BlackRock, the world’s largest asset management firm, has distributed approximately $100 million in dividends since the launch of its tokenized money market fund BUIDL in March 2024, catapulting it to the top ranks among tokenized cash products with over $2 billion in assets. The fund invests in short-term US Treasury bonds, repos, and cash equivalents, operating with token representatives settled on public Blockchains. Confirmed by Securitize, the transfer agent and manager, the figures highlight that institutional-scale finance can function within Blockchain ecosystems. BUIDL stands out as a structure bridging traditional short-term interest markets with a Blockchain-based infrastructure.

BlackRock’s Blockchain-Based Fund Delivers Substantial Returns

BUIDL: A New Paradigm in Financial Instruments

Contrary to classic stablecoins, BUIDL is designed as a regulated money market fund. Qualified institutional investors can hold fund shares as tokens within the Blockchain, distributing the portfolio-generated returns within the Blockchain ecosystem. Initially launched on the Ethereum network, the product expanded to multiple networks as demand for Blockchain-based dollar yields rose. This method enhances settlement speed and operational transparency while providing an alternative to traditional custodial and reconciliation processes.

With assets surpassing $2 billion, the fund’s size indicates the adoption of tokenized Treasury products among institutional investors. Built on short-term government securities, BUIDL targets interest income while emphasizing liquidity and risk management. The $100 million in dividends paid marks a milestone in showcasing the scalability of regulated products utilizing Blockchain representation.

Applications of Blockchain-Based BUIDL Tokens

BUIDL tokens are not solely held for passive income. They are positioned as collateral and foundational elements within cryptocurrency market infrastructure. The product is integrated into various trading and financing arrangements, including serving as collateral for Ethena’s USDtb stablecoin. Thus, returns from short-term interest markets are carried into the Blockchain’s collateral and settlement layer.

In the past year, tokenized money market funds have rapidly grown, drawing regulatory attention to settlement certainty, liquidity assumptions, and the behavior of tokenized securities during stress events. When combined with institutional demand, interest-seeking, and operational efficiency expectations, BUIDL plays a strategic role at the intersection of traditional finance and Blockchain technology. Surpassing lifetime dividend thresholds sends a strong signal of Blockchain representations’ alignment with institutional standards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

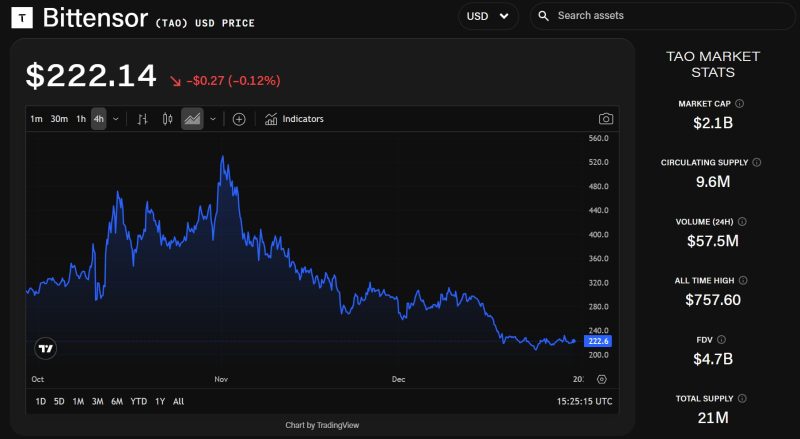

Grayscale files for spot Bittensor ETF following network's first halving event

Blockchain Losses Soar to $2.93B Despite Fewer Incidents in 2025

SEC’s Finance Deputy Director Cicely LaMothe Retires; Who’s Next?

How a governance failure led to the Unleash Protocol hack