BTC Market Pulse: Week 33

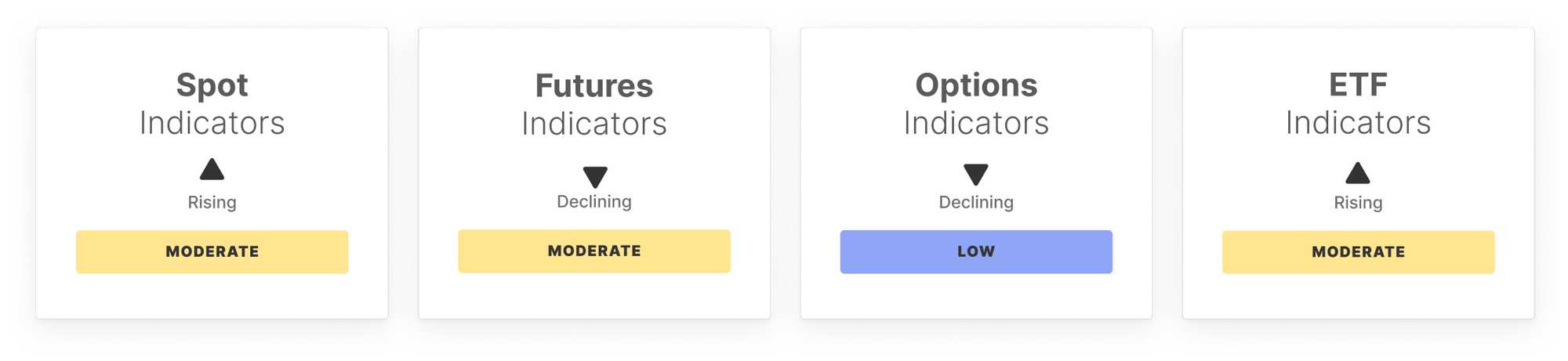

Bitcoin rebounded from last week’s drop below $114K to $121K, with on-chain activity and derivatives sentiment improving. However, falling spot volumes and high profitability suggest caution. This week’s Market Pulse breaks down key BTC market signals across spot, futures, ETFs, and on-chain.

Overview

After a sharp retest of the sub-$114k air gap, Bitcoin’s spot price staged a strong rebound over the past week, climbing back toward $121k. This recovery brought momentum back into the market, with several sectors showing signs of renewed activity, though conditions warrant close monitoring.

In the Spot Market, RSI rose from 41.5 to 47.5, bouncing from oversold territory, while Spot CVD improved sharply from heavy selling to near-neutral levels. However, spot trading volume dropped 22% to $5.7B, indicating that the recovery has yet to be matched by broad participation.

The Futures Market saw Open Interest ease slightly to $44.1B, with long-side funding slipping marginally yet remaining elevated. Perpetual CVD jumped to -$0.2B, signaling a notable shift toward buy-side aggression and renewed confidence among leveraged traders.

In the Options Market, Open Interest rebounded 6.7% to $42.4B, showing growing participation. The volatility spread contracted sharply to 10.45%, near its low band, suggesting complacent volatility pricing, while the 25 Delta Skew eased but stayed above its high band, reflecting lingering demand for downside protection.

The ETF Market recorded a sharp improvement in net flows, with outflows narrowing by over half, though trading volume fell 27.7% to $13.7B, near its low band. ETF MVRV rose above its high band to 2.43, signaling strong unrealized profits and potential profit-taking risk.

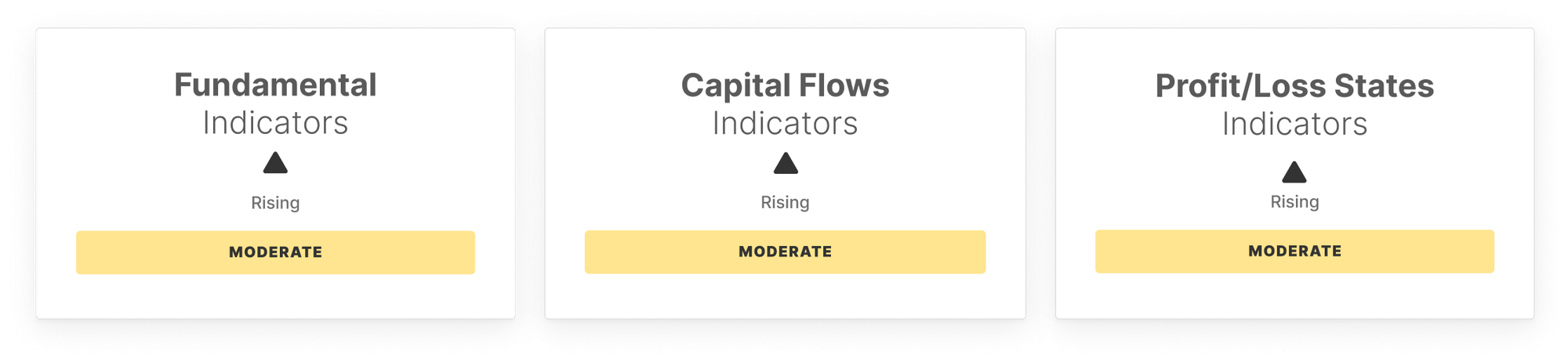

On-Chain Fundamentals strengthened, with active addresses climbing above their high band to 793k. Transfer volume held steady at $8.5B after prior declines, and fee volume rose 10.3%, reflecting increased demand for transaction inclusion.

Capital Flows moderated slightly as Realized Cap Change dipped to 5.2% but stayed above its high band. The STH/LTH ratio and Hot Capital Share remain stable, showing a balanced market structure and liquidity.

Profitability metrics improved, with Percent Supply in Profit at 94.1% and NUPL up to 8.5%. The Realized P/L Ratio rose to 1.9, highlighting profit-taking dominance.

In sum, the market has shifted from seller exhaustion to a strong rebound near recent ATHs. While momentum has returned, the move should be monitored closely, as elevated profitability and profit-taking potential could quickly alter sentiment.

Off-Chain Indicators

On-Chain Indicators

\

\

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.