Horizon Launch Lets Institutions Borrow Stablecoins Onchain

- Horizon enables borrowing of stablecoins using tokenized U.S. Treasuries and funds.

- Investors gain round-the-clock access to capital through a compliant on-chain framework.

- Institutions can now leverage real-world assets for liquidity without selling their holdings.

Aave Labs has introduced Horizon, an institutional platform that enables the borrowing of stablecoins against tokenised real-world assets. The launch represents a decisive shift in decentralised finance, moving beyond crypto-native collateral. Built on a permissioned instance of Aave V3, Horizon enables institutions to deposit tokenized real-world assets, such as U.S. Treasuries and funds, as collateral. In return, they gain round-the-clock access to stablecoin loans, meeting capital efficiency and compliance requirements.

The Aave protocol currently secures more than $62 billion in net deposits. Horizon is positioning itself as a bridge between Wall Street and on-chain finance through partnerships with financial players like VanEck, WisdomTree, Centrifuge, and Circle.

According to Aave founder Stani Kulechov, “Horizon delivers the infrastructure and deep stablecoin liquidity that institutions require to operate on-chain, unlocking 24/7 access, transparency, and more efficient markets.”

How Horizon’s Borrowing Model Works

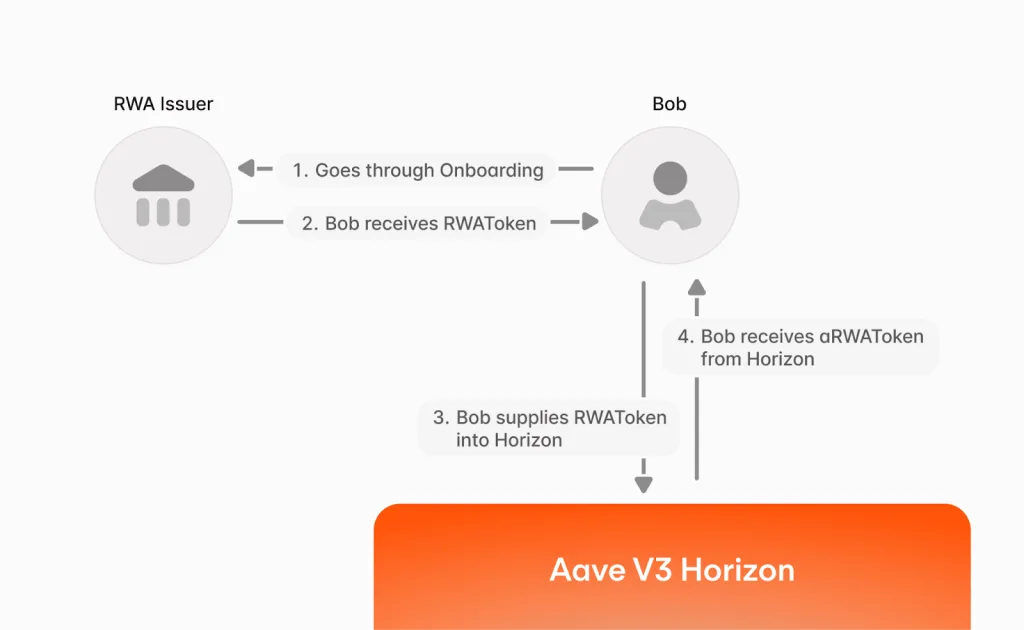

Institutions approved by RWA issuers can deposit tokenised securities as collateral. Each issuer sets its requirements and manages access permissions. When collateral is supplied, Horizon issues a non-transferable aToken that reflects the collateral position. Stablecoins such as USDC, Ripple’s RLUSD, and Aave’s GHO can then be borrowed. Each collateral type carries its own loan-to-value (LTV) ratio, providing predictable liquidity and mitigating risk.

Source:

Aave

Source:

Aave

The authorisation process complies with the token issuance level. Lending pools involving the stablecoin remain open and composable, retaining DeFi’s adaptability. Llama Risk and Chaos Labs assist with risk oversight, while valuations are supported by Chainlink’s NAVLink oracles, ensuring collateral pricing is always accurate and in real time.

The Horizon’s architecture combines efficiency, security, and transparency through its non-custodial framework. The issuers retain control of compliance and whitelisting, and at the same time, lending and governance remain transparent, decentralised, and truly open. At launch, supported collateral includes tokenized U.S. Treasury bills, AAA-rated collateralized loan obligations, and other high-quality corporate securities.

RWAs as Productive Capital in DeFi

In DeFi, tokenized RWAs have typically been isolated instruments with limited real utility. Horizon unlocks their potential by converting them into productive collateral. This transformation enables organisations to obtain stablecoin finance without selling their underlying holdings. It also gives stablecoin lenders new yield opportunities linked to risk profiles beyond purely crypto-native assets.

The integration of RWAs into DeFi represents a broader market trend. Already, Ethereum accounts for roughly 52 percent of the RWA tokenisation market. Forecasts suggest tokenised assets could form a multi-trillion-dollar collateral class within the decade. Aave is positioning Horizon to capture this expansion and scale institutional lending on-chain.

Their partnership with Ripple, WisdomTree, Securitise, VanEck, and Circle further amplifies Horizon’s ecosystem, which attests to the rising trust in tokenised finance. These partnerships also help Aave to position itself at the core of the institutional credit market on-chain.

Related: SEC’s Crypto Decision Sparks Surge in RWA Custody Services

Aave Market Performance

In a span of 24 hours, Aave’s native token (AAVE) was trading at $326.84, signifying a 1.57% decline within 24 hours. The token’s market capitalisation was $4.97 billion, and its fully diluted valuation was $5.22 billion.

There was a drop in trading activity, with a 13.58% decrease in daily volume to $572.63 million. With a circulating supply of 15.21 million AAVE supported by a total supply of 16 million, Aave’s total value locked (TVL) was documented at $39.55 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.