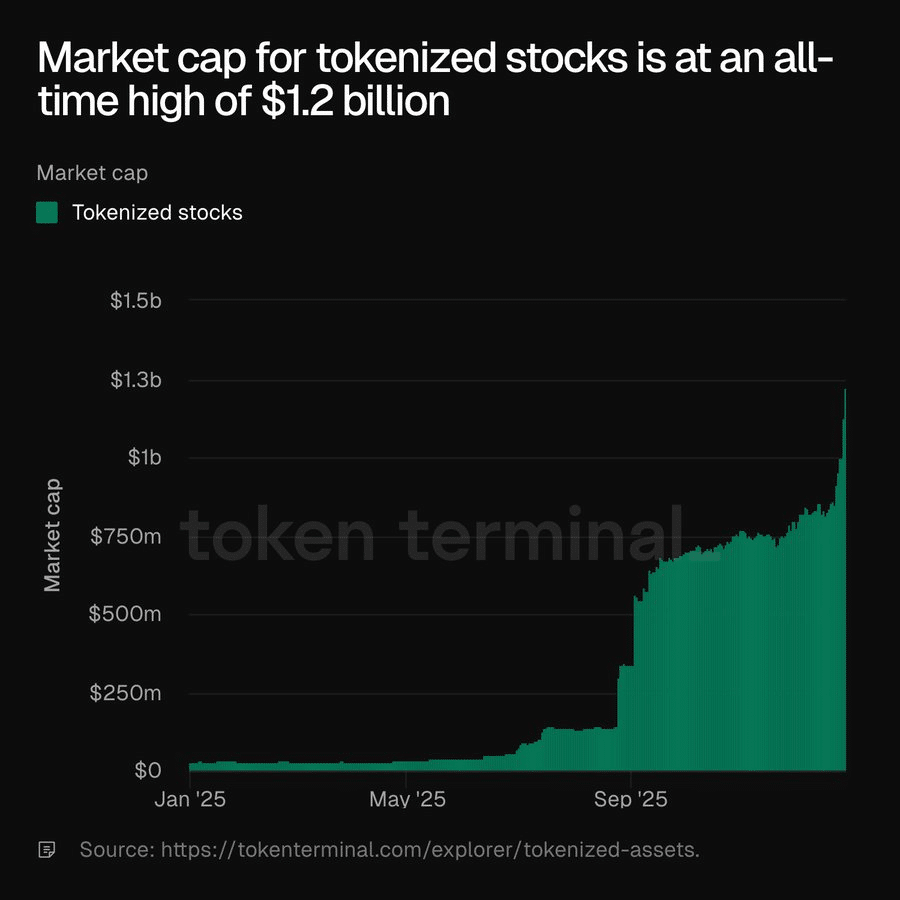

Having started the year outside the top ten, real-world assets (RWAs) are at the center of DeFi now! Here’s the rundown.

Not a niche anymore

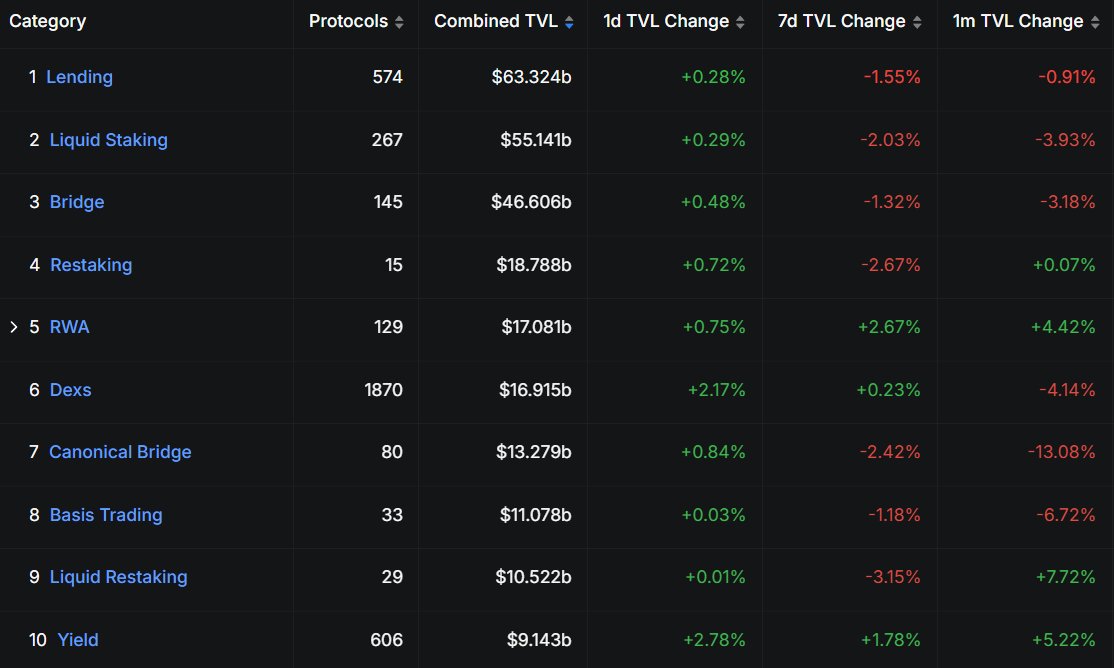

RWAs have overtaken DEXs to become the fifth-largest category by TVL, holding over $17 billion.

But where is this growth coming from?

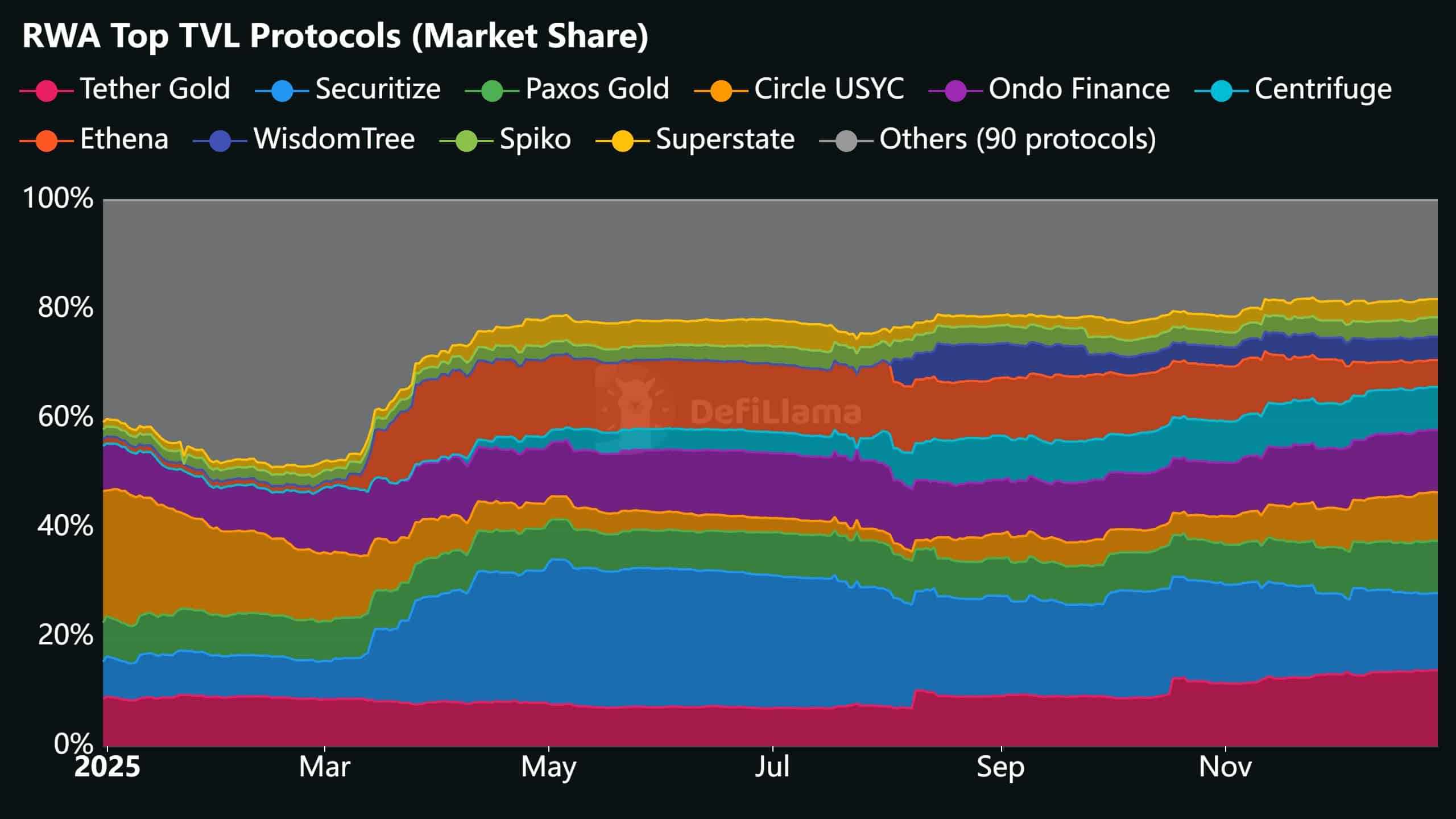

The RWA market is increasingly dominated by a small group of protocols. Tether Gold, Securitize, Paxos Gold, Circle’s USYC, and Ondo collectively account for the majority. Smaller players make up a shrinking share.

Since early 2025, their combined dominance has steadily increased.

One chain dominates it all: Ethereum [ETH].

Over $12 billion of RWA value now sits on the Ethereum Mainnet. That’s more than half of the entire market. After briefly losing share to newer chains, Ethereum is regaining dominance again.

The change is showing up in the returns

RWAs are the most profitable crypto narrative of 2025, per CoinGecko. They’ve delivered 185.8% YTD, far ahead of every other sector.

Only Layer 1s (80.3%) and “Made in USA” tokens (30.6%) managed to stay green, while DeFi, DEXs, AI, and gaming all posted losses.

A closer look will tell you that RWA’s performance was helped by outsized winners like Keeta Network (+1,794.9%), Zebec (+217.3%), and Maple Finance (+123%).

That said, returns are far lower than 2024’s explosive 819% run. The bracket is maturing, perhaps.