Solana in 8 charts: August edition

Solana saw $78 million in REV for August

This is a segment from the Lightspeed newsletter. To read full editions, subscribe .

How was Solana doing in August? Let’s unpack some numbers.

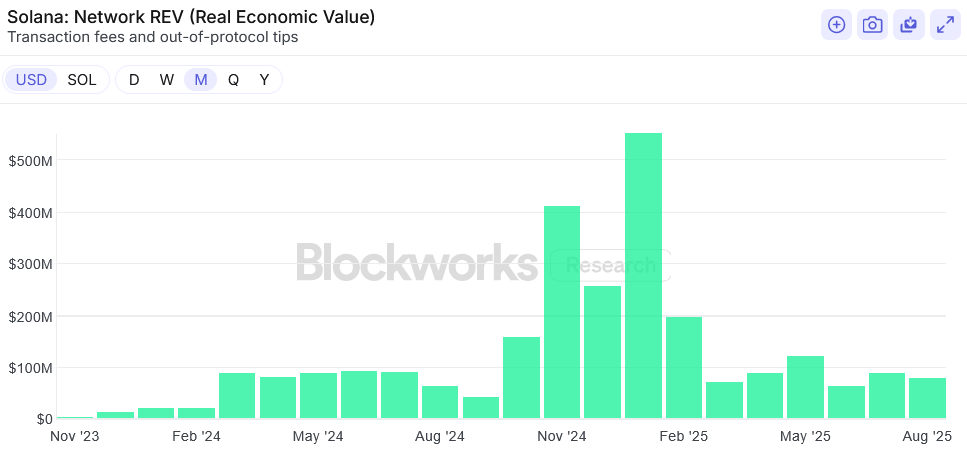

About $78 million REV (fees + tips) was paid to transact on Solana in August. In 2025, that was Solana’s third-lowest REV month.

On a year-over-year basis, Solana’s REV saw about 24% growth.

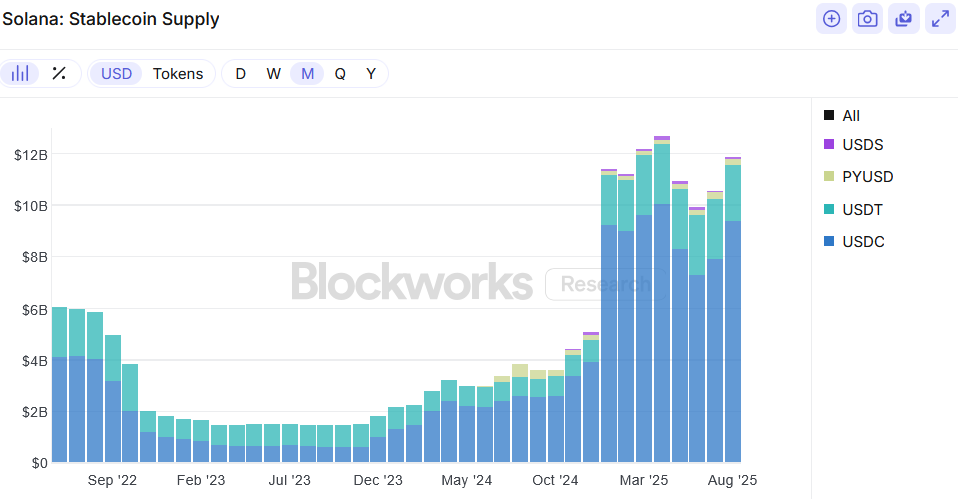

Total stablecoin supply on Solana has stagnated at the $10–$13 billion range since March.

Solana is far from dead, but these numbers certainly don’t scream “growth on all cylinders” as they did in early 2025.

Application revenues tell a more optimistic story. Solana apps generated $148 million in August, a 93% increase on a YoY basis.

I want to say the “fat app thesis,” but in Solana’s case, it’s probably more accurate to call it the “fat memecoin app” thesis. Broken down, the bulk of revenue-generating applications belong to the trading tools and memecoin categories, namely Axiom, Pump, Phantom, LetsBonk, Photon, etc.

In recent months, Solana has tried to position itself as the go-to venue for trading crypto assets, encapsulated by the “ Internet Capital Markets ” meme.

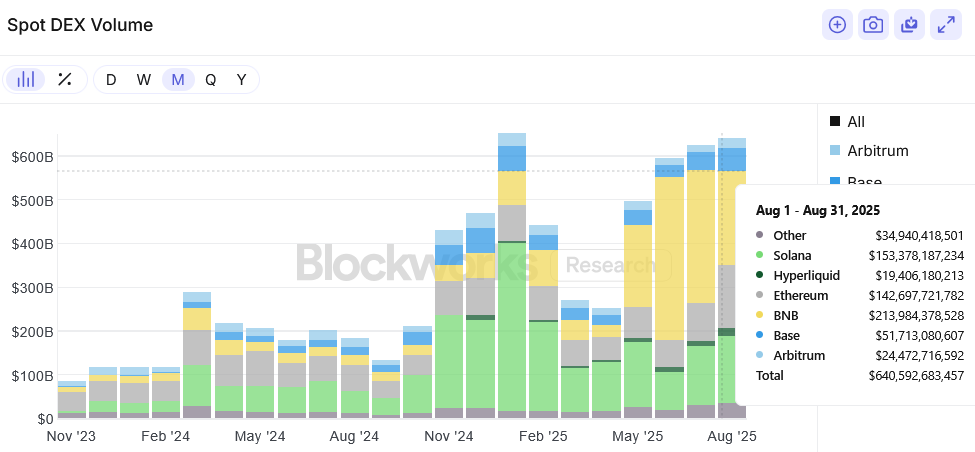

The data seems to affirm that narrative. The below chart shows overall spot DEX volumes broken down for major L1 chains.

BNB Chain claims the top spot with $214 billion in volumes, but those numbers are inflated by the ongoing “Alpha” incentive campaign that’s rewarding wash trading. When adjusted to exclude Alpha tokens, BNB Chain’s August volumes fall to an estimated $138 billion .

That puts Solana in first place at $153 billion, with Ethereum in second at $143 billion.

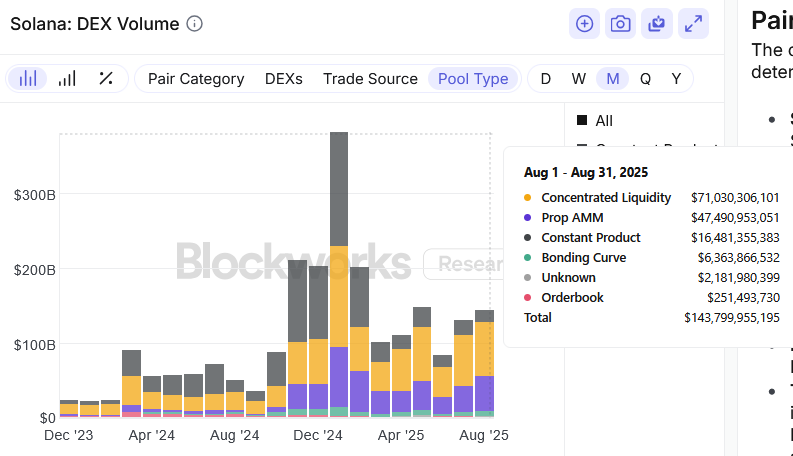

Zooming into Solana DEX volumes, no-name AMMs (prop AMMs) are carving out a significant chunk of market share, about $47 billion in August. These AMMs use one single market-maker for liquidity provision, and route users by plugging into DEX aggregators on the backend (read more here ).

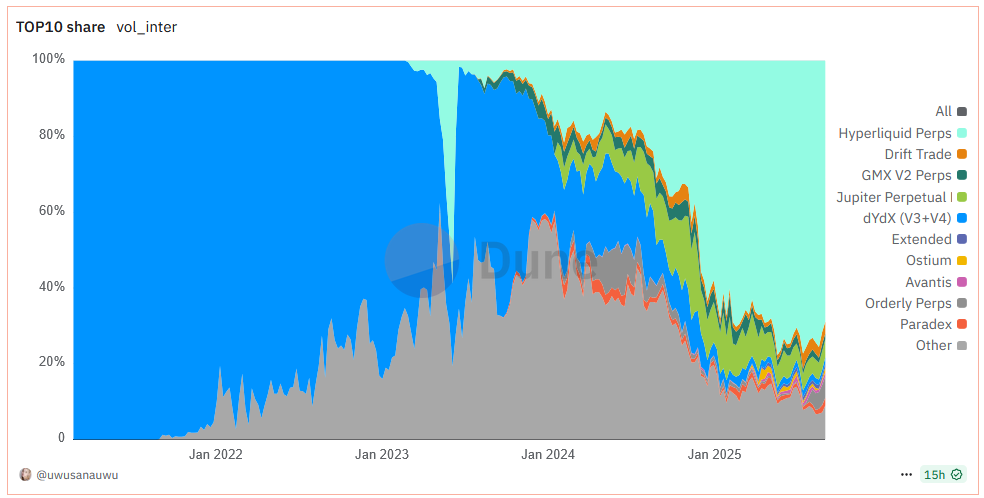

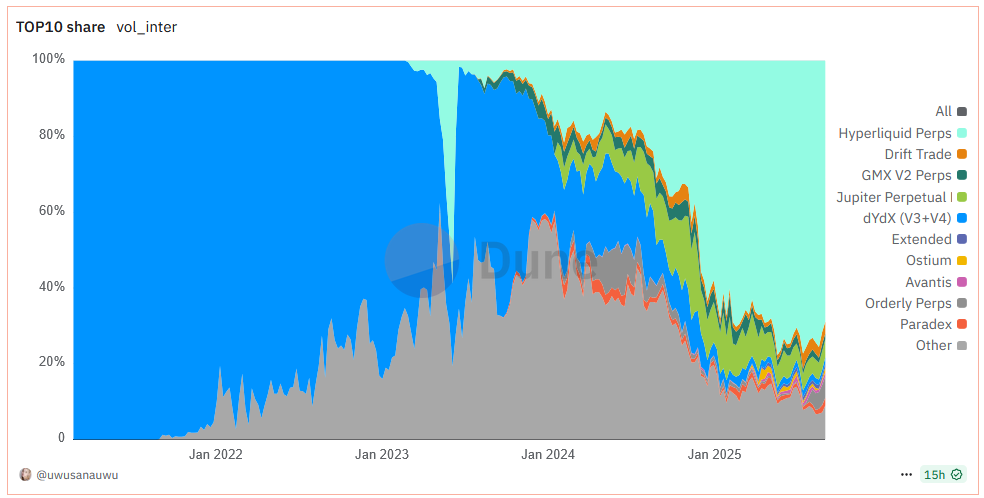

Now let’s look at perps volumes. The two dominant perps exchanges on Solana are Jupiter Perps and Drift, with 4.9% and 3.3% volume market shares, respectively. Unsurprisingly, they’re eclipsed by Hyperliquid (71.6% market share) ,which is averaging about $10.4 billion in daily volumes over the last 90 days.

Solana’s slowing growth can be attributed to Hyperliquid’s dominance over the past four quarters, Blockworks Research’s Ryan Connor told me.

“Making Drift (or something similar) work is critical to Solana’s success.”

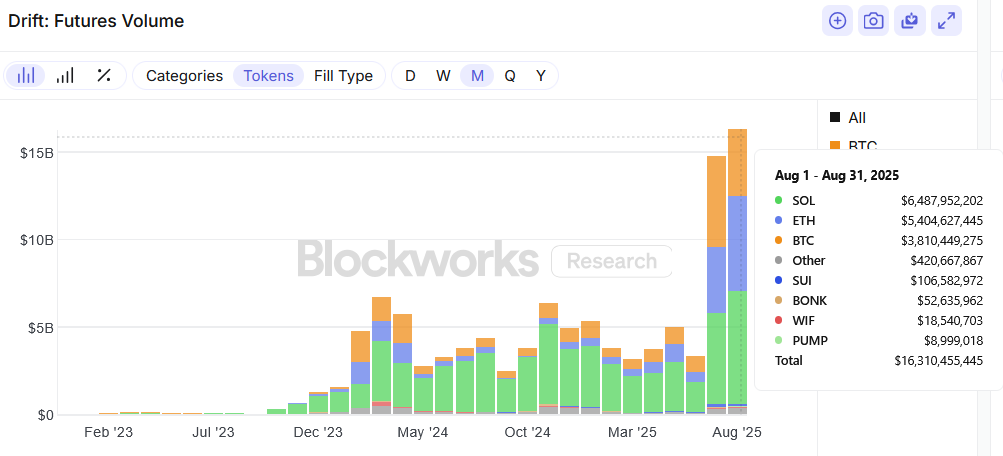

Drift isn’t asleep at the wheel, though. The perps DEX did some of its best lifetime volumes in August, thanks to unique features like cross-margin capabilities.

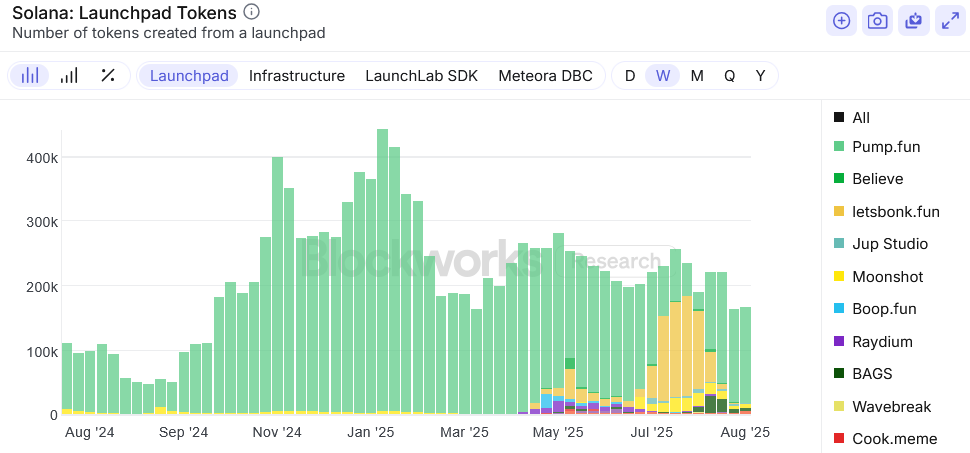

Finally, you can’t talk Solana without talking memecoins.

After a brief two to three weeks during which Pump appeared to lose its leading position, the platform has decisively regained its dominance over competitors like LetsBonk and Heaven. As of the last week, 148K tokens were launched on Pump’s launchpad — about 89% of total tokens launched.

Solana’s largest tailwinds in the near future may have nothing to do with onchain products.

Last week saw reports of three new SOL treasury companies coming to market with about $2.65 billion in total raised.

On the horizon is also a likely October approval of existing Solana ETF applications.

The new ETFs “will be more tax-efficient, have better distribution (from Fidelity, Bitwise, etc.) than REX-Osprey, and [will] likely include in-kind creations and redemptions, as well as support for staking,” wrote Carlos Gonzalez Campo in a Blockworks Research report .

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown : Decoding crypto and the markets. Daily.

- 0xResearch : Alpha in your inbox. Think like an analyst.

- Empire : Crypto news and analysis to start your day.

- Forward Guidance : The intersection of crypto, macro and policy.

- The Drop : Apps, games, memes and more.

- Lightspeed : All things Solana.

- Supply Shock : Bitcoin, bitcoin, bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.