Crypto Investors HODLing Solana in Anticipation of Higher SOL Prices, According to Analytics Firm

New data from market analytics firm Glassnode reveals that traders are keeping their Solana ( SOL ) stacks amid expectations that its price will continue to rise.

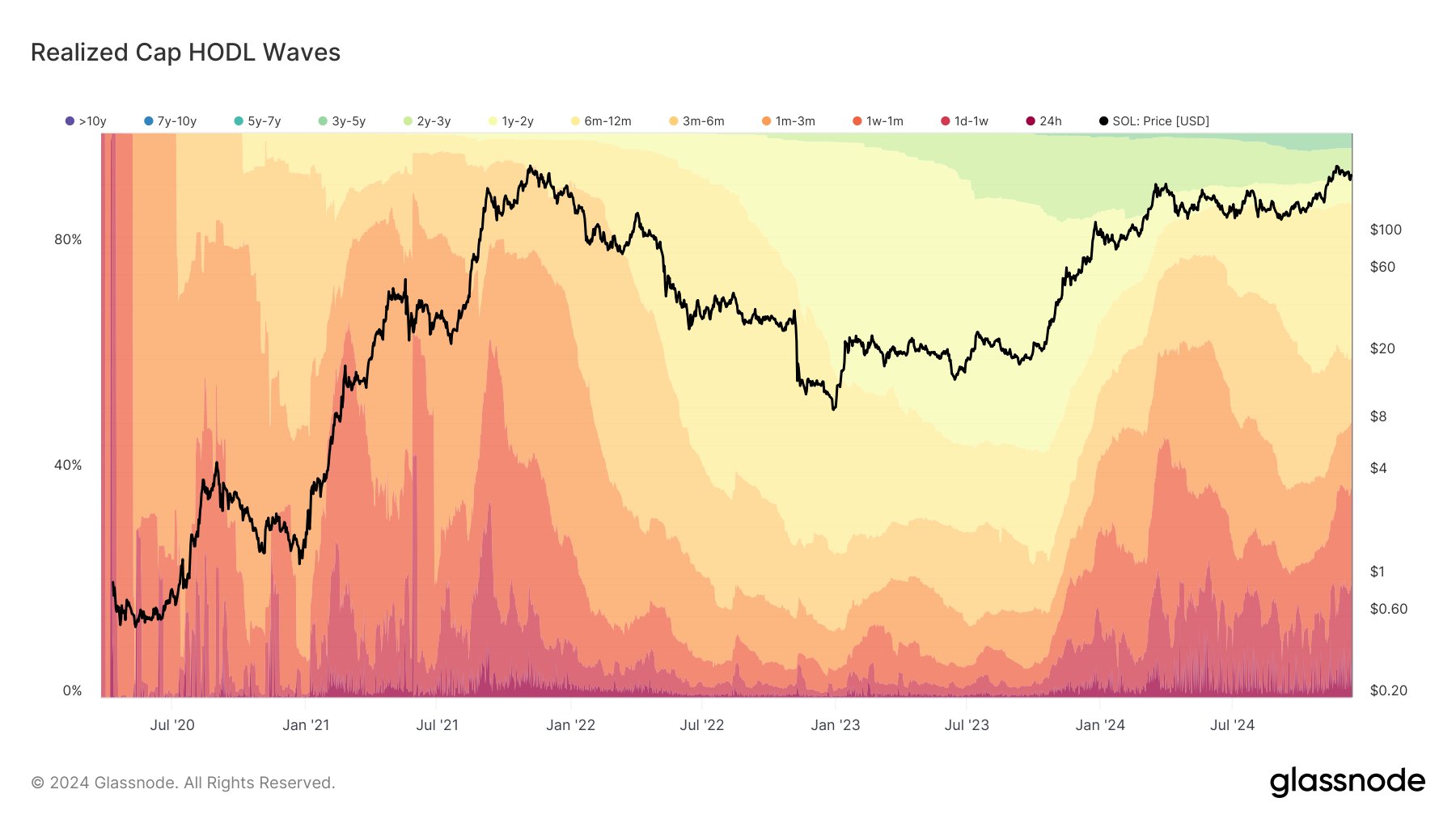

In a new thread on the social media platform X, Glassnode says that long-term holders now own a significant supply of SOL, believing that Solana’s bullish phase is far from over.

“Solana investors are HODL-ing (holding on for dear life) firm, expecting higher prices. Long-term holders’ share of wealth locked in the network is growing. The 6-12 month cohort now holds 27% of the supply, showing conviction from 2024 rally buyers.”

Source: Glassnode/X

Source: Glassnode/X

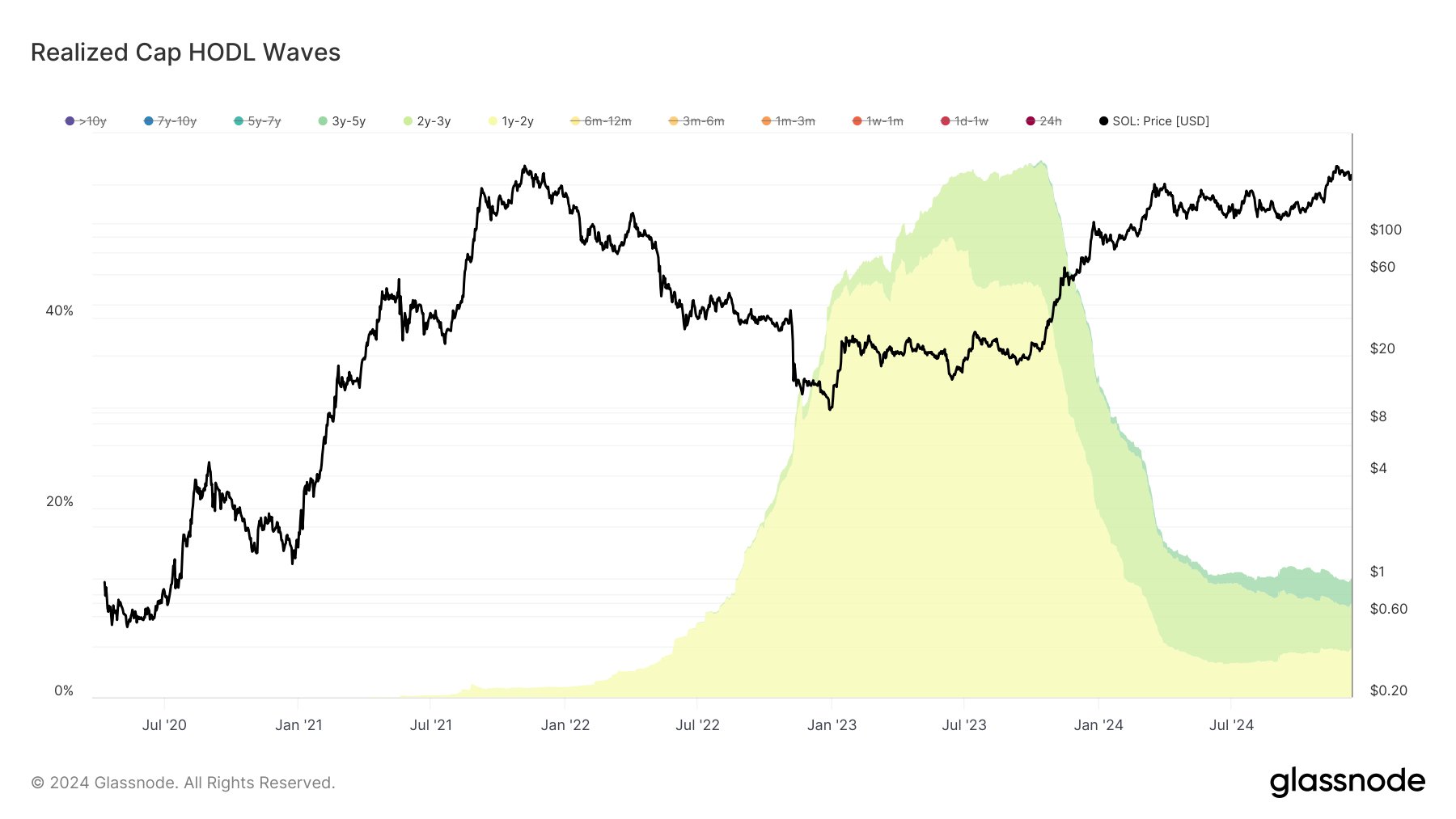

But the data analytics firm notes that investors who accumulated SOL toward the end of the 2022 market cycle have massively unloaded their holdings. According to Glassnode, the distribution of the 2022 investor cohort suggests that selling pressure for SOL is now weak.

“Meanwhile, the 1-2 year cohort has steadily diminished, dropping from 48% in June to just below 5% now. These were investors from the previous bull run who largely took profits during this year’s rally. For now, those who wanted to sell SOL have likely sold.”

Source: Glassnode/X

Source: Glassnode/X

Earlier this week, the co-founders of Glassnode predicted that Solana is due for a major rally.

“SOL hit the marked zone and rebounded toward $230. If it surpasses $235 on a daily timeframe, it could break the price compression, targeting the previous high of $264.

Key Signals: Daily RSI (relative strength indicator) is neutral, far from overbought territory – favorable for a move higher.”

Solana is trading for $224 at time of writing, a 3% decrease during the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.