Bitcoin miner MARA posts $808m profit as BTC rally drives record gains

MARA Holdings reported strong earnings for the second quarter, with a significant increase in revenue and Bitcoin treasury.

- MARA Holdings benefited from the BTC ATH

- The firm’s net income was $808.2 million

- MARA Holdings only trails Strategy in corporate BTC holdings

The recent Bitcoin (BTC) market rally had a strong impact on treasury and mining firms. On Tuesday, July 29, MARA Holdings, formerly Marathon Digital Holdings, reported strong earnings for the second quarter of 2025. The BTC miner and treasury firm benefited from lower energy prices and BTC appreciation.

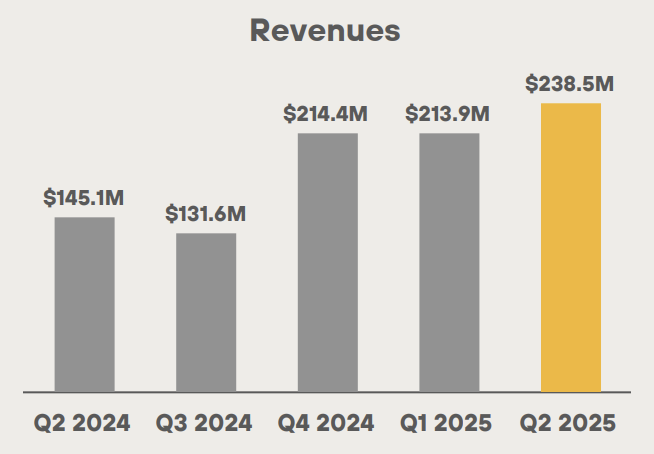

Mara Holdings reported total revenue of $238 million, a 64% year-over-year increase, mostly from its Bitcoin mining operations. This increase was largely driven by the higher price of Bitcoin, which is currently trading near its all-time high. Average BTC prices in Q2, which rose 50% YoY, contributed directly to mining revenues.

MARA holdings quarterly revenues | Source: MARA

MARA holdings quarterly revenues | Source: MARA

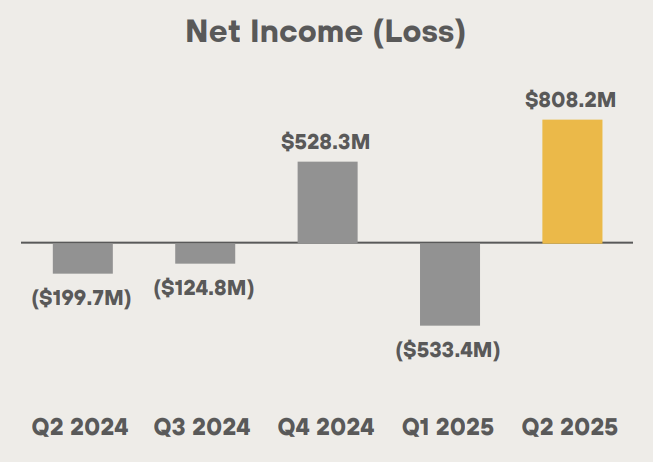

The company reported even stronger net income, at $808.2 million, compared to a $199.7 million loss in Q2 of 2024. This was largely due to a non‑cash gain on Bitcoin holdings, amounting $1.2 billion, largely due to unrealized profits on Bitcoin holdings.

MARA Holdings net income | Source: MARA

MARA Holdings net income | Source: MARA

MARA Holdings continues to accumulate BTC

The company’s Bitcoin holdings also rose by 170%, now totaling 49,951 BTC. Shortly after the quarter-end, MARA’s BTC holdings surpassed 50,000 BTC. This makes it the second-largest BTC treasury firm, only trailing Strategy .

Unlike most Bitcoin miners, MARA Holdings doesn’t sell the BTC it mines. Instead, the firm leverages its BTC as a strategic reserve asset to boost its share price long-term. The company also uses stock offerings to acquire additional Bitcoin reserves.

Since the regulatory changes in the U.S., Bitcoin has become a popular treasury asset. More and more companies are leveraging their Bitcoin reserves to enable investors to gain exposure to the biggest crypto asset.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens