Date: Mon, Dec 29, 2025 | 11:04 AM GMT

The broader cryptocurrency market has seen a short-term retracement over the past few hours, with Bitcoin (BTC) slipping below the $90K mark and trading closer to $88K. This pullback has placed temporary pressure on several altcoins, including Near Protocol (NEAR), which is also trading lower on the day.

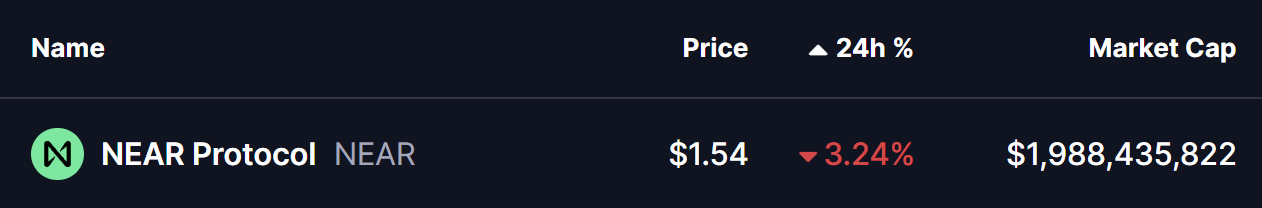

NEAR is down around 3% intraday, but beneath the surface, its price structure is beginning to reflect a meaningful shift. Rather than signaling weakness, the ongoing consolidation appears to be shaping a potential bullish continuation setup.

Source: Coinmarketcap

Source: Coinmarketcap Rounding Bottom in Play

On the 4-hour timeframe, Near Protocol is forming a textbook rounding bottom — a classic bullish reversal pattern that typically develops after a prolonged period of selling pressure. This structure highlights a gradual transition from distribution to accumulation, as sellers lose control and buyers quietly step back in.

Earlier, NEAR faced strong rejection near the $1.7576 neckline zone before entering a sharp decline. The sell-off eventually found a base near $1.4062, a level that repeatedly acted as a demand zone. Each attempt to push price lower was absorbed by buyers, preventing a deeper breakdown and establishing a solid foundation for reversal.

Near Protocol (NEAR) 4H Chart/Coinsprobe (Source: Tradingview)

Near Protocol (NEAR) 4H Chart/Coinsprobe (Source: Tradingview) Since forming this base, NEAR’s price action has begun to curve higher in a smooth, rounded fashion. The steady recovery toward the $1.5524 region suggests selling pressure is fading, while accumulation is gradually strengthening. This type of structure often precedes a more decisive trend shift once key resistance levels are reclaimed.

What’s Next for NEAR?

For the rounding bottom pattern to fully activate, NEAR needs to reclaim the 200-hour moving average, currently hovering around $1.5524. A decisive break and sustained hold above this level would confirm a momentum shift and signal that buyers are regaining control after an extended corrective phase.

Beyond the moving average, the most critical technical hurdle remains the neckline resistance near $1.7576. A clean breakout above this zone would validate the broader reversal structure and could trigger a stronger bullish expansion, as sidelined traders and momentum participants begin to re-enter.

Until those levels are reclaimed, the pattern remains in development. Short-term pullbacks or sideways consolidation are still possible if NEAR struggles near the 200-hour MA. However, as long as price continues to hold within the rounded base, the broader bottoming structure remains intact.

Overall, NEAR is approaching an important technical inflection point. The emerging rounding bottom, improving structure, and proximity to major resistance levels suggest the coming sessions could play a decisive role in determining the token’s next directional move.