Standard Chartered Forecasts Corporate Treasuries Holding 10% of Ethereum’s Supply

Geoff Kendrick from Standard Chartered notes that corporate treasuries have acquired 1% of ETH’s supply since June, with expectations to hold 10%. This surge, driven by staking rewards and DeFi opportunities, has been key to ETH’s price rally.

After Bitcoin (BTC), Ethereum (ETH) has emerged as the next institutional favorite. According to Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, corporate treasuries have purchased 1% of all ETH in circulation since the beginning of June.

This highlights the growing appetite among firms to increase their ETH exposure. Kendrick also shared with BeInCrypto that these corporate treasuries could eventually hold 10% of all ETH.

Institutions Aggressively Accumulate ETH in June

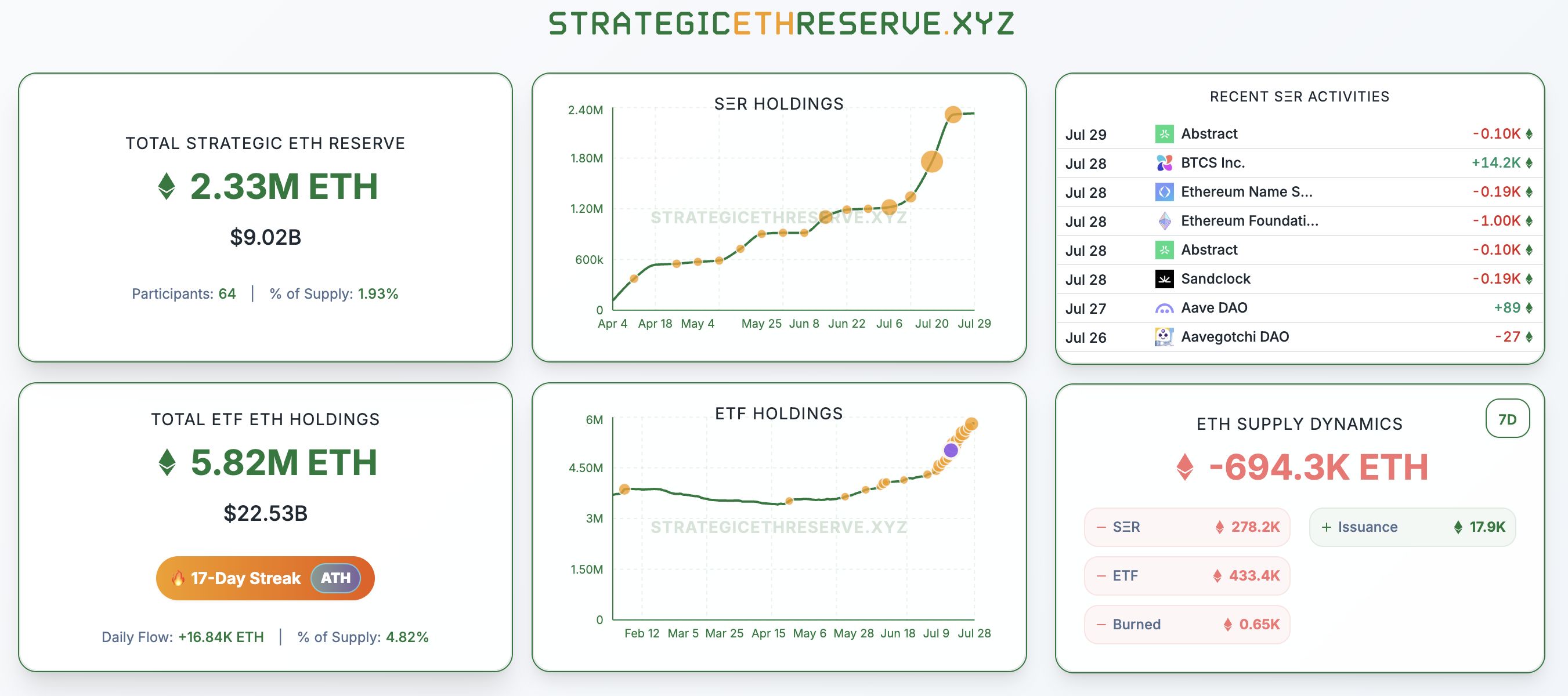

BeInCrypto previously reported that firms are accelerating their efforts to acquire ETH as part of their treasury strategy. According to the latest data, the Strategic ETH Reserve, which tracks entities holding Ethereum in their treasuries, now totals 2.33 million ETH, valued at over $9 billion.

These holdings, distributed among 64 entities, account for 1.93% of Ethereum’s supply. This marks a significant rise from the 789,705 ETH held in mid-May. In just over two months, the entities’ ETH holdings have surged by approximately 195%.

The Rise in Ethereum Holdings. Source:

Strategic ETH Reserve

The Rise in Ethereum Holdings. Source:

Strategic ETH Reserve

Notably, 113,000 ETH (approximately $409 million) is held by companies that revealed their positions for the first time this quarter.

Meanwhile, a few firms stand out for their massive holdings. For instance, BitMine Immersion Technologies, which initially committed $250 million to an ETH reserve, has already topped over $2 billion in ETH holdings in a month.

Furthermore, the firm plans to increase this stake to $4.5 billion, with the long-term vision of owning 5% of ETH’s supply. Similarly, SharLink Gaming has also increased its holdings to $1.7 billion in ETH.

SHARPLINK GAMING NOW HAS $1.7 BILLION USD OF ETHSharpLink Gaming ETH holdings have risen to $1.67 Billion as of last night, when the team acquired an additional $295M of ETH.Will SBET become the MSTR of ETH? pic.twitter.com/nb8gshxcfX

— Arkham (@arkham) July 28, 2025

Standard Chartered’s Geoff Kendrick highlighted that public companies with digital assets on their balance sheets have acquired 1% of ETH’s circulating supply in just two months. What’s particularly noteworthy is the pace of acquisition—this rate is double that of Bitcoin purchases by corporate treasuries.

“This buying was almost as strong as ETH ETF buying, which has also been the strongest on record. We expect ETH treasury companies to eventually own 10% of all ETH, a 10x increase from here,” Kendrick told BeInCrypto.

He stressed that in terms of flows, ETH treasury companies are becoming more important than their BTC counterparts.

“ETH treasury companies make more sense than their BTC equivalents due to staking yield, DeFi leverage. And from a regulatory arbitrage perspective, they make more sense than their BTC equivalents, too,” he said.

Why Corporate Firms Are Increasing Their Ethereum Holdings?

The executive explained that corporate treasury investments in ETH are appealing due to the financial system’s inefficiencies, which are largely driven by regulatory barriers.

Additionally, ETH treasuries can benefit from staking rewards and leverage opportunities within decentralized finance (DeFi). These are currently unavailable through US Ethereum ETFs.

Kendrick also noted that the momentum has contributed to ETH’s latest price rally. BeInCrypto Markets data showed that the price appreciated 56.9% over the past month, and peaked at highs last seen many months ago.

“ETH has significantly outperformed BTC since ETH treasury companies took hold in early June, with the ETH-BTC cross up from an April low of 0.018 to 0.032 now. Buying by these companies, along with the best period for ETH ETFs on record, has certainly contributed to those gains. If the flows can continue, ETH may be able to break above the key USD 4,000 level (our current end-2025 forecast),” Kendrick disclosed to BeInCrypto.

Thus, Ethereum’s growing appeal among corporate treasuries highlights its potential for long-term growth. Now, how the asset will actually perform remains to be seen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.