XRP Price Forecast: SEC Shift, Key Resistance Levels, and New ATH Predictions

XRP has recently gained momentum , with its price currently standing at $2.7433 amid significant market developments. The U.S. Securities and Exchange Commission's (SEC) shifting stance on cryptocurrencies, coupled with technical indicators and bullish analyst forecasts, points to potential gains for XRP. With a market cap of $158.71 billion and a 24-hour trading volume of $3.83 billion, XRP continues to capture investor attention. In this article, we explore the key factors driving XRP's price, including regulatory shifts, critical resistance levels, and predictions of a new all-time high

1. SEC's Evolving Crypto Stance

The SEC's recent changes in its approach to cryptocurrency regulation have stirred optimism within the XRP community . Analysts suggest that the regulator's softer stance could ease legal pressures on XRP, potentially opening the door to institutional adoption. With XRP previously entangled in a high-profile SEC lawsuit, this shift marks a significant development for the asset's long-term growth potential. Market observers believe that increased regulatory clarity may support a positive price trend in the coming months.

2. Key Resistance Levels: The $3.40 Threshold

Technical analysis highlights critical resistance levels that XRP must surpass to confirm a sustained uptrend. Currently, the $3.40 mark remains a pivotal point. According to analysts, breaching this level could signal bullish momentum and attract further buying interest. Additionally, XRP has recently crossed its 100-day Simple Moving Average (SMA) and surpassed the $2.70 resistance, reinforcing the potential for upward movement. Traders are closely watching for consistent closes above these levels to validate the bullish trend.

3. Analysts' Forecasts: Targeting a New All-Time High

Analyst forecasts indicate the possibility of XRP reaching a new all-time high (ATH) . A golden cross pattern, formed when the 50-day SMA moves above the 200-day SMA, has been identified—a historically reliable bullish indicator. One prominent analyst suggests that XRP could hit $5.80 if the current momentum persists, marking a significant rise from its previous ATH of $3.84. Factors such as increased adoption, positive regulatory developments, and technical strength contribute to this optimistic outlook.

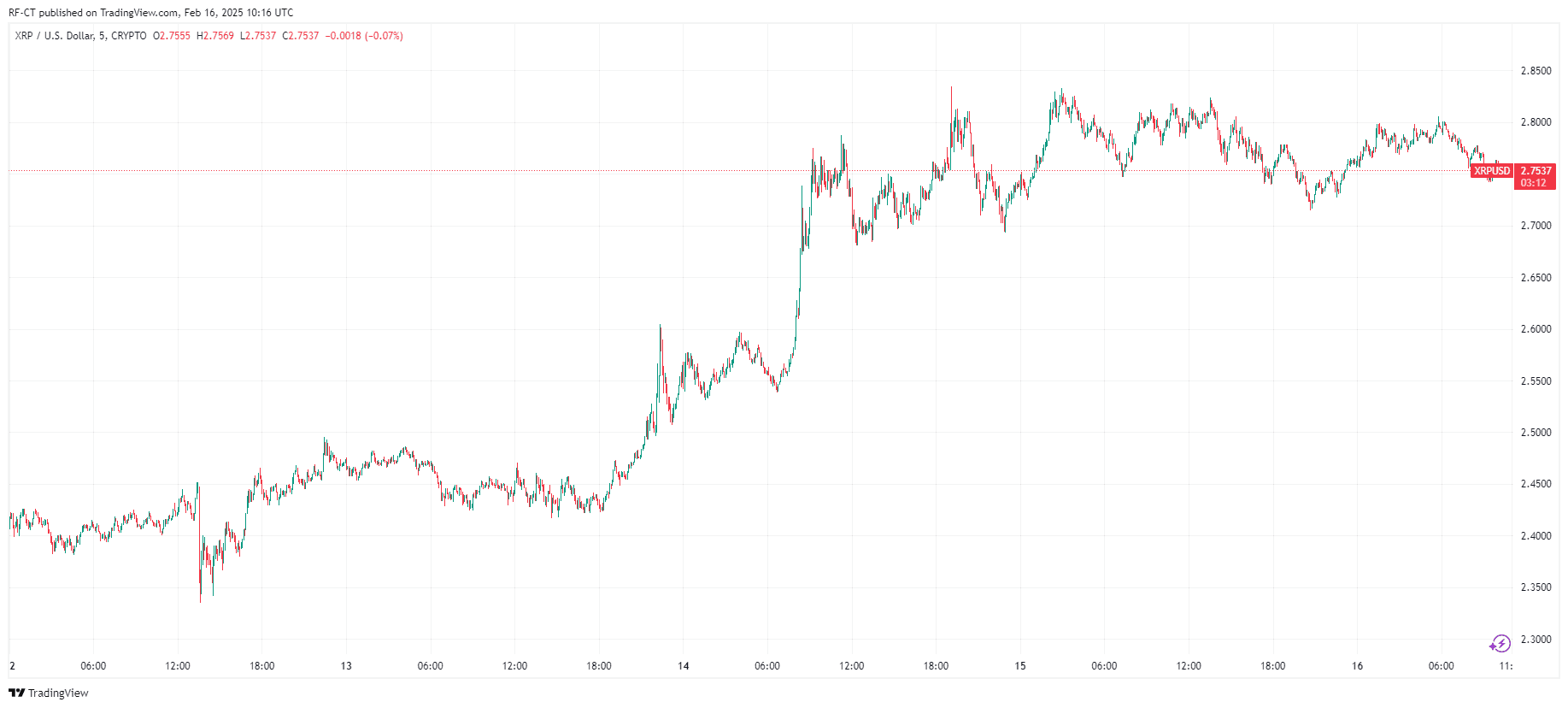

By TradingView - XRPUSD_2025-02-16 (5D)

By TradingView - XRPUSD_2025-02-16 (5D)

4. Market Metrics and Current Performance

XRP's market cap currently stands at $158.71 billion, with a circulating supply of 57.81 billion tokens. Despite a 49% decrease in 24-hour trading volume to $3.83 billion, the asset has demonstrated resilience by maintaining levels above key technical supports. This suggests that while short-term trading activity has slowed, long-term investor sentiment remains robust.

5. XRP Price Prediction: What to Expect Next

Looking ahead, analysts emphasize the importance of monitoring regulatory developments and technical signals. A confirmed break above $3.40 could pave the way toward the projected $5.80 target. Additionally, the SEC's ongoing regulatory adjustments will likely influence investor sentiment and XRP's performance .

By TradingView - XRPUSD_2025-02-16 (3M)

By TradingView - XRPUSD_2025-02-16 (3M)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin FOMO trickles back at $94K, but Fed could spoil the party

Beyond Cryptocurrency: How Tokenized Assets Are Quietly Reshaping Market Dynamics

Tokenization is rapidly becoming a key driving force in the evolution of financial infrastructure, with an impact that may go beyond short-term fluctuations, reaching the deeper logic of market structure, liquidity, and global capital flows.

On the eve of the interest rate decision, hawkish rate cuts loom, putting the liquidity gate and the crypto market to the year-end test

A divided Federal Reserve and a possible "hawkish" rate cut.

Gensyn launches two initiatives: a quick look at the AI token public sale and the model prediction market Delphi

Gensyn has launched its public sale with a valuation cap of 1 billion USD, offering the same entry price as a16z for AI computing infrastructure.