Metaplanet Reports 568.2% BTC Yield for 2025 as Bitcoin Holdings Reach 35,102

By:BeInCrypto

Tokyo-listed Metaplanet Inc. has revealed a dramatic acceleration in its corporate Bitcoin strategy, reporting a year-to-date BTC Yield of 568.2% for 2025 while boosting total holdings to 35,102 BTC. The disclosure highlights the companys aggressive accumulation approach, positioning it among the worlds largest publicly disclosed corporate holders of Bitcoin. Metaplanet Buys More Bitcoin The company acquired an additional 4,279 BTC in the fourth quarter of 2025, paying an average of 16.33 million ($104,642) per coin, according to CEO Simon Gerovich. This brings the aggregate investment in Bitcoin to approximately 559.7 billion, with an average price of 15.95 million ($102,207) per BTC for the year. *Metaplanet Acquires Additional 4,279 BTC, Total Holdings Reach 35,102 BTC* Metaplanet Inc. (@Metaplanet) December 30, 2025 Metaplanets Bitcoin accumulation is part of its officially designated Bitcoin Treasury Operations, a strategic business line launched in December 2024. Purchases are executed through a combination of operating income, capital market activities, and Bitcoin-backed credit facilities. This reflects a sophisticated treasury strategy that integrates market timing, equity management, and corporate financing tools. In Q4 alone, BTC Yield reached 11.9%, a steady contribution to the annual performance, following earlier quarters that posted yields of 95.6%, 129.4%, and 33.0%. The companys proprietary BTC Yield metric measures the change in Bitcoin holdings per fully diluted share, isolating the impact of dilution from new equity issuance. This provides investors with a framework to assess shareholder accretion from Bitcoin accumulation rather than direct profit. BTC Gain and BTC Gain translate these holdings into quantitative metrics in BTC and Japanese yen. This offers insight into the hypothetical value growth driven purely by the treasury strategy. Metaplanet Ranks 4th Globally as Corporate Bitcoin Adoption Gains Momentum Despite Market Volatility Despite the headline yield, data from Bitcoin Treasuries shows that Metaplanets portfolio is down 18.9% in market value terms. This reflects Bitcoins price volatility over the year. Metaplanet BTC Holdings. Source: Bitcoin Treasuries The company emphasizes that BTC Yield is a KPI rather than a measure of realized gains or operational performance. It provides a lens into strategic accumulation rather than traditional financial returns. Metaplanet now ranks as the fourth largest corporate Bitcoin holder globally, following Strategy (672,497 BTC), MARA (53,250 BTC), and Twenty One Capital (43,514 BTC). Top Companies Holding BTC. Source: Bitcoin Treasuries Its approach, which blends disciplined accumulation, capital market activity, and leveraged facilities, highlights a trend among Japanese and global corporates to adopt Bitcoin as a treasury asset, balancing risk with strategic positioning for potential upside. The announcement reinforces the growing role of corporate treasuries in Bitcoin markets, where companies like Metaplanet are quietly amassing significant positions while using metrics like BTC Yield to communicate strategy and performance to shareholders. However, while headline yields are impressive, investors should differentiate between proprietary performance metrics and realized financial gains. This distinction is increasingly critical as institutional participation in Bitcoin scales globally. With 35,102 BTC under management and a record BTC Yield, Metaplanets quiet accumulation strategy in 2025 positions it as a notable force in corporate Bitcoin adoption. It signals that publicly listed companies are increasingly using crypto as a strategic treasury tool rather than a speculative asset.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

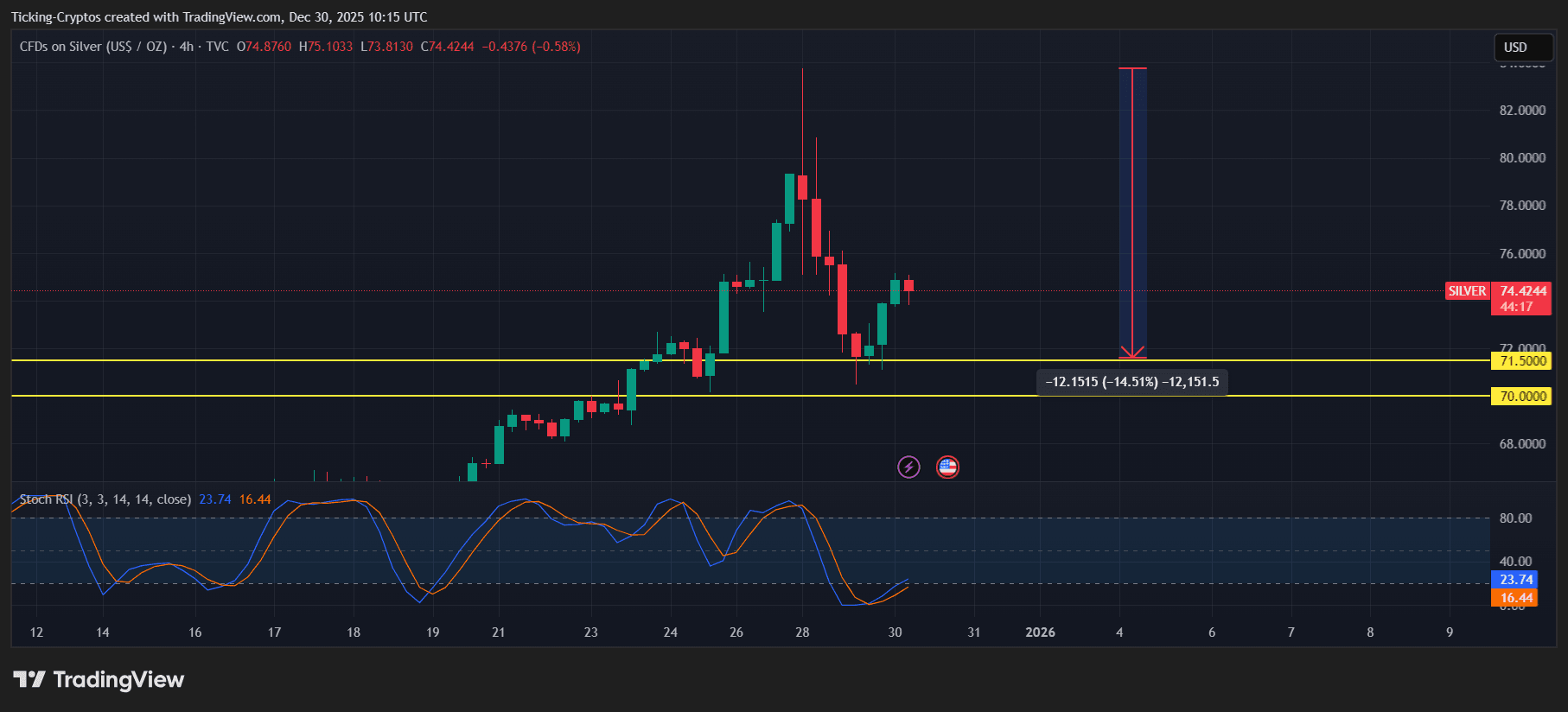

Silver Price Crash after Big Rally: Where Does Liquidity Go Next?

Cryptoticker•2025/12/30 10:33

Lummis Announces RFIA of 2026 That Differentiates Securities And Commodities

Coinedition•2025/12/30 10:33

Shiba Inu Launches SOU NFT System to Repay Plasma Bridge Losses With Full Transparency and On-Chain Tracking

Cryptonewsland•2025/12/30 10:30

Analyst warns prediction markets stack odds against 99% of retail traders

Crypto.News•2025/12/30 10:27