Analyst: If the Fed Resists Rate Cut Bets, the Dollar May Rise

BlockBeats reported on May 6 that Monex Europe analysts stated in a report that if the Federal Reserve dampens market expectations for a rate cut at Wednesday's meeting, the dollar may rise. They indicated that the market expects a rate cut in June, but recent U.S. data suggests that the Federal Reserve is unlikely to ease policy before the fourth quarter.

As tariffs will further increase price pressures, inflation remains high. The labor market remains robust, contrary to expectations of an economic slowdown. This leaves the Federal Reserve with "little room for action other than delaying market expectations for easing and emphasizing the resilience of underlying economic conditions."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

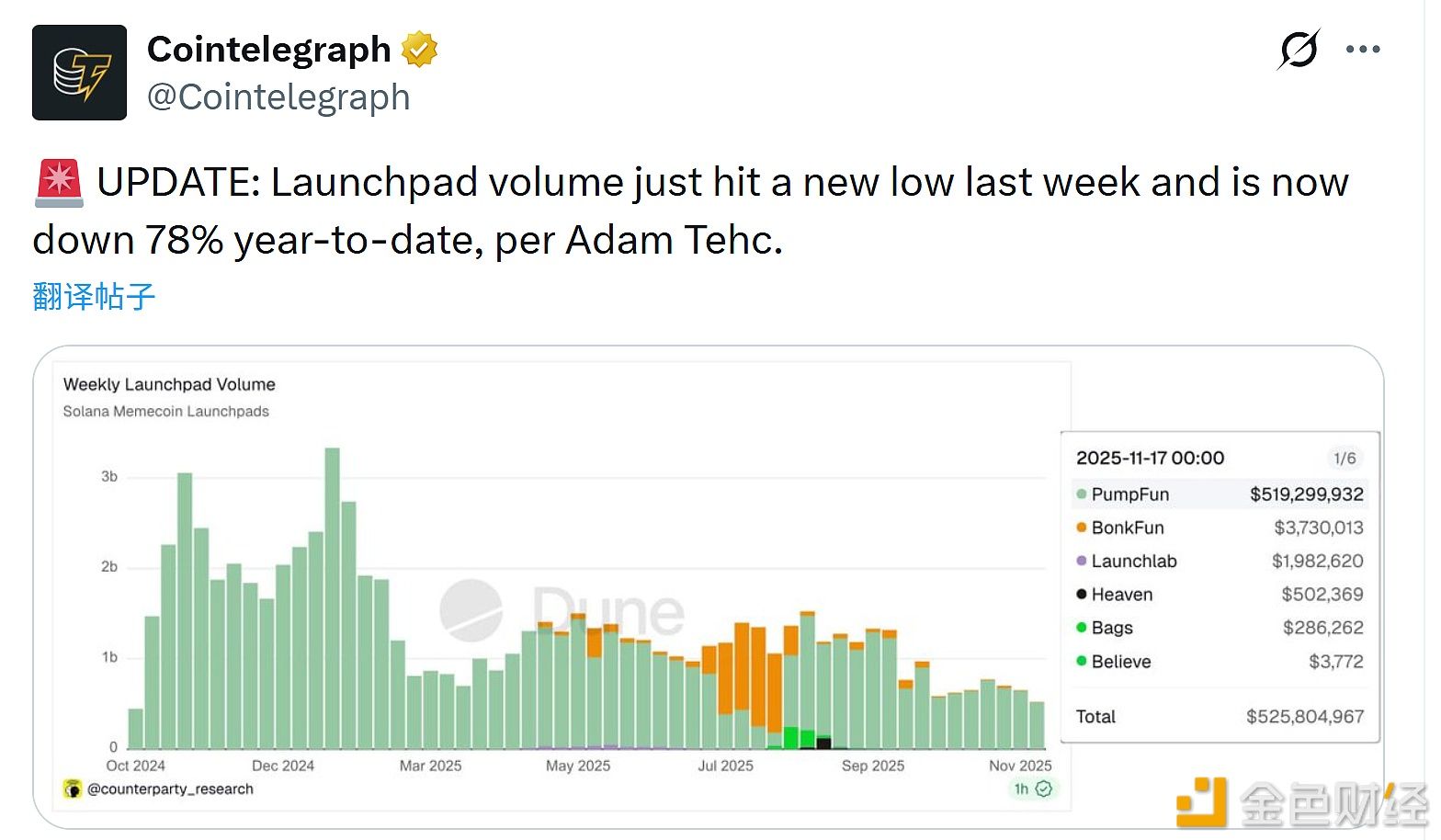

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93