Uniswap's UNI rises 20% as revenue sharing mechanism proposal nears approval

UNI has risen more than 20% in the past 24 hours, touching $17 for the first time since January 2022 before retreating slightly to $15.7. The rally was driven by investors re-evaluating the price of UNI in light of a major governance reform plan that created a program to reward UNI holders who pledge and entrust tokens by distributing a portion of the revenues that the protocol earns from exchange fees.Uniswap's example may inspire other decentralized finance (DeFi) protocols to follow suit.Frax Finance has revealed plans to propose a revenue sharing mechanism similar to Uniswap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

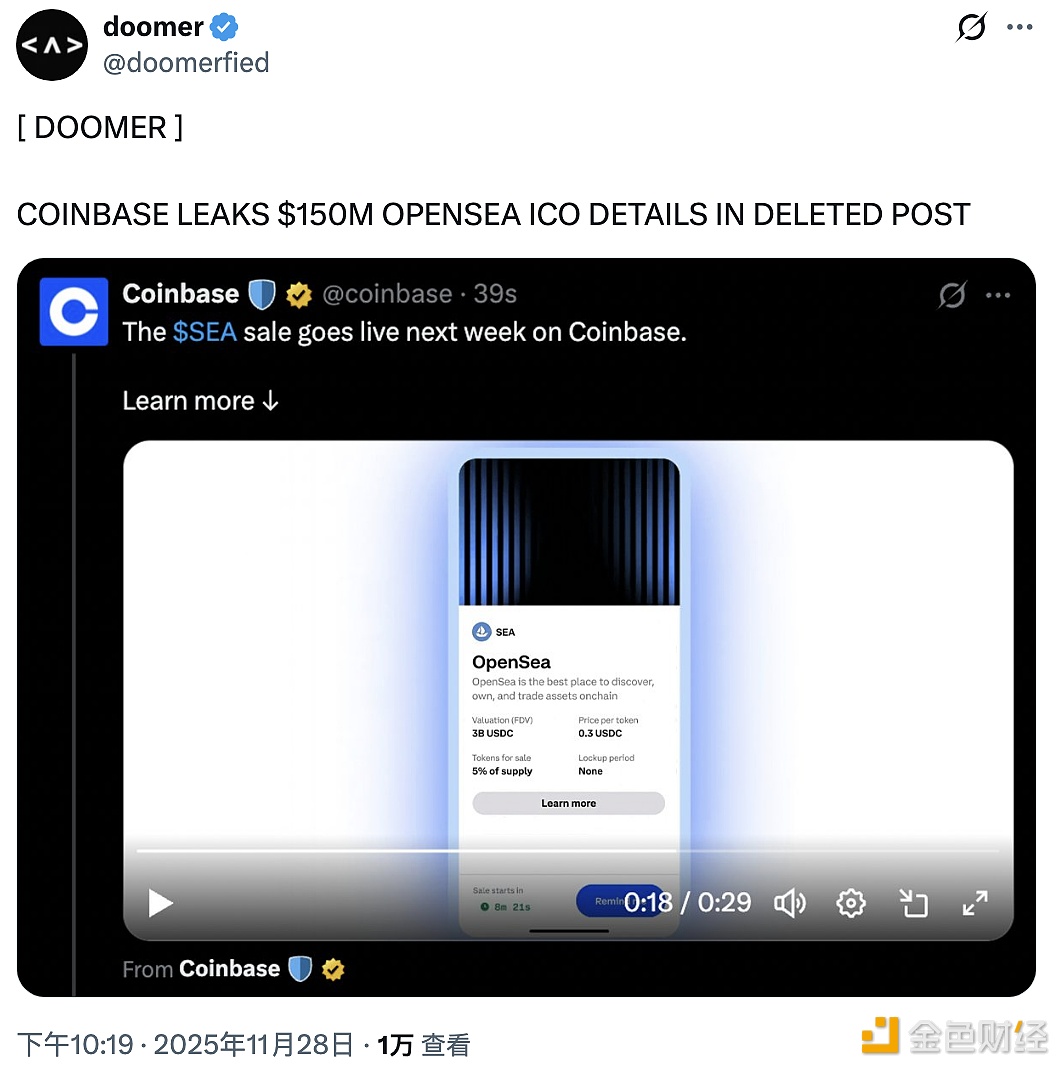

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.