XRP price is trapped close to the $1.85-$1.90 zone as Bitcoin slipped toward $87,000 over the past week.

Meanwhile, between December 22-26, roughly $782 million in net outflows from spot BTC ETFs were recorded, with BlackRock’s IBIT alone shedding more than $435 million. Ethereum-linked products followed a similar pattern.

XRP, however, continues to sit on the opposite side of the flow equation. SoSoValue data shows that spot XRP ETFs posted approximately $64 million in net weekly inflows and now, cumulative inflows stand at $1.14 billion and total net assets stand in the $1.24-$1.25 billion zone.

Franklin Templeton’s XRP ETF led the week with $28.6 million in new capital, followed by Bitwise’s product with just over $19 million.

It is important to note that XRP ETF flows have been steadier than the start-stop behavior seen in Bitcoin and ETH funds.

Despite ETF demand, XRP price action has remained lackluster. XRP traded down to around $1.87 and on the supply side, XRP balances on centralized exchanges have continued to drift toward multi-year lows.

Fewer coins sitting on CEXs reduce immediately available liquidity. While this dynamic does not guarantee upside, it does increase sensitivity to sustained demand.

On the weekly period, XRP price is situated in a bearish channel. Price continues to respect the $1.80-$1.85 demand zone, which has absorbed repeated tests without a decisive crash.

Also, the relative strength index (RSI) remains below neutral but has stabilized, while MACD compression indicates declining downside momentum rather than acceleration.

Interestingly, a clean weekly close above the descending channel would shift focus toward the $3.00-$3.60 region.

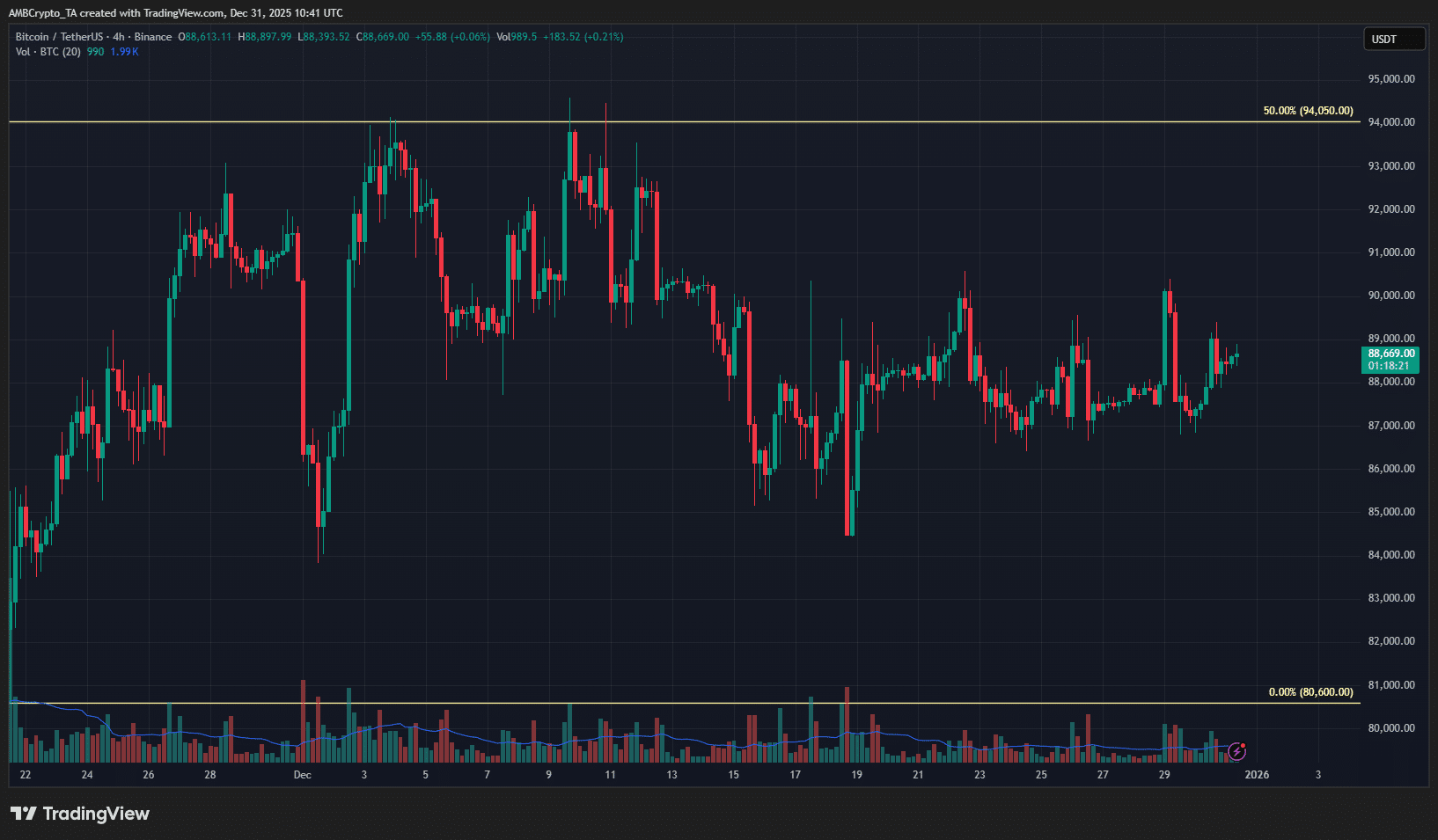

Source:

TradingView

Source:

TradingView

Related : XRP Price Prediction: Sellers Defend EMA Ceiling as Exchange Inflows Cap Recovery

On the other hand, a loss of the $1.80 base would expose XRP to deeper retracements toward the $1.30-$1.50 area before any renewed attempt higher.

Standard Chartered has predicted a move toward $8 by the end of 2026, a roughly 3x upside from current levels.

The forecast takes into account improving US regulatory clarity, the removal of long-standing legal overhangs, and the belief that spot XRP ETFs will continue to attract institutional capital.

(adsbygoogle = window.adsbygoogle || []).push({});A more conservative base case places XRP closer to the $3 level into 2026. That scenario assumes ETF inflows persist, exchange supply continues to tighten, and the broader market avoids a prolonged crypto winter.

Related : XRP Analyst Urges Holders to Reset Adoption Expectations as Central Banks Lag