Date: Wed, April 16, 2025 | 06:14 PM GMT

The cryptocurrency market has faced a sharp correction phase, with Ethereum (ETH) recording its worst Q1 performance since 2018 — dropping by over 50% since the start of the year. This brutal downturn has had a ripple effect across altcoins , including Core (CORE), which plunged more than 40% over this year.

However, today CORE comes into the spotlight with an impressive pump—rallying more than 25% in the last 24 hours. What’s more interesting is that CORE is now flashing a nearly identical bullish reversal pattern on its charts: the falling wedge — a classic signal often seen at major bottoms.

Source: Coinmarketcap

Source: Coinmarketcap

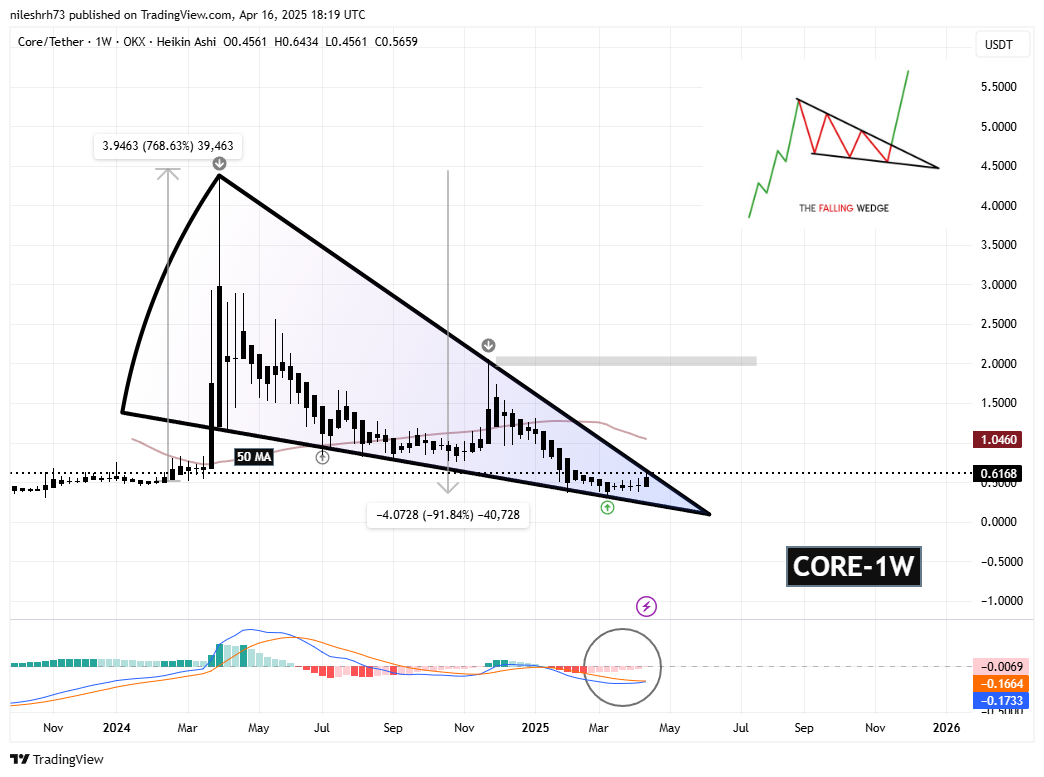

Approaches Falling Wedge Resistance

CORE’s price action over the past year has carved out a textbook falling wedge, beginning right after a parabolic 750% rally. The coin hit a peak of $4.37 in April 2024, only to crash more than 90% from those highs, bottoming out at $0.34 on March 10, 2025. That level has now emerged as a strong demand zone, with bulls stepping in aggressively to halt the prolonged slide.

CORE Token Weekly Chart/Coinsprobe (Source: Tradingview)

CORE Token Weekly Chart/Coinsprobe (Source: Tradingview)

Now, CORE has rebounded to nearly $0.62 and is testing the wedge’s upper boundary. A breakout here—especially if confirmed with a clean retest—could set the stage for a powerful recovery move. The next major upside target is the 50-week moving average (MA) and the $2.06 resistance zone, which represents a potential 245% upside from the current price.

Another factor supporting the bullish reversal narrative is the weekly MACD indicator. As shown in the chart, the MACD lines are flattening and appear close to a bullish crossover. This is often a precursor to a trend shift, especially when combined with a falling wedge breakout. It suggests that downward momentum may be drying up and bulls could be preparing for a return.

What’s Ahead?

CORE’s structure on the weekly timeframe is one of the cleaner wedge formations seen in the market right now. With price pressing up against long-standing resistance and momentum indicators signaling a possible shift, this setup could be on the verge of triggering a recovery phase.

Of course, it all hinges on whether the breakout is successful. If CORE gets rejected again at the wedge resistance, another retest of the support trendline is possible. But if it breaks out with volume and strength, the doors to a much larger move open up—possibly catching many traders off guard.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.