Bitcoin ( BTC ) faces new lower BTC price targets after dropping up to 15% since the weekend.

Traders and analysts are lining up to consider where the market might bottom — and how soon this could occur.

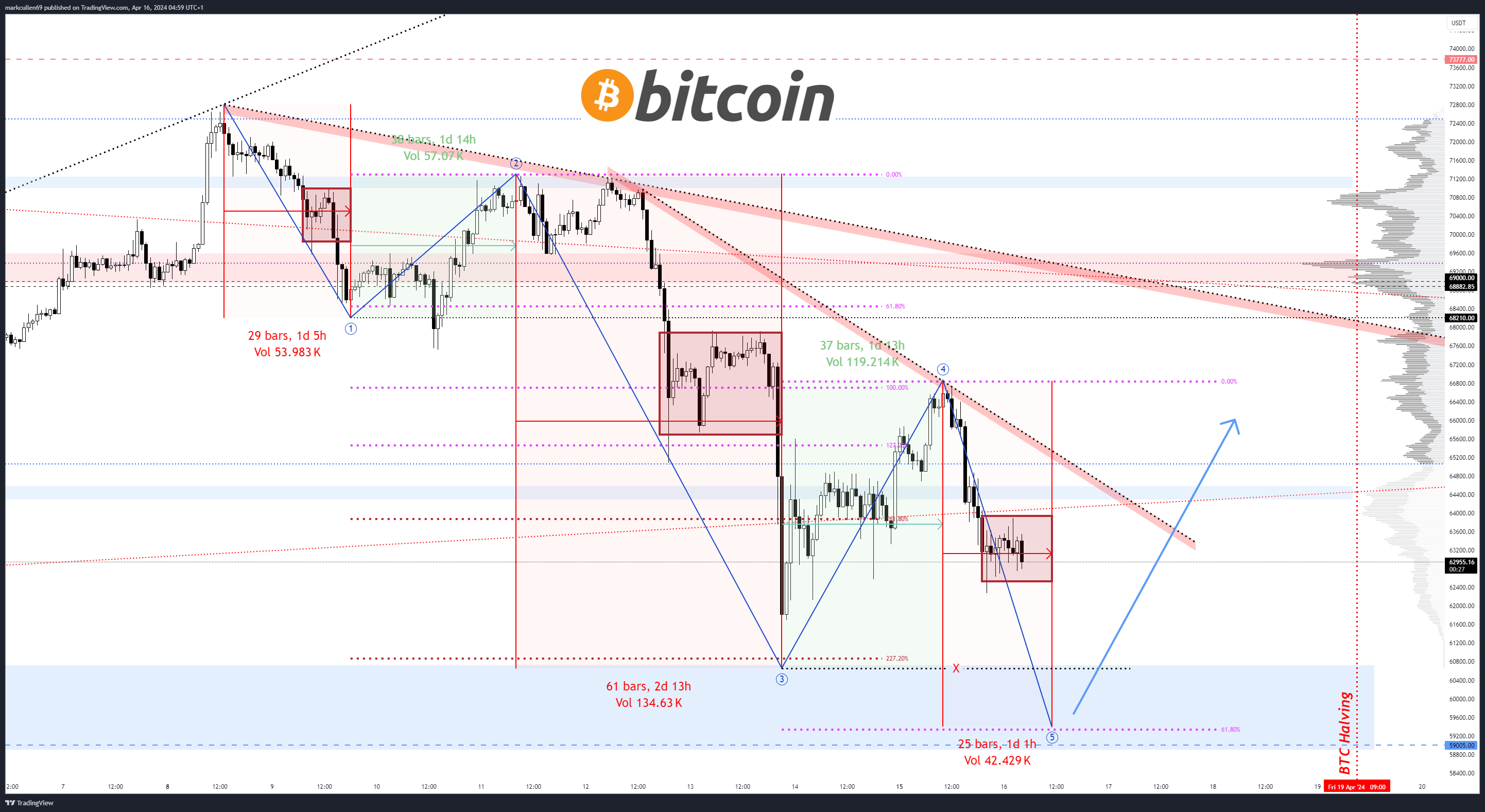

$59,000 final BTC price dip by April 17?

After challenging $61,000, a significant rebound failed to hold for BTC/USD, which now circles $62,000 as of April 16.

For popular analyst Mark Cullen, the course is set for a fresh attack on $60,000 resistance.

Utilizing the Elliott Wave method, he suggested that a final downmove could come imminently, taking Bitcoin to around $59,000.

“Still very possible that there is 1 more leg down for $BTC to complete the Wave C of the larger flat corrective formation,” he told followers on X (formerly Twitter).

“Should complete today if its going to play out.”

BTC/USD chart. Source: Mark Cullen/X

$59,000 would put BTC price action at its lowest levels since late February and also represent the largest drawdown versus recent all-time highs to date — around 20%.

Bitcoin risks loss of key moving average

Continuing, others, including popular analyst Matthew Hyland, looked to the upcoming weekly close for insights into the nature of the current pullback’s staying power.

Uploading a chart to X, Hyland noted that BTC/USD had lost the support of its 10-week simple moving average (SMA), with this currently lying at $64,130.

“This is highly dependent on how the weekly candle closes,” he wrote in part of accompanying commentary.

“The last time it tested it, it was a great buying opportunity and never closed below it. The close will be what matters most.”

BTC/USD 1-week chart with 10SMA. Source: TradingView

Full candles below the 10-week SMA last occurred in mid-2023, data from Cointelegraph Markets Pro and TradingView shows.

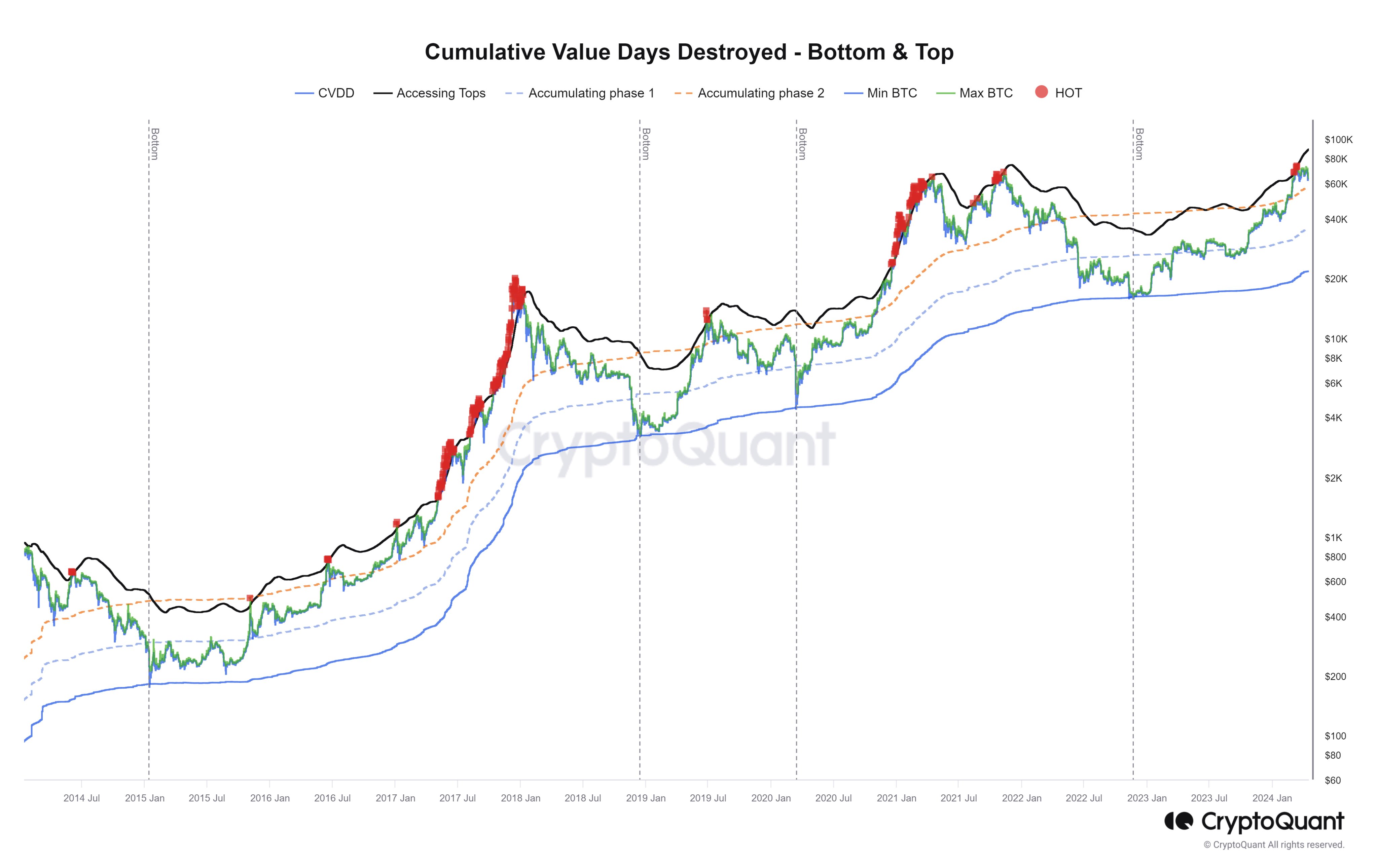

BTC price metric calls for lower reaccumulation phase

For Binh Dang, a contributor to on-chain analytics platform CryptoQuant, longer timeframes could yield frustrating conditions for Bitcoin bulls.

Analyzing his Adjusted Cumulative Value Days Destroyed (CVDD) metric, he predicted that BTC/USD could stay lower for longer before rechallenging its highs.

CVDD measures the number of days a coin has been in its wallet when it moves on chain and multiplies this by the current price.

“My adjusted CVDD metric recognized the local tops very well, and now, I am looking forward to BTC backing to test and accumulate at Phase 2 (orange line),” Binh explained alongside an illustrative chart.

While history shows that deeper corrections can occur, Binh added that he did not expect the current geopolitical impetus for the downmove to reach the levels of panic seen, for example, during the COVID-19 cross-market crash in March 2020.

A trip to the chart’s “Phase 1” line at just under $40,000 now constitutes the “worst case.”

Bitcoin Adjusted Cumulative Value Days Destroyed (CVDD) chart. Source: Binh Dang/X

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.