Why These Altcoins Are Trending Today — January 2

As 2025 begins, altcoins like VIRTUAL and KEKIUS are making waves. Read about their recent price jumps and what could be next for these trending altcoins.

As 2025 kicks off, investors are optimistic for a year of stronger gains. Interestingly, bar a few, most of the altcoins trending today have seen their prices increase in the last 24 hours.

According to CoinGecko, two of the top three altcoins — Virtuals Protocol (VIRTUAL) and Kekius Maximus (KEKIUS) — have recorded impressive double-digit growth, while ai16z (AI16Z) has bucked the trend with a decline. Here are the details.

Virtuals Protocol (VIRTUAL)

Throughout Q4 of last year, VIRTUAL was a regular on the trending list as one of the top-performing altcoins. Today, January 2, it continues to capture attention, surging by 23.60% in the last 24 hours.

VIRTUAL’s sustained rise could be attributed to the growing buzz around AI and gaming, which has propelled the altcoin to new heights. Following the price increase, VIRTUAL now trades at $4.89.

On the daily chart, VIRTUAL continues to hit a higher high, indicaitng notable demand for the altcoin. The Relative Strength Index (RSI) reading has also increased, indicating notable bullish momentum around the token.

Virtuals Protocol Daily Analysis. Source:

TradingView

Virtuals Protocol Daily Analysis. Source:

TradingView

Should this trend continue, the altcoin’s value could climb to $6. However, if demand for the Virtuals Protocol token drops, it might face correction. In that case, the value could decline to $2.90.

Kekius Maximus (KEKIUS)

Unlike VIRTUAL, Kekius Maximus price has decreased by 50% in the last 24 hours. However, that is not the major reason it is part of the altcoins trending today.

Earlier on, the meme coin built on Ethereum recorded a mind-blogging increase after Elon Musk changed his X handle to Kekius Maximus. However, yesterday, the Tesla CEO switched back to his original name, causing the meme coin’s market cap to fall by $300 million within an hour.

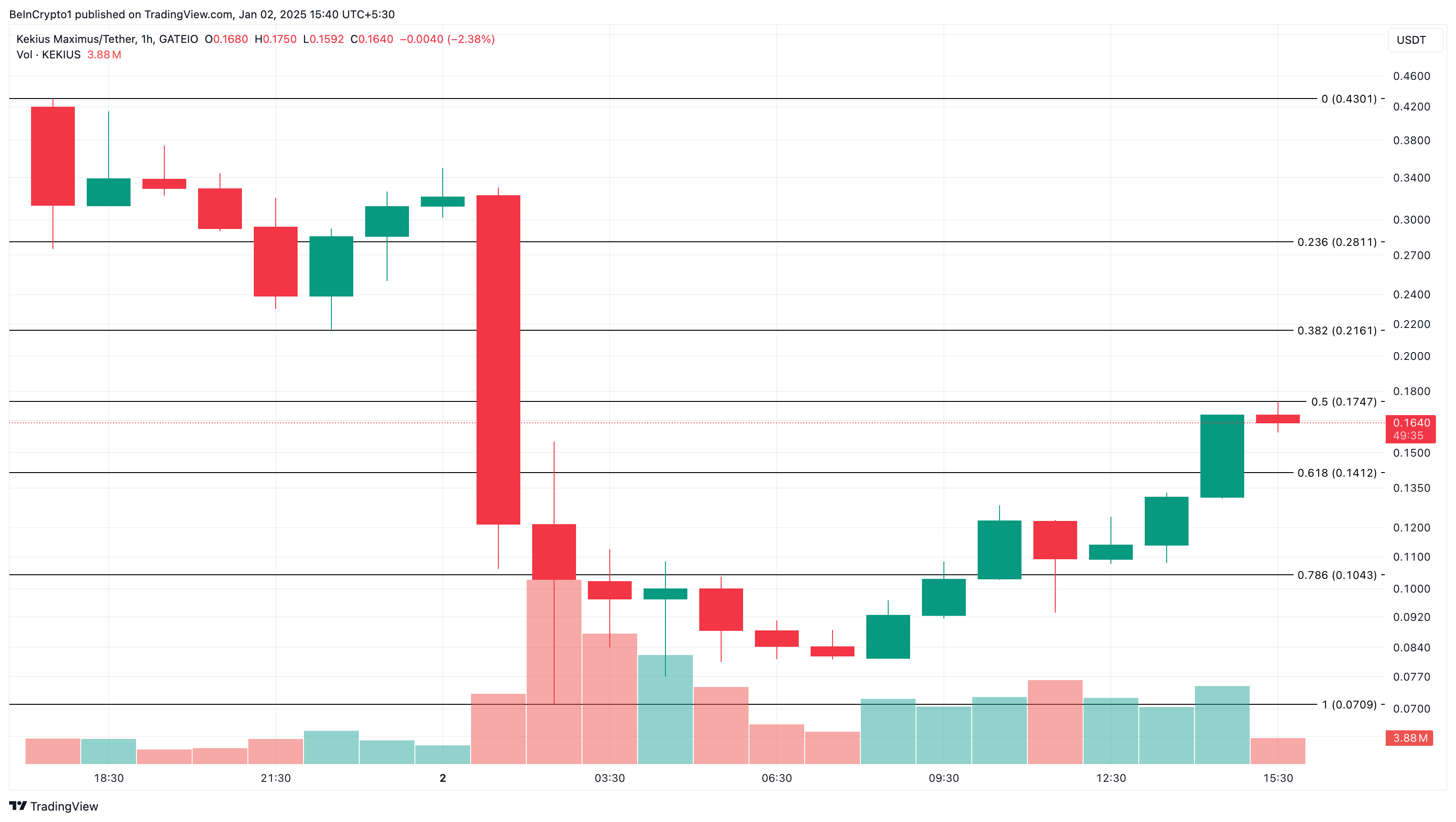

However, the 1-hour chart shows that the token has erased some of those losses. If sustained, KEKIUS value might rally toward $0.28 in the short term. On the flip side, if bears take over the price action, it could decline to $0.10.

Kekius Maximum 1-Hour Analysis. Source:

TradingView

Kekius Maximum 1-Hour Analysis. Source:

TradingView

ai16z (AI16Z)

Ai16z, a token deployed by venture capital led by AI agents, has increased by 20% in the last 24 hours, which is why it is trending. Beyond that, the bullish sentiment around AI agent cryptos is another reason it is on the list.

As of this writing, AI16Z trades at $2.27. On the 4-hour chart, the Bull Bear Power (BBP) has remained in the positive region. This indicates that bulls are in control of the altcoin’s direction.

ai16z 4-Hour Analysis. Source:

TradingView

ai16z 4-Hour Analysis. Source:

TradingView

Should this remain the same, then the token’s value might rally toward $3.50. However, if bears have the upper hand, the trend might change. If that is the case, AI16Z could decline to $1.73.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Importance of Industrial Property in Webster, NY, in Light of $9.8 Million Infrastructure Investment

- Webster , NY, transformed a 300-acre brownfield into the NEAT industrial hub via $9.8M FAST NY funding, boosting economic growth and real estate value. - Infrastructure upgrades (roads, utilities) reduced industrial vacancy rates to 2%, attracting high-capacity industries like semiconductor manufacturing and food processing. - A $650M fairlife® dairy facility will create 250 jobs by 2025, while rezoning expanded 1,400 acres of contiguous industrial land with mixed-use development. - Residential property

Trust Wallet Token (TWT) Price Forecast for 2025: Should You Invest Now?

- TWT defied 2025 crypto market declines with 0.81% 24h gain vs sector's 3.63% drop, driven by staking incentives and supply reduction via Trust Premium program. - Onramper partnership expanded TWT's utility to 210M users via 130+ local payment methods, enhancing adoption in emerging markets and governance value. - Fixed supply model with 40% circulating for 5+ years, combined with BNB Chain's 274% trading volume surge, supports TWT's undervaluation thesis. - Whale activity contrasts with Bitcoin's 87% vol

TWT's Updated Tokenomics Framework: Transforming Utility and Enhancing Investor Benefits within the Web3 Landscape

- TWT rebranded as a utility-driven DeFi asset in 2025, shifting from governance to cross-chain incentives and user engagement. - Trust Premium and Trust Alpha programs gamify TWT utility through tiered rewards, gas discounts, and early access to airdrops. - Fixed supply management and Binance integration strengthen TWT's scarcity, while FlexGas expands its transactional use across Ethereum and BNB Chain. - Analysts project $1.17-$2.86 price range for 2025, but warn of risks from regulatory uncertainty and

New Prospects for Economic Growth Infrastructure in Upstate New York

- Upstate NY's economic revival relies on shovel-ready infrastructure investments, as seen in Webster's $9.8M FAST NY grant transforming a brownfield into an advanced manufacturing hub. - Public-private partnerships (PPPs) like NY's $51M program reduce industrial vacancy rates (Webster's now 2%) and attract high-growth sectors like semiconductors and cleantech. - Governor Hochul's $300M POWER UP initiative and NY SMART I-Corridor are accelerating semiconductor manufacturing, positioning Upstate as a critic