Interactive Brokers: MicroStrategy benefits from its self-fulfilling feedback loop

Steve Sosnick, the chief strategist at Interactive Brokers, pointed out last week that Michael Saylor's strategy for MicroStrategy is to issue convertible bonds and use the proceeds to buy Bitcoin. This is essentially a definition of leveraged trading - borrowing money to buy financial assets.

This method works very well when the price of an asset moves in your favor, and Bitcoin has performed quite impressively. But if it moves in the opposite direction, this method can collapse in an annoying way. Steve Sosnick emphasized that MicroStrategy benefits from a "self-fulfilling feedback loop".

It bought more Bitcoins, which helped push up prices, then sold more debt and stocks to buy even more Bitcoins, further pushing up prices. But such things never go on forever and often end badly - the question is when? The short-term answer seems to be not yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

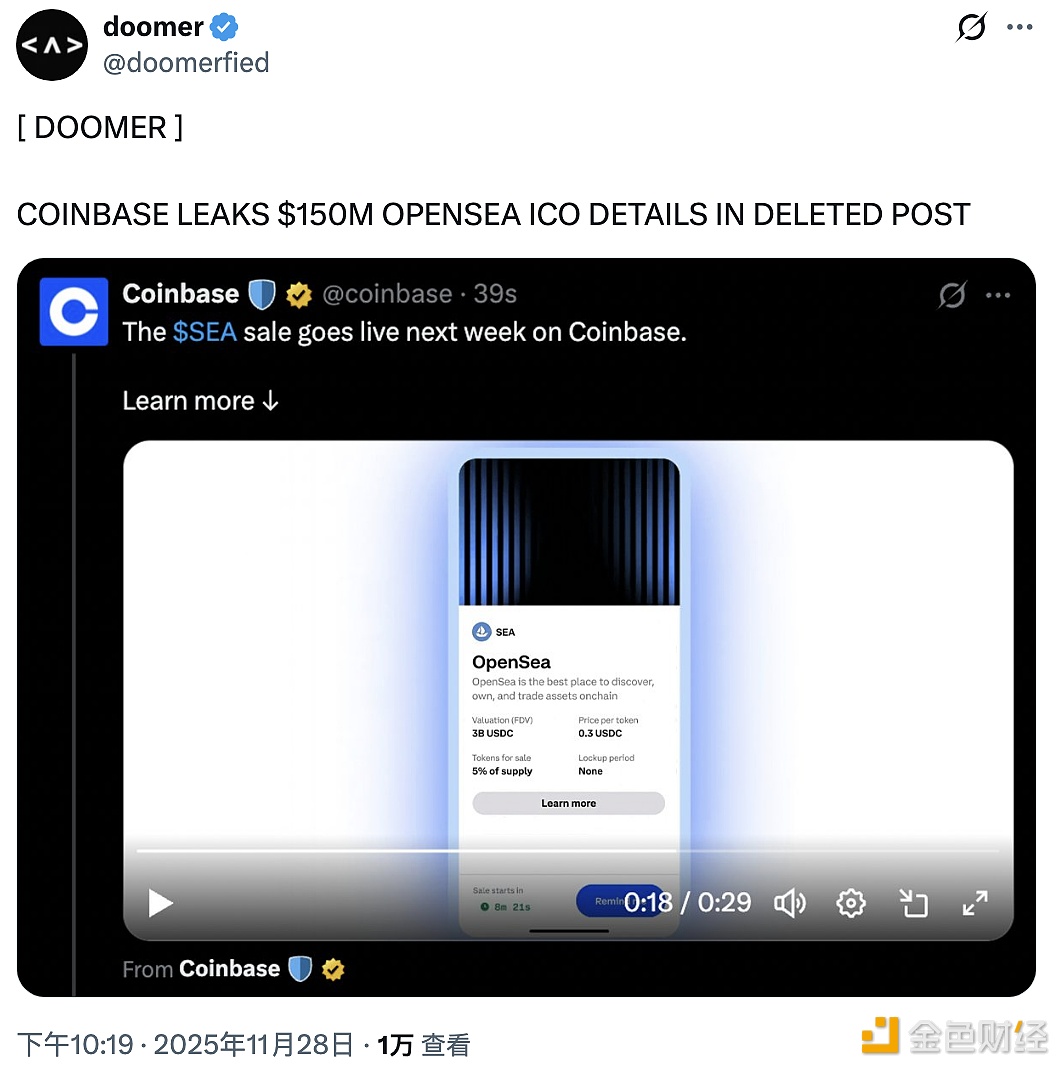

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.