- HYPE shorts traced to a former employee acting independently after early 2024 dismissal.

- Largest leveraged trades reached $223K across HYPE and Bitcoin positions on Hyperliquid.

- Hyperliquid confirmed platform transparency and no current team involvement in trades.

Hyperliquid confirmed on December 22, 2025, that large short positions on its HYPE token were executed by a former employee fired in early 2024. The disclosure followed weeks of on-chain scrutiny across Hyperliquid’s decentralized perpetuals exchange, where traders tracked unusual leveraged activity. Co-founder Iliensinc said blockchain data verified the wallet’s ownership, explained how the trades occurred, and clarified why the activity surfaced months later.

Wallet Tracing Led to Former Employee Identification

Hyperliquid addressed the matter in a Discord statement on December 22, responding to growing community concerns. According to Iliensinc, the wallet responsible belonged to an individual dismissed in the first quarter of 2024 for insider trading violations. Notably, the firm said the individual lost all internal access immediately after termination.

Community attention intensified after on-chain observers flagged wallet address 0x7Ae4 for holding persistent HYPE short positions. These positions appeared directly on Hyperliquid and remained active long after the employee’s dismissal. As a result, traders questioned whether internal actors influenced post-airdrop price movements.

Further on-chain analysis traced the funding source of 0x7Ae4 to an Arbitrum-based wallet, 0xA2c5. However, investigators noted that the fund flow continued across networks, raising additional questions. The Arbitrum wallet later transferred assets to a Polygon address 0x5a62.

The Polygon address showed repeated activity on Polymarket under the account name “trytings.” Between September and November, on-chain data showed 0x5a62 received approximately $66,000 in USDC from Hyperliquid. These transfers later became central to reconstructing the trading timeline.

Leveraged Shorts Executed Days Before Public Disclosure

On December 17, five days before Hyperliquid’s public clarification, the Polygon-linked wallet deposited funds back onto the platform. Specifically, address 0x5a62 sent roughly $53,000 USDC into Hyperliquid. Shortly after the wallet opened multiple leveraged short positions.

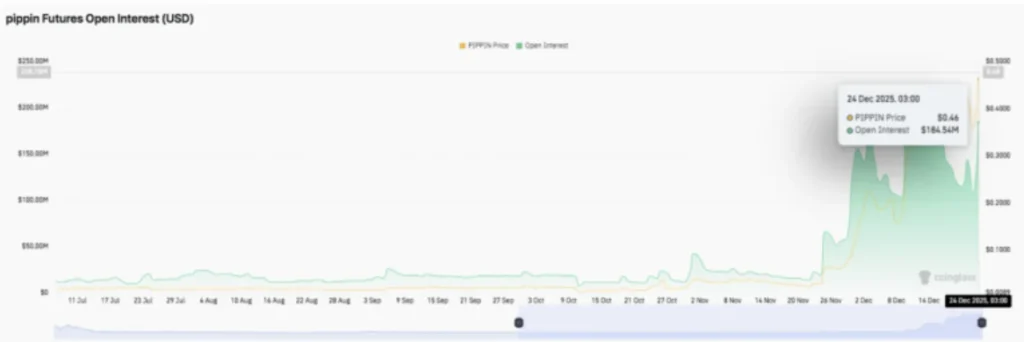

The biggest trade was a $180,000 short on the HYPE token using 10x leverage. The same wallet also opened a $43,000 Bitcoin short with 40x leverage. Together, these positions added up to about $223,000 in total exposure.

On-chain data showed the account retained around $63,000 USDC in free margin after opening the positions. However, Hyperliquid emphasized that these trades did not involve current employees or contractors. According to the company, the individual acted independently using personal wallets.

Iliensinc reiterated that Hyperliquid enforces a strict internal trading policy. Employees and contractors are prohibited from trading HYPE derivatives, either long or short. Violations result in immediate termination, according to the firm.

Hyperliquid stated that the policy exists to prevent conflicts of interest and protect market integrity. The company said the former employee’s actions clearly violated these rules. However, it stressed that the misconduct does not reflect current operational standards.

Transparency Response and Platform Clarifications

Alongside the disclosure, Hyperliquid responded to separate claims questioning its transparency and solvency. The company rejected allegations of hidden controls, special user privileges, and retroactive volume manipulation. It said such claims relied on incorrect interpretations.

Hyperliquid stated that all USDC held on HyperCore is fully accounted for on-chain. It added that some reports failed to include balances on its native HyperEVM. According to the firm, these balances remain publicly verifiable by anyone running a node.

Related: POPCAT Attack Burns $3M, Triggers $4.9M Loss for Hyperliquid

The platform also denied allegations involving administrative “godmode” functions. Hyperliquid clarified that referenced functions are either testnet-only or misunderstood. Notably, it said all orders, trades, liquidations, and fees remain publicly visible.

The response came as Hyperliquid continues to process significant decentralized perpetual trading volume. However, the company focused its statement strictly on factual clarification. It emphasized separating individual misconduct from platform governance.

Hyperliquid confirmed that no current team members are linked to the wallets in question. The firm said it cannot control external wallets once individuals leave the organization. According to the company, enforcement applies only during active employment.

Meanwhile, Hyperliquid confirmed that HYPE token shorting activity traced back to a former employee dismissed in early 2024. The company detailed wallet movements, leveraged positions, and policy violations using on-chain evidence. It also reaffirmed transparency while distinguishing past misconduct from current platform operations.