The year 2025 wasn’t just like any other year for crypto; it was the year that changed the trajectory of blockchain technology for years to come. During this year, crypto directly collided head-on with global politics, macro policy, and institutional power. From Donald Trump’s return to the White House and an aggressive pro-crypto agenda, to rate cuts, trade wars, ETF breakthroughs, and record-setting market swings, crypto moved from the fringes of finance deeper into the center of policy and capital markets.

January

The year opened on a strong note, with markets expecting President Donald Trump to act quickly on his crypto agenda after his January 20 inauguration. On his second day in office, he granted clemency to Ross William Ulbricht, the founder of the Silk Road marketplace. In the days that followed, he signed an executive order prohibiting the creation of a U.S. CBDC and another order, “Strengthening American Leadership in Digital Financial Technology,” which established the Presidential Working Group on Digital Asset Markets to evaluate and define criteria for a national digital asset stockpile.

Before taking office, Trump had already made waves by launching his own memecoin, OFFICIALTRUMP, which reached an ATH of $75.35 on January 19. The momentum carried into his inauguration, with Bitcoin hitting a new ATH of $108,786 on the day he was sworn in, and Bitcoin ETFs reached $5.25 billion in monthly inflows, one of the highest of the year. During this period, SEC Acting Chairman Mark T. Uyeda launched a crypto task force, with Commissioner Hester Peirce as the lead, to help clarify the crypto market.

February

February unfolded with intensifying geopolitical drama and sharp swings in the crypto landscape. President Donald Trump ignited a trade war by threatening new tariffs on Canada, Mexico, and China. Although he later paused the 25% tariffs on Canada and Mexico after their leaders committed to stronger border security, tensions rose again when China retaliated with fresh duties. The market reacted sharply, with Bitcoin falling from above $100K to roughly $78K.

Argentina’s President Javier Milei added to the chaos after the memecoin $LIBRA, launched with his endorsement, exploded to a $4B valuation before collapsing over 98%, amid allegations of insider profit-taking. Meanwhile, Bybit suffered one of the largest hacks on record, losing around $1.5B, with early investigations pointing to North Korea’s Lazarus Group.

On the regulatory side, the SEC closed several high-profile disputes by dismissing its cases against Coinbase, Gemini, and Robinhood. Commissioner Hester Peirce outlined new priorities for the SEC Crypto Task Force, including clearer token classifications and updated rules for custody, lending, and staking. The agency formed a new Cyber and Technologies Unit to combat crypto fraud, AI-driven scams, and cybersecurity threats, replacing its previous crypto-focused team. Furthermore, the agency clarified that meme coins are not securities, exempting them from registration requirements while warning that fraudulent activity remains subject to enforcement. Trump-aligned World Liberty Financial unveiled a “token reserve” designed to hold a diversified mix of crypto assets and tokenized traditional instruments to support emerging DeFi ecosystems.

March

At the start of the month, President Trump unveiled plans for a national “crypto reserve” featuring BTC, ETH, XRP, SOL, and ADA as part of his push to make the U.S. the “Crypto Capital of the World.” He then signed an executive order establishing two separate reserves: a Strategic Bitcoin Reserve, a Bitcoin-only, non-saleable national asset, and a U.S. Digital Asset Stockpile for government-held non-BTC tokens. The order also directed Treasury and Commerce to devise budget-neutral ways to accumulate additional Bitcoin over time, positioning BTC as a modern “digital Fort Knox.” He also pardoned the three co-founders of the BitMEX crypto exchange, Arthur Hayes, Benjamin Delo, and Samuel Reed.

World Liberty Financial launched its USD-backed stablecoin USD1, and Binance secured what it called its largest investment ever after Abu Dhabi’s MGX committed $2 billion. The month also included the SEC’s first digital-asset roundtable under the new administration.

Corporate Bitcoin adoption accelerated. Strategy (formerly MicroStrategy) became the first Digital Asset Treasury company to surpass 500,000 BTC, while Japan’s Metaplanet expanded its holdings to over 3,300 BTC with a target of 10,000 BTC by year-end, earning it the label “Asia’s MicroStrategy.” GameStop announced plans to add Bitcoin to its treasury and later approved a $1.3 billion convertible bond raise aimed primarily at BTC purchases.

Related: President Trump Pardons BitMEX Co-Founders & Ex-employee

April

April opened with escalating trade tensions as President Trump introduced a “reciprocal tariff” policy, a blanket 10% tariff on all countries, with higher rates for select nations. Markets reacted sharply, with crypto, equities, and gold all selling off. China responded with a 34% tariff on U.S. goods and banned 11 American companies, intensifying global risk-off sentiment. Markets only began to stabilize in late April after Trump signed orders adjusting auto tariffs.

Following Senate confirmation on April 9, Paul Atkins formally became SEC Chair on April 21. He publicly pushed for clearer regulatory frameworks and criticized prior uncertainty for holding the industry back. The SEC also conducted its second and third crypto roundtables, focusing on custody, tokenization, and DeFi oversight.

The Federal Reserve rescinded earlier guidance requiring banks to notify regulators before engaging in crypto activities, allowing institutions to participate in permitted crypto operations without pre-approval. Globally, the UK moved to exempt overseas stablecoin issuers from its upcoming crypto rules to strengthen U.S.-UK tech cooperation, while the EU published and adopted its first delegated MiCA regulations, including new standards for market-abuse prevention.

On the corporate front, Ripple announced a $1.25B acquisition of Hidden Road, making it the first crypto company to operate a full-service global prime brokerage. BTCS Inc. acquired 1,000 ETH and projected its holdings would reach 13,500 ETH by the end of Q2 2025 as part of its long-term infrastructure strategy. Meanwhile, Tether, SoftBank, and Jack Mallers unveiled Twenty One, a Bitcoin-native company formed through a business combination with CEP and targeting $585 million in additional fundraising.

May

After months of volatility, crypto markets regained strength, with Bitcoin climbing to a new all-time high of around $112,000 by late May. The rally was fueled partly by softer-than-expected U.S. CPI data, which eased inflation concerns. The long-anticipated Ethereum Pectra upgrade also went live, merging the Prague (execution layer) and Electra (consensus layer) updates. Pectra introduced multi-validator configuration per key, more flexible staking, and EIP-7702 for account abstraction, making Ethereum more developer- and user-friendly.

President Donald Trump hosted a black-tie gala for the top 220 holders of his OFFICIAL TRUMP memecoin, an event that triggered more than a 10% price drop amid political risk concerns. It was also confirmed that World Liberty Financial’s USD1 stablecoin would be used for MGX’s $2 billion payment to Binance. At the state level, New Hampshire became the first state to pass a “Strategic Bitcoin Reserve” bill (HB 302), followed the next day by Arizona, which passed its own cryptocurrency reserve bill (HB 2749).

Coinbase agreed to acquire Deribit, the largest Bitcoin and Ether options exchange, for $2.9 billion, and announced plans to offer BTC and ETH futures to U.S. retail users, challenging traditional derivatives markets. Circle launched an IPO of 24 million Class A shares under the ticker CRCL, while Galaxy Digital completed its U.S. public listing on the Nasdaq Global Select Market under the ticker GLXY.

June

In the final month of Q2, governments and crypto firms worldwide made moves that highlighted the rapidly shifting blockchain landscape. In South Korea’s Presidential election, both major candidates, Kim Moon-soo (PPP) and Lee Jae-myung (DPK), pledged policies to expand crypto adoption. Thailand approved a capital gains tax exemption on crypto transactions through December 31, 2029, while Texas Governor Greg Abbott signed SB 21 into law, creating a Texas Strategic Bitcoin Reserve. Vietnam also passed legislation recognizing crypto as protected property and laying the foundation for a regulated market by January 2026.

In the U.S., updated filings revealed the Trump family reduced its stake in World Liberty Financial from 60% to about 40% amid growing congressional scrutiny. Tensions increased after Magic Eden promoted an “Official $TRUMP Wallet,” a claim publicly rejected by Donald Trump Jr., Eric Trump, and Barron Trump. Meanwhile, Trump Media’s Truth Social filed an S-1 with the SEC to launch a spot Bitcoin and Ethereum ETF, shortly after receiving approval for a Bitcoin treasury strategy.

Stablecoin activity accelerated globally. A consortium of eight major South Korean banks announced plans for a won-backed stablecoin, with KB Kookmin filing 17 KRW-pegged trademarks. Walmart and Amazon reportedly explored issuing proprietary stablecoins, while Visa partnered with African fintech Yellow Card to expand stablecoin-based cross-border payments across more than 20 African countries.

On the trading side, Robinhood rolled out over 200 tokenized U.S. stocks and ETFs for EU users via an Arbitrum-based network and finalized its $200 million acquisition of Bitstamp, adding global licenses and institutional infrastructure. Separately, Nasdaq-listed Nano Labs announced plans to adopt Binance’s BNB as its primary reserve asset, launching a $500 million convertible-note deal as part of a broader $1 billion treasury strategy to acquire up to 5–10 % of all BNB.

Related: Visa Joins Yellow Card to Expand Stablecoin Use in Africa

July

July turned out to be a strong month for crypto markets, with Bitcoin jumping to a new ATH of around $123,000 and policy momentum. During “Crypto Week,” the U.S. House passed the GENIUS Act on July 17 with a 308–122 vote, establishing the first federal framework for stablecoins. President Trump signed the bill into law the next day. The Digital Asset Market Clarity Act also cleared the House, defining when tokens are treated as securities or commodities, and advanced to the Senate. Meanwhile, the Anti-CBDC Surveillance State Act passed the House 219–210 and also moved to the Senate for review.

Market activity accelerated: CEX spot volume jumped 54% to $2.2T, derivatives hit a 2025 high of $6.5T, BNB Chain led DEX activity, and Base reached a new TVL record. Coinbase launched perpetual futures for U.S. customers for the first time, while Kraken pushed expansion plans by securing $500+ million at a $15 billion valuation. Pump.fun, a memecoin launch platform on the Solana blockchain, raised approximately $500 million in 12 minutes in its ICO. The month also featured Robinhood’s IPO under the ticker symbol “HOOD”, priced at $38 per share, raising $2.1B.

On July 30, the White House released its first Strategic Crypto Report, concluding a 180-day policy review. It formally rejected a U.S. CBDC, proposed treating roughly 200,000 seized BTC as a strategic reserve asset, and outlined stricter but growth-oriented rules for stablecoin issuers and digital-asset infrastructure.

Treasury adoption also grew rapidly. SharpLink Gaming acquired 10,000 ETH, Sonnet BioTherapeutics launched an $888M crypto-reserve initiative, MEI Pharma secured $100M to build a Litecoin reserve, and BIT Mining prepared a $300M raise for a Solana treasury. Public companies like GameSquare and Upexi also moved to build ETH and SOL reserves. On the ETF side, REX-Osprey launched its SOL + Staking ETF (SSK) on July 2, the first of its kind.

Globally, regulators showed sharply diverging approaches. Turkey blocked access to 46 crypto platforms, including PancakeSwap, while New Zealand banned crypto ATMs as part of updated AML rules. In contrast, Spain’s BBVA opened retail crypto trading and custody.

August

August unfolded with Bitcoin and Ethereum setting new all-time highs. Bitcoin surged to a new ATH of around $124,000, while Ethereum climbed to a record $4,953. DeFi and ETH-centric ecosystems also gained strong momentum, with capital flowing into the sector following the signing of the GENIUS Act last month.

The long-running SEC v. Ripple case reached final resolution after both parties jointly moved to dismiss the SEC’s appeal and Ripple’s cross-appeal in the Second Circuit around August 6–7, a request the court accepted. This followed Ripple dropping its cross-appeal in June and earlier rulings by Judge Analisa Torres that left the $125 million penalty and injunction intact.

Regulatory momentum shifted further on July 31, 2025, when SEC Chairman Paul Atkins unveiled “Project Crypto,” stating most crypto assets are not securities and calling for clear, innovation-friendly rules, tailored exemptions, and closer SEC–CFTC coordination.

On the policy front, the Federal Reserve ended its crypto bank supervision program. President Trump also signed an executive order allowing cryptocurrencies and other alternative assets, such as private equity and real estate, to be included in 401(k) retirement accounts. Wyoming launched the first state-issued stablecoin, $FRNT.

Corporate activity remained strong. Ripple acquired stablecoin payments platform Rail for $200M, strengthening its XRP and stablecoin payment infrastructure with enhanced on/off-ramps and settlement tools. Bullish signaled plans to raise its IPO target to nearly $1B, Coinbase announced a $2B convertible note offering and plans for U.S. tokenized stocks and prediction markets, and VERB Technology committed $780M toward a TON-focused treasury strategy. SharpLink also accelerated its accumulation, acquiring over 200,000 ETH across two weeks in mid-to-late August.

September

After months of anticipation, in September the Federal Reserve delivered its first rate cut of 2025, lowering interest rates by 25 basis points to a 4.00%–4.25% range. Around the same time, the SEC approved generic listing standards for commodity-based trust shares, including crypto-backed products, across NYSE, Nasdaq, and Cboe. The move eliminated the need for individual 19b-4 filings for each eligible spot crypto ETP, cutting time-to-market from roughly 240 days to about 75 days and significantly reducing listing friction.

ETF activity also accelerated. Market participants widely viewed Solana and XRP ETFs as the most likely first approvals under the SEC’s new framework. Bitwise filed for an Avalanche ETF, while VanEck disclosed plans for a Hyperliquid staking ETF. In tokenization, Galaxy and Superstate launched GLXY tokenized public shares on Solana, and BlackRock signaled plans to tokenize exchange-traded funds. REX-Osprey launched the DOGE ETF (CBOE: DOJE) and XRP ETF (CBOE: XRPR) on the 18th. This launch marks the first ETF for memecoins.

On the exchange side, Gemini debuted on the Nasdaq Global Select Market under the ticker GEMI, raising $425 million in its IPO. Kraken completed its acquisition of Breakout and rolled out Kraken Launch, while FalconX introduced 24/7 OTC crypto options for BTC, ETH, SOL, and HYPE. Polymarket CEO Shayne Coplan also confirmed the platform received approval to operate in the U.S. following a favorable CFTC ruling.

Digital asset treasury activity remained active. Forward Industries announced a $1.65 billion Solana treasury strategy, followed by a $4 billion ATM program. Helius Medical Technologies raised more than $500 million to build a Solana-focused treasury vehicle. Metaplanet added 1,009 BTC, Figma disclosed approximately $91 million in Bitcoin ETF exposure, and SharpLink acquired 39,008 ETH.

Related: XRP and Dogecoin ETFs Debut With Record Trading Volumes

October

October opened with one of the sharpest market shocks of the year. On October 10, President Donald Trump announced plans to impose an additional 100% tariff on Chinese imports alongside tighter export controls on critical software. The statement triggered a rapid sell-off across global markets. In crypto, more than $19 billion in leveraged positions were liquidated within 24 hours, wiping out over 1.6 million traders. The scale of the unwind drained order books, forced market makers to pull liquidity, and amplified price dislocations.

The shock came just days after Bitcoin had printed a new all-time high around $126,000. During the sell-off, BTC fell roughly 18%, Ethereum dropped about 20%, and altcoins suffered even steeper losses. Against this backdrop, President Trump issued a pardon to Binance founder and former CEO Changpeng Zhao. On the monetary front, the Federal Reserve delivered another 25-basis-point rate cut, bringing the policy range down to 3.75%–4.00%.

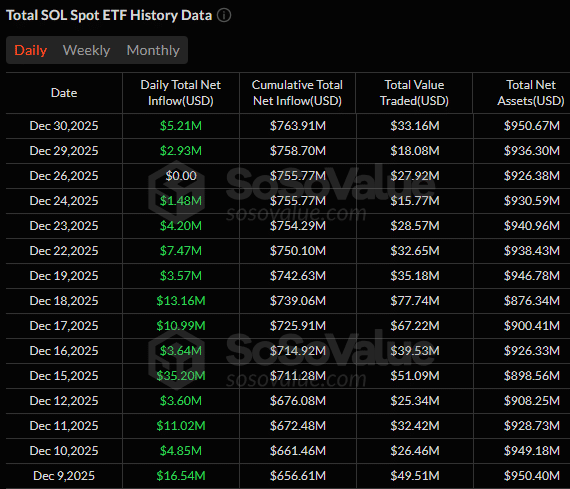

ETF activity remained active despite the volatility. On October 28, Bitwise launched the first spot Solana ETF (BSOL), followed a day later by Grayscale’s Solana Trust ETF (GSOL). Canary Capital also rolled out a Litecoin ETF (LTCC) and an HBAR ETF (HBR), expanding the menu of altcoin-linked exchange-traded products.

Deal-making accelerated across exchanges and infrastructure. Kraken acquired derivatives platform Small Exchange for $100 million, while FalconX bought ETP provider 21Shares for an undisclosed sum. Coinbase acquired Echo, an on-chain capital-raising and tokenization firm, for roughly $375 million. Ripple announced the acquisition of corporate treasury software provider GTreasury for about $1 billion.

Strategic partnerships and institutional moves continued globally. SoftBank’s PayPay acquired a 40% stake in Binance Japan to integrate crypto into cashless payments. Intercontinental Exchange, the owner of the NYSE, announced plans to invest up to $2 billion in Polymarket, valuing the prediction platform at $8 billion. Japan’s major banks, MUFG, Sumitomo Mitsui, and Mizuho, outlined plans for interoperable yen- and dollar-pegged stablecoins targeting a 2026 launch, while Abu Dhabi Airports began piloting stablecoin payments at duty-free stores.

On the infrastructure side, Circle began live testing its Arc blockchain, a permissioned network built for high-throughput USDC settlement. Bybit secured the UAE’s first Virtual Asset Platform Operator license, allowing it to offer fully regulated crypto trading in Dubai. Coinbase introduced the Coinbase One Card, a crypto-enabled Visa debit card for U.S. subscribers that offers zero-fee spending with crypto rewards.

Regulatory momentum also picked up in Asia. Thailand officially implemented a 0% capital gains tax on crypto and stock investments to attract capital, while Japan’s Financial Services Agency signaled plans to allow domestic banks to hold crypto assets for investment, marking a notable shift from its traditionally conservative stance if finalized in 2026.

November

The fallout from the October 10 shock extended into November, keeping markets under pressure. Bitcoin opened the month near $110,000 but slid to lows around $80,000. Altcoins followed the same trajectory, with most recording drawdowns of roughly 25%–40% as risk appetite remained subdued.

Political uncertainty added to volatility. During the U.S.–Saudi Investment Forum in Washington, President Donald Trump openly criticized Federal Reserve Chair Jerome Powell, saying, “I’ll be honest, I’d love to fire his ass.” Trump added that Treasury Secretary Scott Bessent had restrained him from doing so, while urging Bessent to “work on” Powell, remarks that reignited concerns over central bank independence.

At Devconnect Argentina, Vitalik Buterin emphasized that the FTX collapse proved why decentralization is a practical necessity, not just an ideal, as centralized platforms concentrate risk and trust. He warned that advances in quantum computing could threaten the cryptography securing blockchains as early as 2028, urging the ecosystem to prepare for post-quantum security. Vitalik also highlighted Ethereum’s push toward privacy-preserving design, advocating zero-knowledge proofs and local ZK-proving to enable private, user-controlled accounts. Together, these themes reinforce Ethereum’s roadmap: reduce central points of failure, future-proof security, and embed privacy at the protocol level.

ETF launches continued despite weak market conditions. Canary Capital launched its XRP ETF (XRPC) on November 13, followed by the Bitwise XRP ETF (XRP) on November 20. On November 24, both the Grayscale XRP Trust ETF (GXRP) and the Franklin XRP ETF (NYSE Arca: XRPZ) debuted. Solana-linked products also expanded, with Fidelity’s Solana Trust (FSOL), VanEck’s Solana ETF (VSOL), 21Shares Solana ETF (TSOL), and the Canary Marinade Solana ETG (SOLC) all launching during the month. Meme-coin exposure followed suit, with Grayscale’s Dogecoin Trust ETF (GDOG) launching on November 24 and Bitwise’s Dogecoin ETF (BWOW) arriving on November 26.

Beyond prices, on-chain activity weakened sharply. Aggregate blockchain revenues and DEX volumes declined by roughly 25%–35% month-on-month, while perpetual DEX earnings fell about 37% to near $200 million. In contrast, prediction markets surged. Polymarket and Kalshi both posted record volumes of approximately $4.3 billion and $5.8 billion, respectively, more than 50% higher than the prior month. Kalshi’s momentum was reinforced by a major funding round that lifted its valuation to $11 billion.

Infrastructure and consolidation moves continued globally. Ripple acquired UK-based digital asset custody and wallet firm Palisade. In Asia, Naver agreed to acquire Dunamu, the parent company of Upbit, in a stock deal valued at roughly $10.3 billion, one of the largest crypto exchange acquisitions on record and a major Web2–Web3 convergence play. In the U.S., SoFi became the first nationally chartered bank to allow retail customers to trade cryptocurrencies such as BTC, ETH, and SOL directly within its regulated banking app.

Late in the month, a widespread Cloudflare outage disrupted access to numerous websites, including crypto and Web3 platforms. The incident reignited debate over hidden centralization risks in the broader crypto ecosystem, highlighting the industry’s continued reliance on critical Web2 infrastructure.

December

December closed the year with sharp contrasts across crypto, macro policy, and traditional markets, highlighting how tightly digital assets are now intertwined with global finance and regulation.

Bitcoin spent most of the month battling the psychological $90,000 level. After breaking resistance early in December, BTC climbed to a monthly high above $94,000 before slipping back into the $85,000–$90,000 range. Volatility spiked on Christmas Eve when a brief, localized flash crash on Binance saw the BTC/USD1 pair print near $24,000 for a few seconds before instantly recovering to around $87,000. Screenshots of the anomaly went viral, though broader markets remained unaffected. December also marked Bitcoin’s largest derivatives expiry on record, with $23.6 billion in BTC contracts settling on December 26, adding to short-term price pressure.

While crypto struggled for direction, traditional safe-haven assets surged. Gold and silver staged historic rallies, with gold hitting an all-time high of $4,553 per ounce and silver surging above $83 on December 29. On a yearly basis, silver gained over 155%, while gold rose more than 67%. Adding to bullish momentum, China, the world’s largest silver exporter, announced new export rules effective January 1, 2026. Under the policy, only large, state-approved producers with government licenses will be allowed to export silver, effectively shutting out smaller suppliers. With the global silver market already in a multi-year deficit, the move is expected to keep prices elevated.

Regulation was another dominant December theme. SEC Chair Paul Atkins said the agency will move ahead with crypto rulemaking without waiting for Congress, including rolling out an innovation exemption within weeks. He outlined a four-part token taxonomy in which only tokenized securities fall under SEC oversight, while most ICOs, network tokens, and digital tools are treated as non-securities, largely under CFTC jurisdiction. Reinforcing this shift, the CFTC opened the first pathway for spot crypto trading on fully regulated U.S. markets and elected Michael Selig as the 16th Chairman, while the OCC granted conditional national trust bank approvals to Ripple, Circle, BitGo, Paxos, and Fidelity Digital Assets.

Macro policy also shaped sentiment. The Federal Reserve delivered its third rate cut of the year, lowering rates to 3.50%–3.75%, but signaled a slower easing path ahead. In Japan, regulators advanced plans for a 20% flat tax on crypto gains, while the Bank of Japan raised rates to around 0.75%, the highest in three decades.

On the industry front, Ethereum activated its Fusaka upgrade, introducing PeerDAS and flexible blob scaling to push an L2-first roadmap with lower fees and faster transactions. Governance tensions also surfaced as Wintermute announced it would vote against an Aave proposal, citing unclear value flow to token holders. Terraform Labs founder Do Kwon received a 15-year prison sentence, underscoring a growing era of accountability in crypto.

Related: Fusaka Redefines Ethereum With L2-Driven Throughput

Conclusion

By the end of 2025, crypto had decisively crossed the line from an experimental asset class into a pillar of global finance and policy. The year showed that digital assets no longer move in isolation; they now react to interest rates, trade wars, and regulatory frameworks in real time. Governments formalized their stances through legislation, reserves, and oversight, institutions deepened their exposure via ETFs, treasuries, and tokenization, and blockchains continued to evolve toward scalability, usability, and compliance. At the same time, sharp market shocks, governance disputes, and high-profile convictions reminded the industry that maturity comes with accountability.

Taken together, 2025 was not just a year of growth or volatility; it was the year crypto became structurally embedded in the global financial system, setting the foundation for how digital assets will be regulated, adopted, and challenged in the decade ahead.