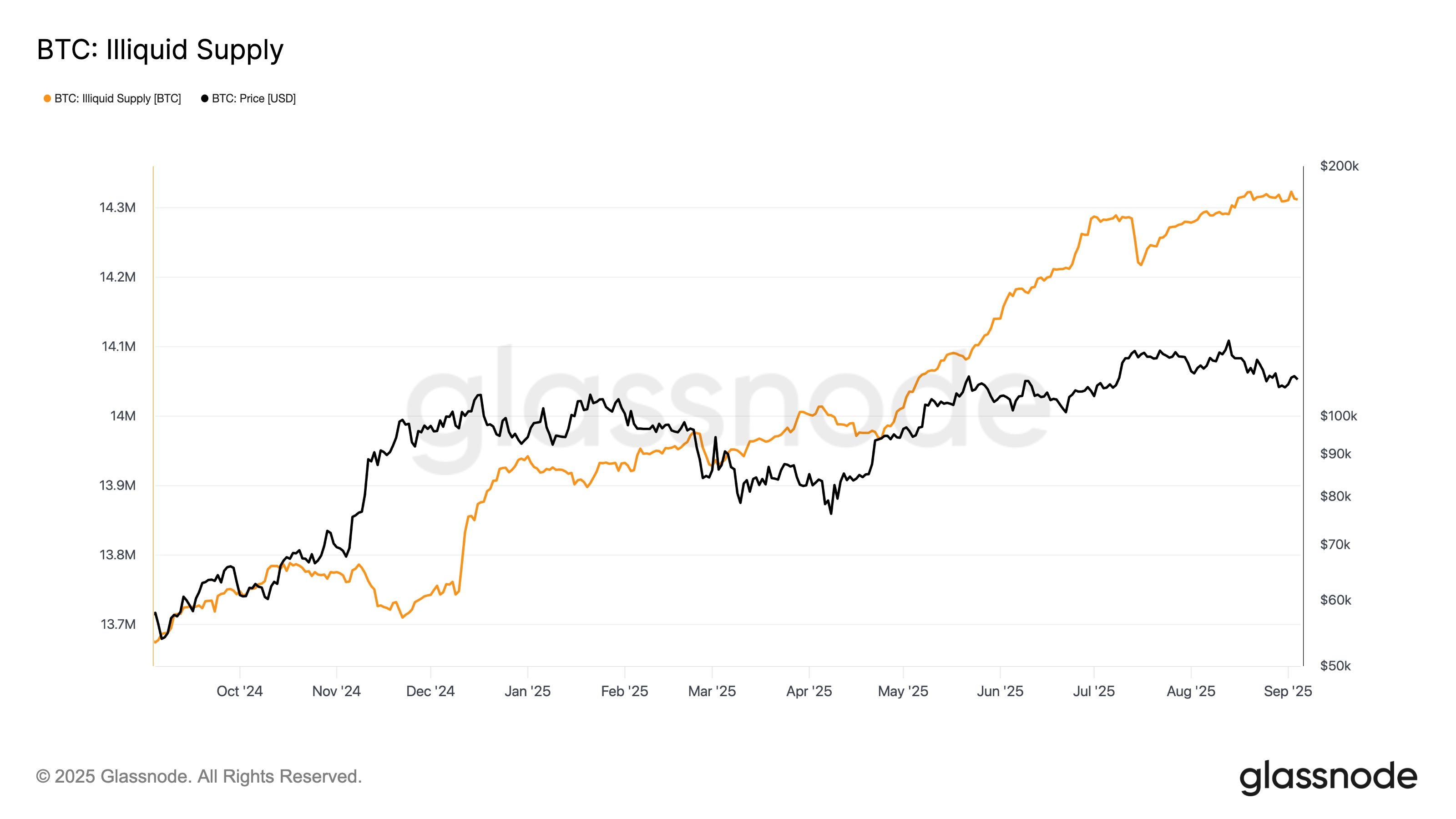

Bitcoin Illiquid Supply Hits Record 14.3M as Long-Term Holders Continue to Accumulate

Bitcoin’s illiquid supply—the portion of coins held by entities with little history of spending—has climbed to a new record high, surpassing 14.3 million BTC in late August, according to Glassnode.

With 19.9 million BTC currently in circulation, around 72% of the total supply is now illiquid, held by entities such as long-term holders and cold storage investors. This growth highlights a sustained accumulation trend, even during recent market volatility.

In mid-August, bitcoin hit an all-time high of $124,000 before retreating roughly 15%. Despite the price pullback, the illiquid supply continued to rise, showing that holders remain undeterred by short-term corrections.

Over the past 30 days alone, the net change in illiquid supply has increased by 20,000 BTC, underscoring persistent investor conviction.

The ongoing increase in this category suggests tightening supply dynamics that could set the stage for renewed momentum once sentiment recovers. For now, the trend reflects growing confidence in bitcoin as a long-term store of value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.