Throughout 2025, the Bitcoin market experienced significant stabilization as institutional investors systematically increased their pursuit of returns via derivatives. One of the key dynamics in reducing price volatility was the income derived from the sale of options on idle BTCs held in the spot market. As the year progressed, the anticipated volatility that had been high at the beginning gradually decreased, rendering the market more predictable. This scenario highlighted a shift towards more traditional financial practices within the cryptocurrency realm.

Bitcoin Embraces Stability as Institutional Moves Redefine Its Dynamics

Institutional Yield Strategies Suppress Volatility

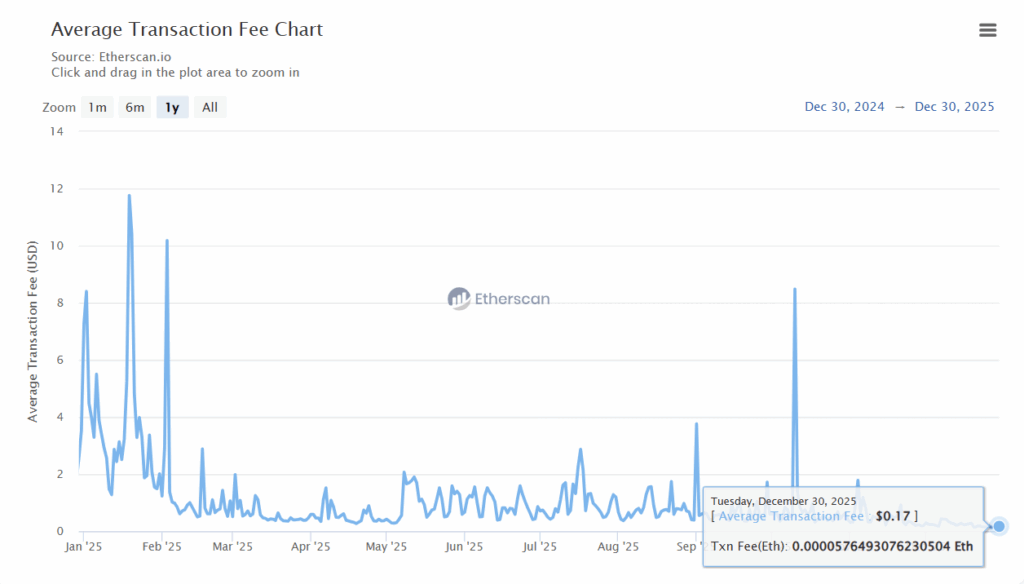

Throughout 2025, annualized 30-day implied volatility indicators for Bitcoin consistently exhibited a downward trend. The BVIV and Deribit DVOL indices, initially around 70% at the start of the year, descended to the 45% band by year-end. The rates even touched 35% in September, numerically illustrating the market’s newfound calmness.

This decline was primarily driven by “covered call” strategies employed by major funds and professional investors. Institutions holding BTC or spot Bitcoin ETFs generated premium income by selling high-strike price call options, which represented expectations of upward price movement. The majority of these options were worthless at expiration, providing sellers with a steady cash flow.

The rampant option sales in the options market exerted continuous pressure on implied volatility. As option sales became a standard revenue mechanism, the market’s sensitivity to sudden price spikes diminished. Imran Lakha, founder of Options Insights, emphasized that institutional capital’s shift from upward risk to a focus on steady returns has structurally reduced volatility.

Shifting Equilibrium in the Options Market

The increased institutional interest reshaped the typical balances in the Bitcoin options market. For most of 2025, protective put options were more expensive than call options, both short-term and long-term. Previously prevalent long-term bullish expectations gave way to cautious and protective positions.

This change did not imply a pessimistic drift in the market. Rather, it demonstrated a preference among major investors to hedge downside risks while maintaining long-term positions. Lakha suggested that this pattern, evident in the entire options curve, signifies “long and hedged” institutional stances.

Meanwhile, a significant portion of BTC’s supply is now held in ETFs and institutional treasuries. According to OTC trading desk Wintermute, more than 12.5% of all issued Bitcoins are held via these channels. Jake Ostrovskis, speaking on behalf of Wintermute, noted that generating income through option sales on these non-yielding assets became the dominant trend of 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Coin Price Unshaken by Scam Shock — Strong Support or Delayed Reaction?

Bitcoin Whale Shorts TRUMP Token With 10x Leverage: $500K Position at $4.9361 Entry