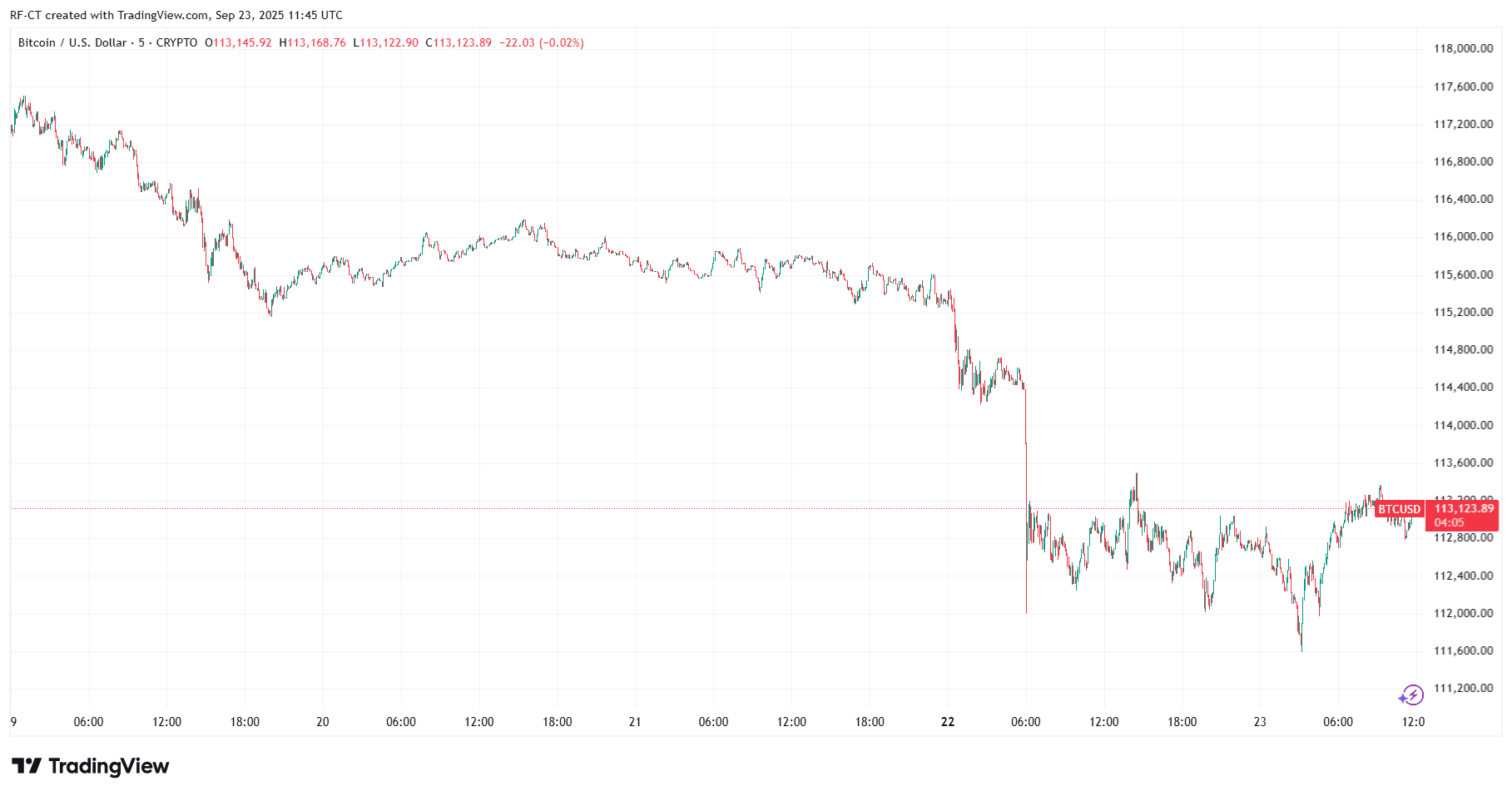

ETF Outflows Signal Bearish Pressure

Fresh data reveals that Bitcoin spot ETFs collectively faced $363 million in outflows. With big names like BlackRock and Fidelity involved, the move raised concerns about institutional confidence in Bitcoin at current levels.

Historically, ETF outflows have applied downward pressure on price. If this trend continues, Bitcoin risks losing its $110,000 support, potentially triggering liquidations and sending it toward $100,000–105,000.

This bearish case suggests that, at least in the short term, Bitcoin could face a correction rather than a surge.

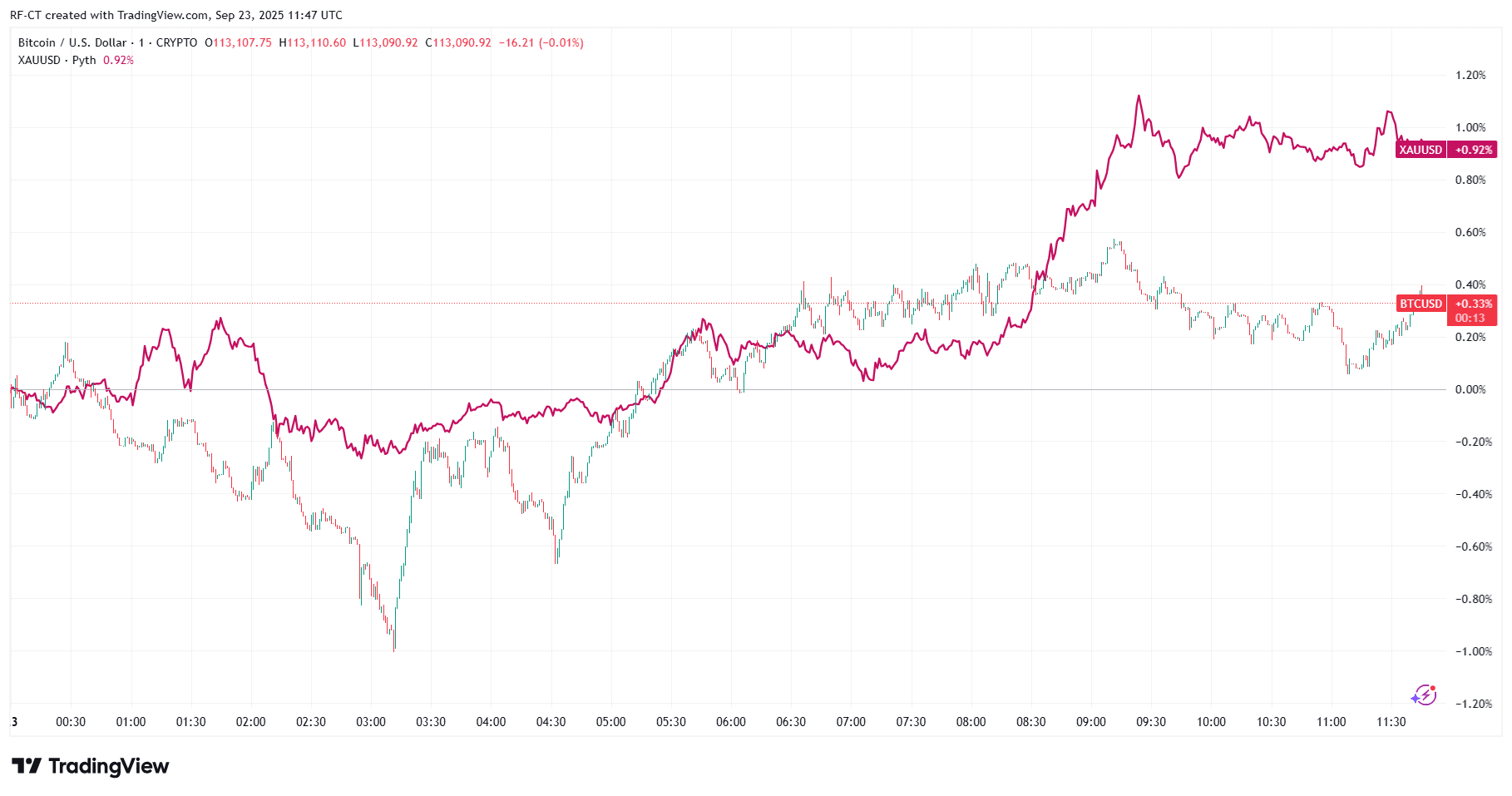

Gold’s Breakout and the Bitcoin Supercycle Theory

Despite the selling pressure, optimists point to gold’s recent rally . Gold broke out of a long consolidation, a pattern Bitcoin seems to be mirroring. Analysts suggest that if Bitcoin follows the same path, it could break above $124,000–126,000, unlocking a run toward $140,000+.

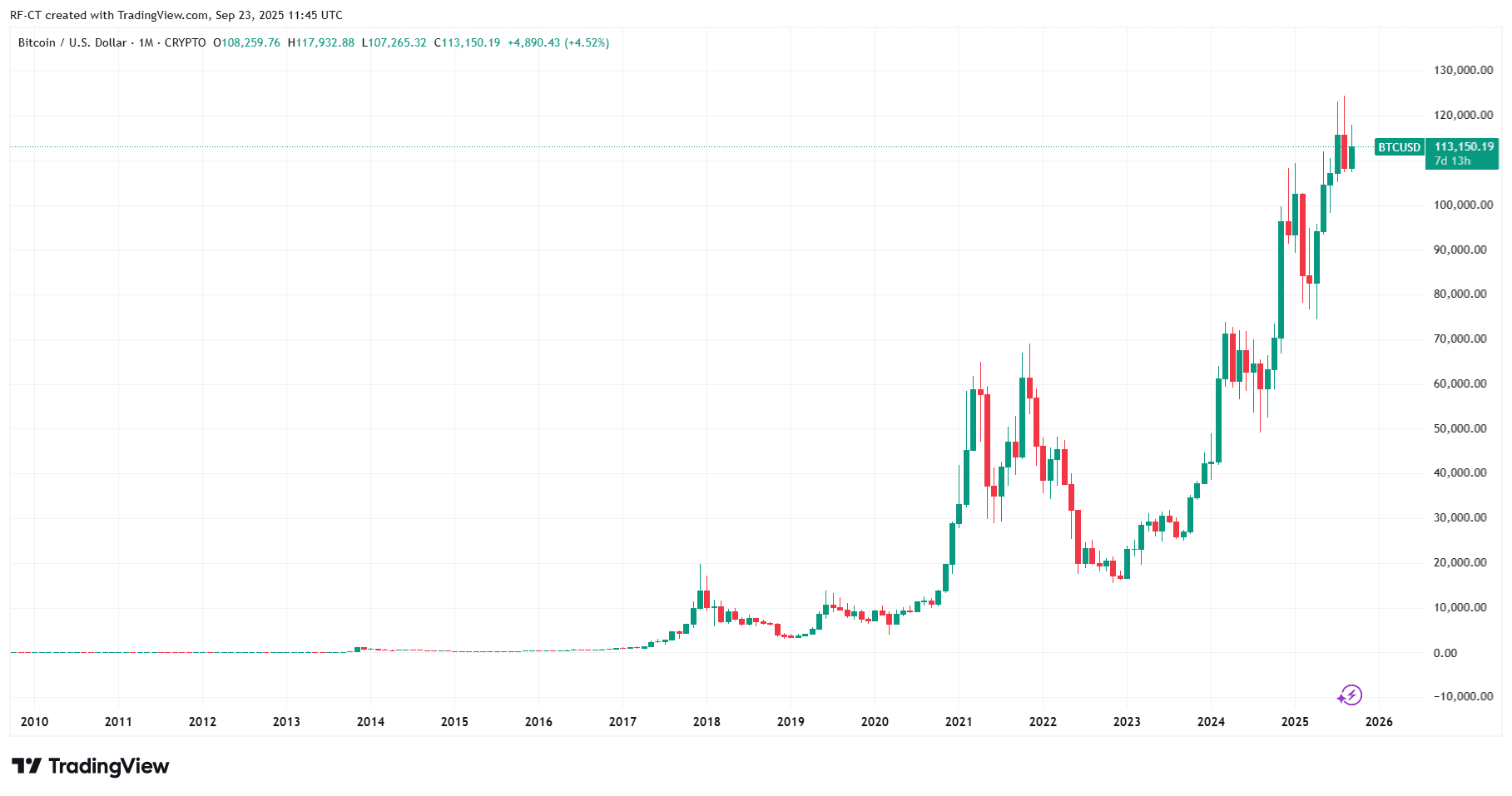

This idea, known as the Bitcoin supercycle thesis, argues that long-term adoption, ETF approvals, and scarcity from the halving could propel BTC far higher, even after temporary dips.

By TradingView - BTCUSD vs XAUUSD _2025-09-23 (1D)

By TradingView - BTCUSD vs XAUUSD _2025-09-23 (1D)

Crash, Rally, or Sideways? What Comes Next

The truth is, Bitcoin doesn’t move in straight lines. Current conditions suggest three potential paths:

- Crash Scenario: ETF outflows accelerate → BTC falls below $110K → drop toward $100K.

- Bullish Breakout: Bitcoin breaks $124K → rallies to $140K+ following gold’s lead.

- Sideways Range: Bitcoin consolidates between $110K–124K while waiting for stronger macro or institutional catalysts.

For traders and investors, the critical level to watch remains $110,000. Holding above it keeps the bullish case alive; losing it risks a sharper selloff.

By TradingView - BTCUSD_2025-09-23 (5D)

By TradingView - BTCUSD_2025-09-23 (5D)

Conclusion: Will Bitcoin Crash?

So, will Bitcoin crash ? The answer depends on which force proves stronger: bearish ETF outflows or the bullish gold-like breakout pattern.

Short-term risks point toward volatility and possible corrections, but the long-term narrative remains intact. As always, Bitcoin thrives in uncertainty, whether this moment becomes a crash or the start of a supercycle rally will soon be revealed.

By TradingView - BTCUSD_2025-09-23 (All)

By TradingView - BTCUSD_2025-09-23 (All)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

From pushing the performance limit of 1 Gigagas to building the architectural vision of Lean Ethereum, Fede showcased with the most hardcore technical details and sincere passion how Ethereum should maintain its dominance in the next decade.

"Stepless Transmission" in Ethereum Fusaka Upgrade: Establishing a Rapid Response Mechanism for L2 Scaling

In the future, Ethereum will be like being equipped with a "continuously variable transmission," so expanding Blobs will no longer need to be closely tied to major version upgrades.

Every country is heavily in debt, so who are the creditors?

As national debts rise, the lenders are not external forces, but rather ordinary people who participate through savings, pensions, and the banking system.

If Bitmain is sanctioned, which American mining company will fall first?

The U.S. government is conducting a stress test on Bitmain, with the first casualties likely to be domestic mining farms in the United States.