Dow Jones drops as tariff fears outshine tech earnings, Nasdaq breaks records

Strong tech earnings balanced ongoing fears over trade as Trump’s tariff deadline looms.

- Nasdaq hits record on Meta and Microsoft earnings.

- Key tariff deadline approaches for major U.S. trading partners.

- Apple’s upcoming earnings will reveal the real impact of tariffs.

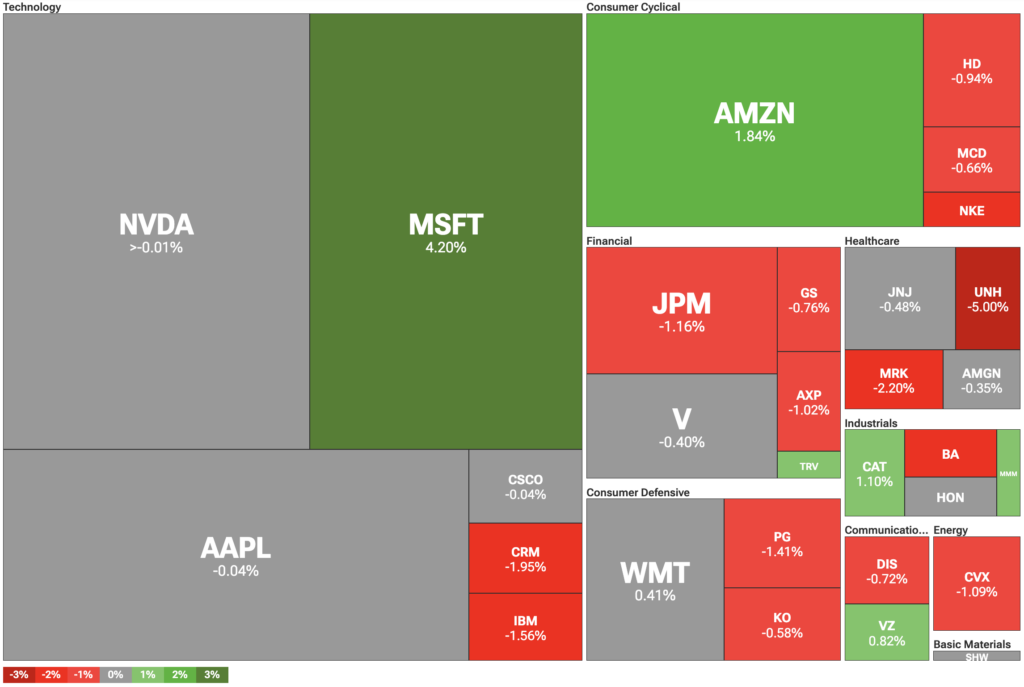

U.S. stock indices rose as strong tech earnings offset concerns about the approaching tariff deadline. On Thursday, July 31, the Dow Jones slipped 0.19% due to losses in financial and consumer defensive companies. Meanwhile, the S&P 500 gained 0.10%, and the Nasdaq reached a record high with a 0.45% increase.

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Markets were focused on tech earnings, particularly Microsoft and Meta , which reported strong quarterly results. After the announcements, Microsoft rose 9% and Meta gained 12%. Traders are now awaiting Apple’s earnings, scheduled after the market close on Thursday.

Apple’s report is critical because of the company’s globally distributed manufacturing. It will help gauge the effect of President Donald Trump’s tariffs on U.S. businesses, especially after Trump threatened a 25% tariff on iPhones if the company does not move production to the U.S.

Trump tariff deadline looms, as Mexico gets relief

On July 31, the White House extended the tariff deadline for Mexico by 90 days, giving the two countries more time to negotiate. Trump said he had a “very successful” conversation with Mexican President Claudia Sheinbaum and highlighted the unique relationship between the two nations.

For the U.S., Mexico is a key trading partner and a major recipient of American investment. Punitive tariffs could place U.S. companies with production in Mexico in a difficult position and significantly impact U.S. consumers.

Still, several other major U.S. trading partners, including Canada, India, and Brazil, still face increased tariffs starting on August 1. Still, White House aides stated that negotiations would continue even after that date.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.