Strong networks continued attracting capital despite short-term volatility across digital asset markets, even as some chain activity weakened and key support levels gave way.

Market fear reduced retail participation across crypto, pressuring usage metrics without erasing long-term network relevance. Solana remained one of the more resilient Layer-1 chains as risk appetite deteriorated.

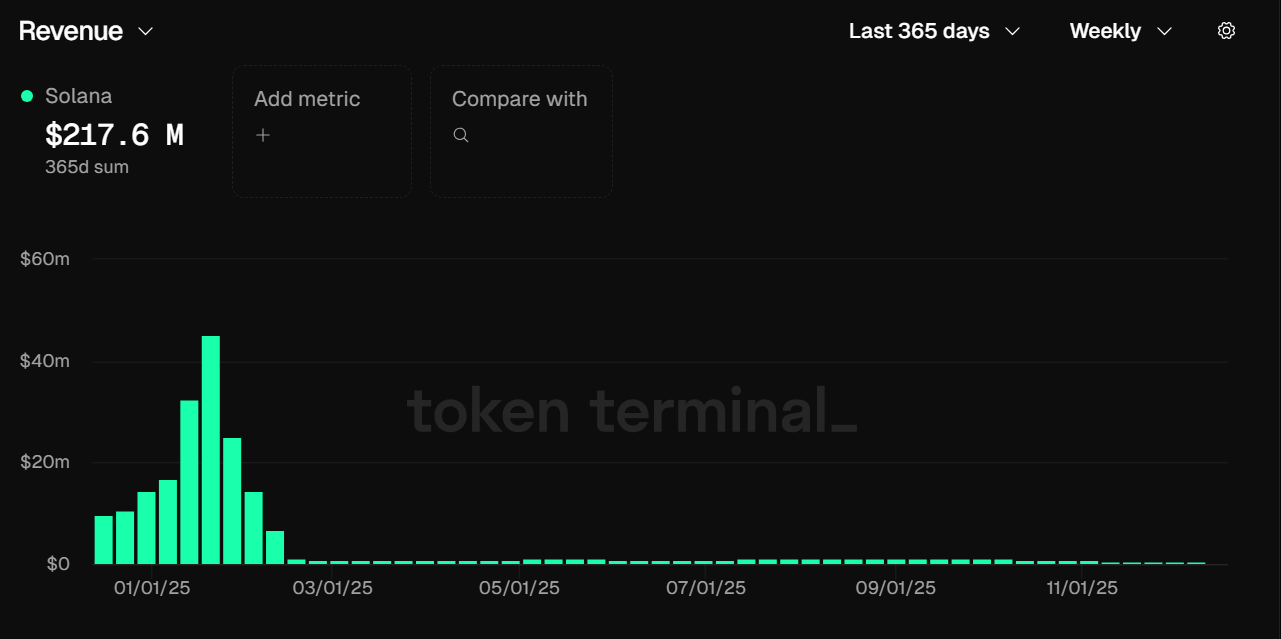

Source: Token Terminal

Solana’s [SOL] network Revenue peaked sharply in January before declining to the lowest levels of the year.

The pullback erased earlier gains as trading activity slowed across decentralized applications. That contraction aligned with extreme fear conditions rather than signs of structural deterioration.

Source: Token Terminal

Weekly Active Addresses also trended lower during the same period. The decline reflected risk-off behavior and reduced retail participation across crypto markets.

Activity stabilized near recent lows as volatility compressed.

Solana whale accumulation emerges below $120

As Solana dropped back below $120 on the 18th of December, whale accumulation intensified across several wallets.

Wallet G6gemN bought 41,000 SOL worth approximately $5 million during the dip. The buying suggested strategic positioning into weakness rather than reactive selling.

Historical behavior added context to the move.

About eight months earlier, the same wallet accumulated 24,528 SOL near $122. It was later sold for around $175, realizing roughly $1.28 million in profit.

The renewed accumulation followed a familiar pattern. Price weakness attracted capital instead of triggering broad distribution. Whale behavior pointed toward confidence during periods of elevated fear.

SOL ETF inflows offset spot selling pressure

Spot Solana ETFs recorded $11 million in Net Inflows on the 18th of December. Institutional products continued absorbing supply even as spot prices weakened.

ETF demand counterbalanced selling pressure during the pullback.

Source: X

Flows suggested positioning during fear-driven declines. Institutions appeared willing to accumulate amid heightened volatility. ETF activity reinforced demand beneath short-term weakness.

Support holds as momentum steadies

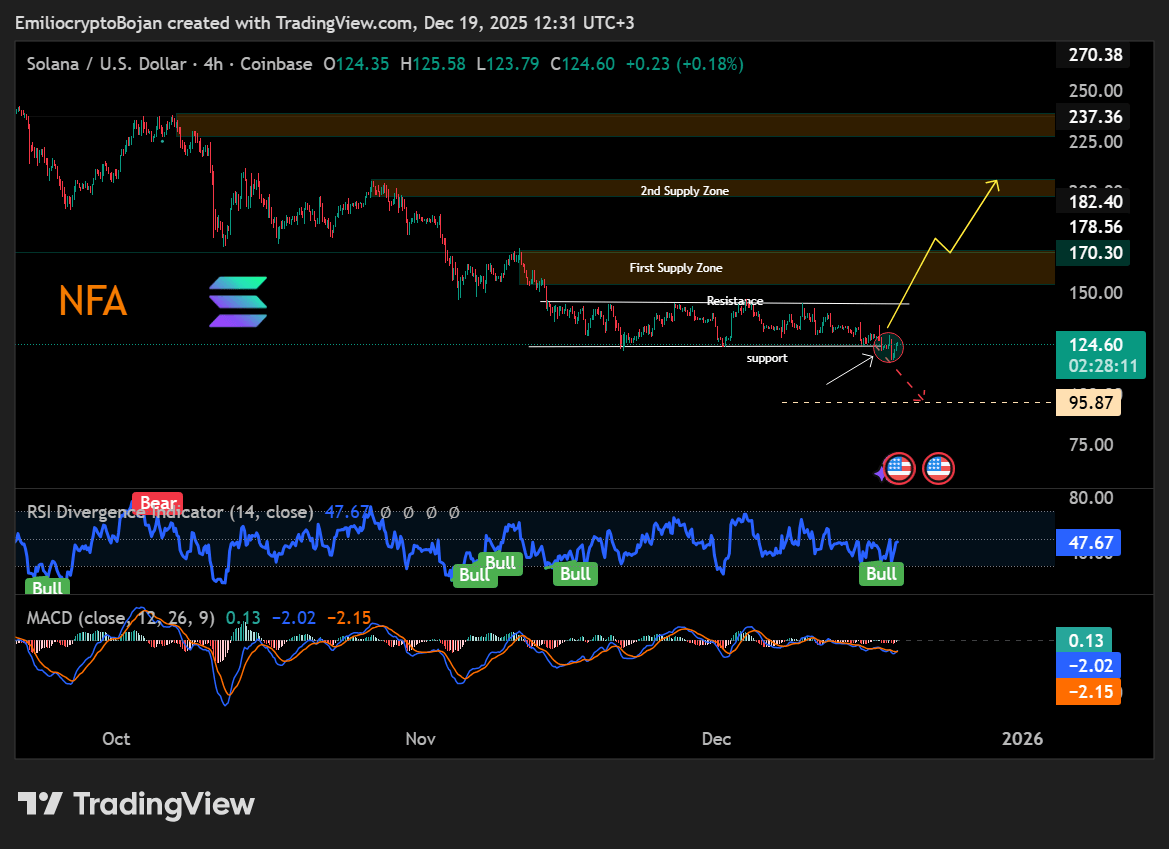

From a technical perspective, Solana traded near $124 at press time, after dipping from $122 to $117.

Bulls defended that zone, pushing price back into the broader $122–$145 accumulation range. Price action held around support, signaling absorption rather than continuation lower.

Source: TradingView

Momentum indicators also improved. MACD showed a developing bullish crossover, while RSI printed a bullish divergence as selling pressure faded near recent lows. Momentum improved as Solana remained within its established accumulation range.

That setup left traders focused on whether support could hold as broader sentiment stabilized.

Final Thoughts

- Solana’s recent price action highlighted a growing divide between short-term participation and longer-term conviction.

- While fear weighed on activity metrics, accumulation beneath support hinted at confidence during uncertainty.