Crypto brokers such as FalconX, GSR and others are offering short-term financing to their clients, charging up to 25% APR

According to The Information, the collapse of major cryptocurrency-friendly banks last year caused quite a bit of trouble in the cryptocurrency market, making it more difficult for hedge funds and other cryptocurrency investors to move their money at the pace required for most transactions.

However, a growing number of cryptocurrency brokers (such as FalconX) and cryptocurrency trading firms (including GSR and B2C2) have stepped in to provide short-term financing to ensure that their clients' trades can be settled immediately, generating huge returns in the process, and several cryptocurrency brokers acting as shadow banks are offering short-term loans to make up for the mismatch in timing, charging up to 25% in per annum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

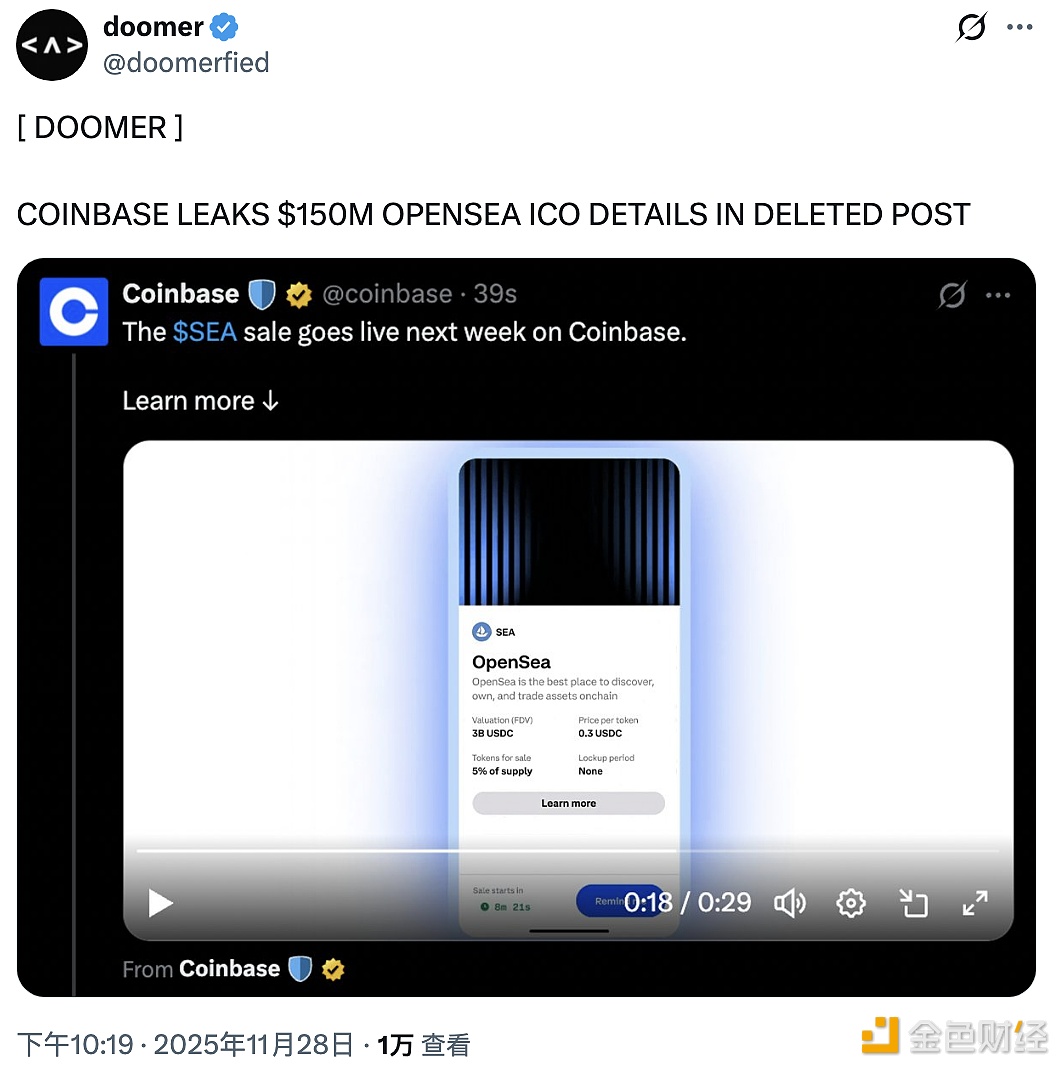

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.