$174 Million FET Accumulation Pushes Price Toward Resistance

FET's 31% surge over the past week is driven by $174 million in whale accumulation, bringing it close to breaking its $1.72 resistance level.

Artificial Superintelligence Alliance (FET) has been on an uptrend, gaining 31% over the past week. This rally is driven by increased whale accumulation, indicating heightened interest from large-scale investors.

FET’s double-digit price surge has brought it near the upper boundary of the horizontal channel it has traded within since June. The key question is whether this momentum will trigger a breakout above this critical resistance level.

FET Whales Drive Rally

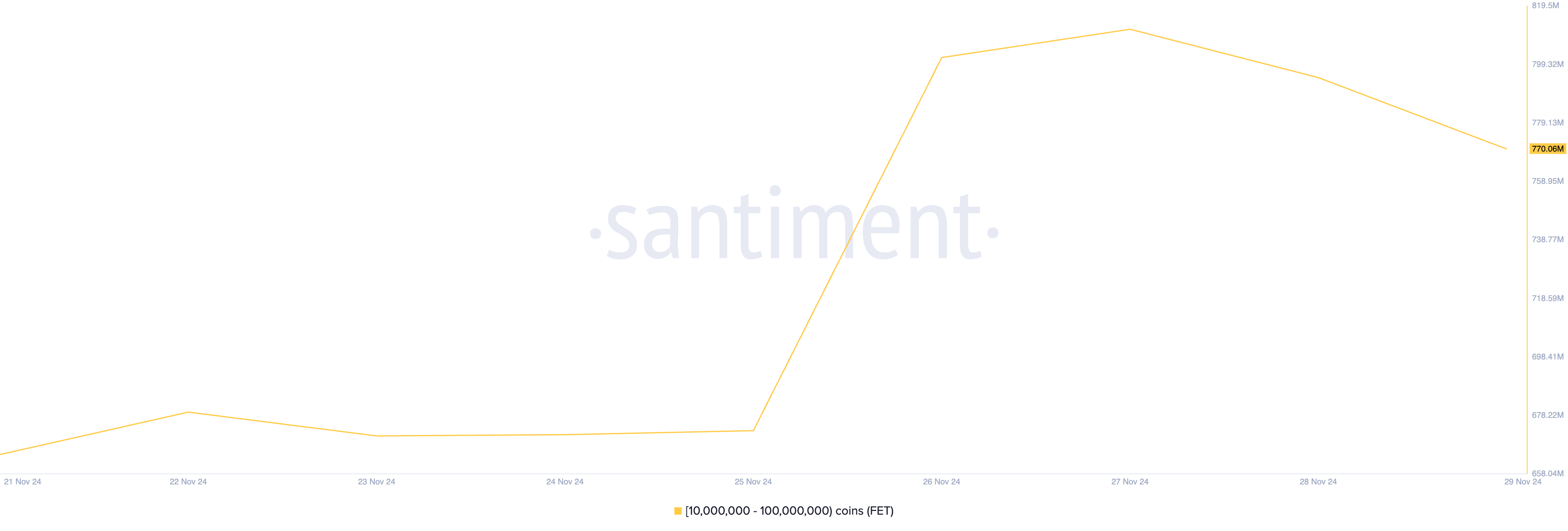

BeInCrypto’s analysis of FET’s on-chain performance has revealed a significant rise in whale accumulation over the past week. Data from Santiment reveals that, in the past seven days, whale addresses holding between 10 million and 100 million FET tokens have collectively purchased 106 million tokens valued at $174 million at current market prices.

When whales accumulate more coins, it signals confidence in the asset’s future value. This heightened demand often influences retail interest, which increases buying pressure and drives up the asset’s price.

FET Supply Distribution. Source:

Santiment

FET Supply Distribution. Source:

Santiment

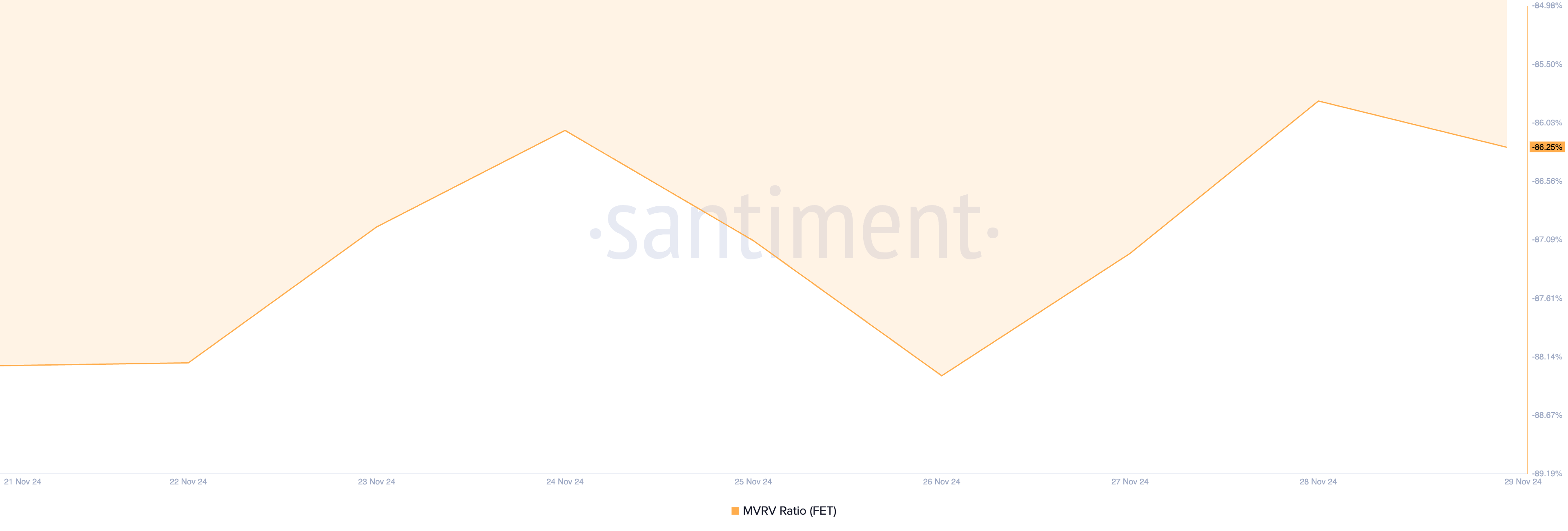

This surge in whale accumulation is largely attributed to FET’s undervalued status, as indicated by its negative market value to realized value (MVRV) ratio. Santiment reports that FET’s current MVRV ratio stands at -86.25%.

The MVRV ratio compares an asset’s market capitalization to the total value of coins purchased at their realized price, offering insights into whether the asset is overvalued or undervalued relative to its historical cost basis.

FET MVRV Ratio. Source:

Santiment

FET MVRV Ratio. Source:

Santiment

Historically, investors view negative MVRV ratios as a buying opportunity, recognizing that the asset trades below its historical acquisition cost and may rebound. This expectation of a rebound has led FET whales to increase their holdings in recent days.

FET Price Prediction: A Rally Above $2 Is Possible

On a daily chart, FET has traded within a horizontal channel since June. This channel is formed when an asset’s price fluctuates between parallel support and resistance levels, indicating a period of consolidation or range-bound trading. Since June, FET has faced resistance at $1.72 and has found support at $1.09.

FET Price Analysis. Source:

TradingView

FET Price Analysis. Source:

TradingView

At press time, FET trades at $1.63, attempting to break above the upper line of this channel. If successful, this will propel its price to trade at $2.09. Conversely, a failed attempt to breach resistance will send FET’s price toward support at $1.35.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.