Grayscale files for spot Bittensor ETF following network's first halving event

Grayscale is seeking to convert its Bittensor Trust into an exchange-traded fund, just weeks after the network’s native token underwent its first halving event.

On Tuesday, the digital asset investment firm filed a registration statement with the Securities and Exchange Commission for the Grayscale Bittensor Trust (TAO). The filing marks the first attempt to launch a U.S spot ETF offering direct exposure to Bittensor.

"We’re pleased to take this early step as we continue to expand the tools available to investors and further develop Grayscale’s product platform to meet the growing investor demand for digital asset exposure," a Grayscale spokesperson said in a statement sent to The Block.

The Grayscale Bittensor Trust, which had been private since 2024, became more accessible to a broader set of investors via public quotation earlier this month. Grayscale's Bittensor ETF would trade on NYSE Arca under the ticker symbol GTAO. Coinbase Custody Trust Company LLC and BitGo Trust Company, Inc., would be the custodians, according to Tuesday's filing.

TAO is the native token of Bittensor, a decentralized, AI-focused network built on a hub-and-spoke blockchain architecture that supports application-specific subnets. Participants earn TAO by contributing computing resources that help improve and support these AI-driven networks.

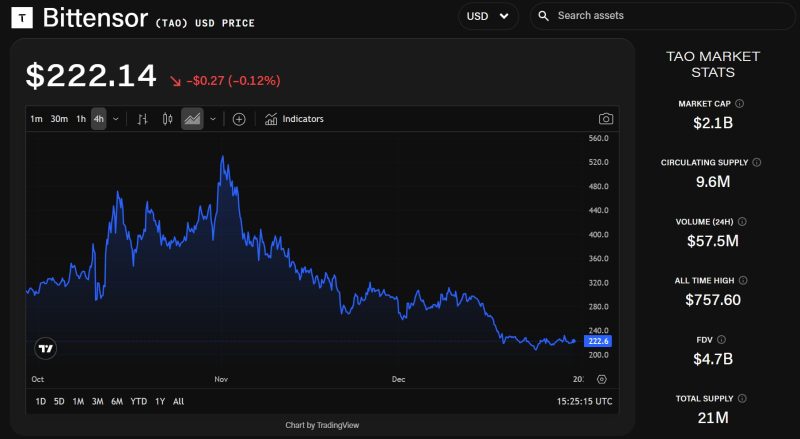

Bittensor's halving occurred in mid-December, reducing the rate at which new TAO tokens are made in the Bittensor network — a mechanism similar to bitcoin's halving events, which occur roughly every four years. After Bittensor's halving, the price of TAO dipped, but has since leveled to a value of about $222, according to The Block's price page.

Bittensor (TAO) price chart. Source: The Block/TradingView

Grayscale operates some of the largest ETFs tracking major cryptocurrencies like Bitcoin and Ethereum, and over the past year has converted several altcoin trusts into ETFs — like the more recent launch of the Grayscale LINK fund, the first Chainlink ETF to market.