DOGE Plunges by Double Digits Daily as BTC Price Slides Below $115K: Market Watch

Bitcoin’s Monday began on a positive note, but the bears quickly reemerged and halted the asset’s ascent by pushing it south to under $115,000.

The altcoins have followed suit, with even more painful declines from ETH, XRP, and especially DOGE, which has posted a massive daily drop.

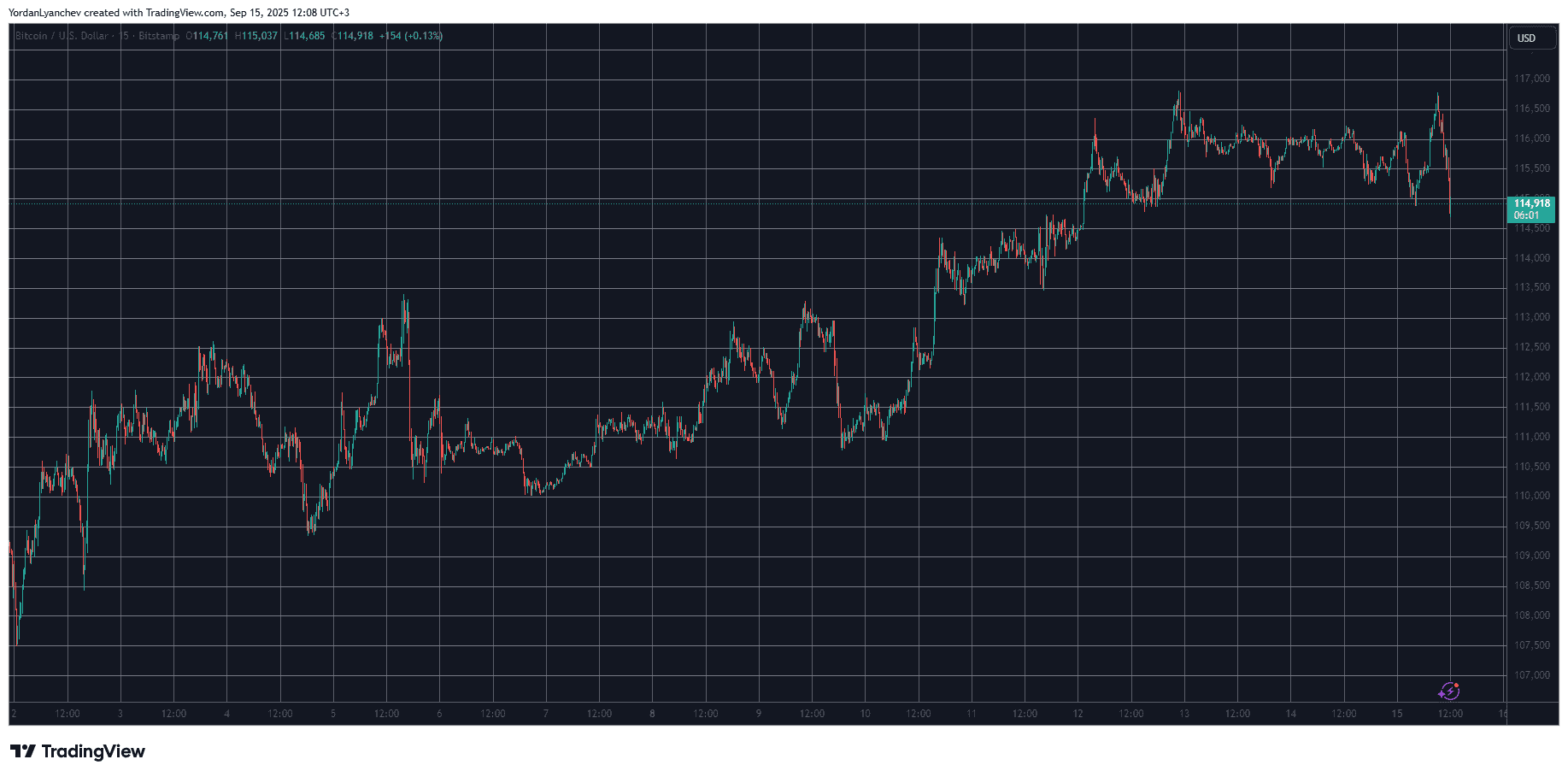

BTC Falls Below $115K

The past several days were going rather well for the primary cryptocurrency. Its gradual recovery began last Tuesday when the asset dropped to $111,000 and the bulls stepped up. Instead of another crash below $110,000, they started to drive BTC north. The culmination during the business week came on Friday, when bitcoin topped $116,000.

It faced an immediate rejection at that level but initiated another leg up on Saturday morning. This time, it climbed to $116,800 but failed once again and spent most of the weekend sideways around $116,000.

As hinted above, Monday started on the right foot, with BTC nearing $117,000 once again. However, the scenario repeated, but this rejection pushed it to below $115,000 for the first time since Friday.

Its market capitalization has dropped below $2.290 trillion on CG, while its dominance over the alts has shot up to 56% as most of them have marked even more significant declines.

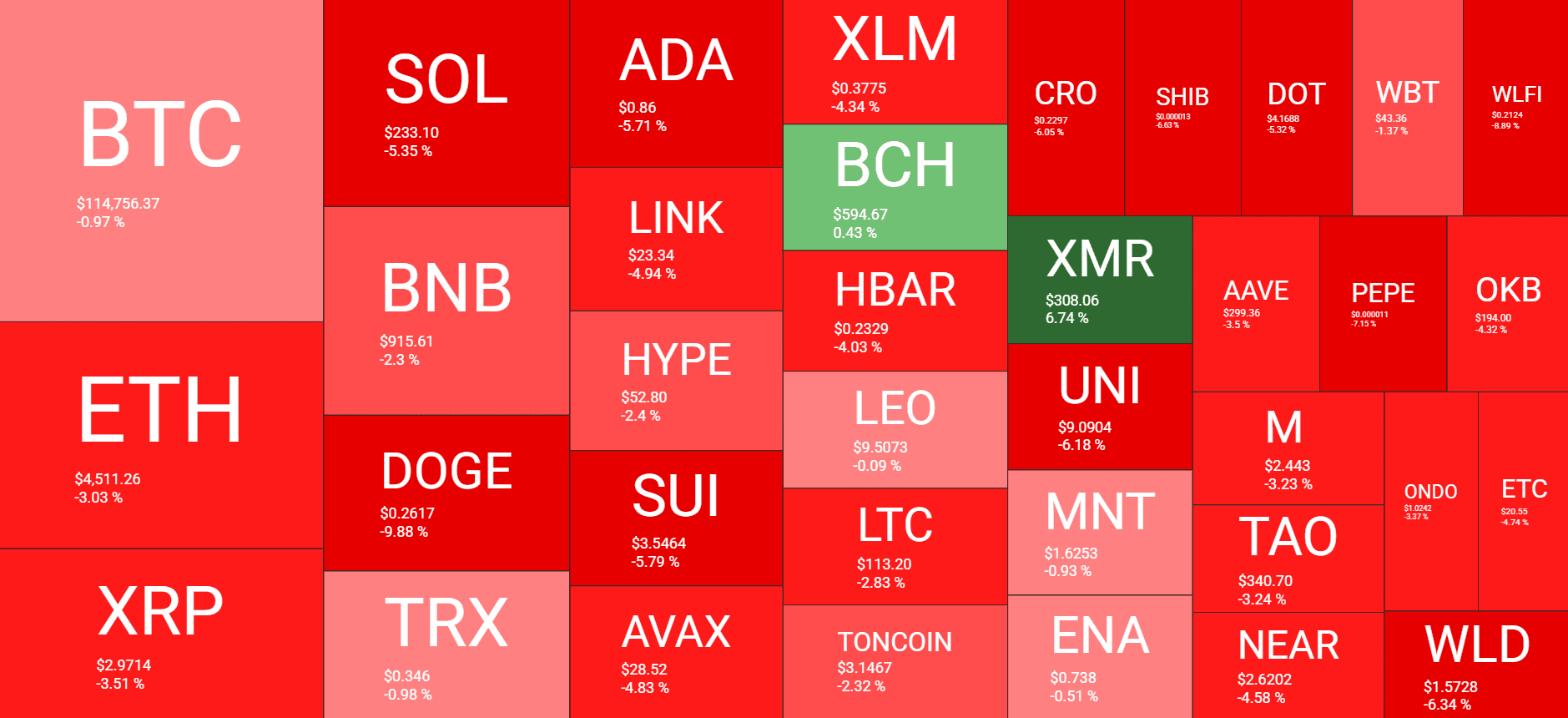

DOGE Leads the Way Down

Dogecoin is among the poorest performers in the past 24 hours, after its superb surge during the weekend. The asset is down by almost 10% and now struggles to remain above $0.26. Solana, Cardano, and SUI have dropped by somewhere around 5-6%. LINK and AVAX are down by 5% each.

Ethereum failed at $4,750 during the weekend and is now just inches above $4,500 after a 3% daily decline. XRP has slipped below a key support level following a 3.5% drop. XMR is the only exception from the larger-cap alts, surging by 8% to almost $310.

The cumulative market cap of all crypto assets has lost approximately $80 billion since yesterday and is below $4.090 trillion on CG.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.