Morgan Stanley: U.S. 'No Job Productivity Boom' Will Prompt Fed to Further Cut Rates

BlockBeats News, December 25, a Morgan Stanley strategist pointed out that the U.S. economy may be facing a "jobless productivity-led boom," which will suppress inflation and pave the way for more Fed rate cuts.

U.S. Labor Department data shows that in the second quarter, the year-on-year growth in hourly output of all non-farm workers was 3.3%, a significant improvement from the 1.8% year-on-year decline in the previous quarter. Investors' expectations for the Fed's rate cut pace next year are more aggressive than official forecasts.

According to the CME FedWatch Tool, Fed officials expect to cut rates only once by 2026, but investors believe there is a 72% probability of a year-end rate cut. (FXStreet)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

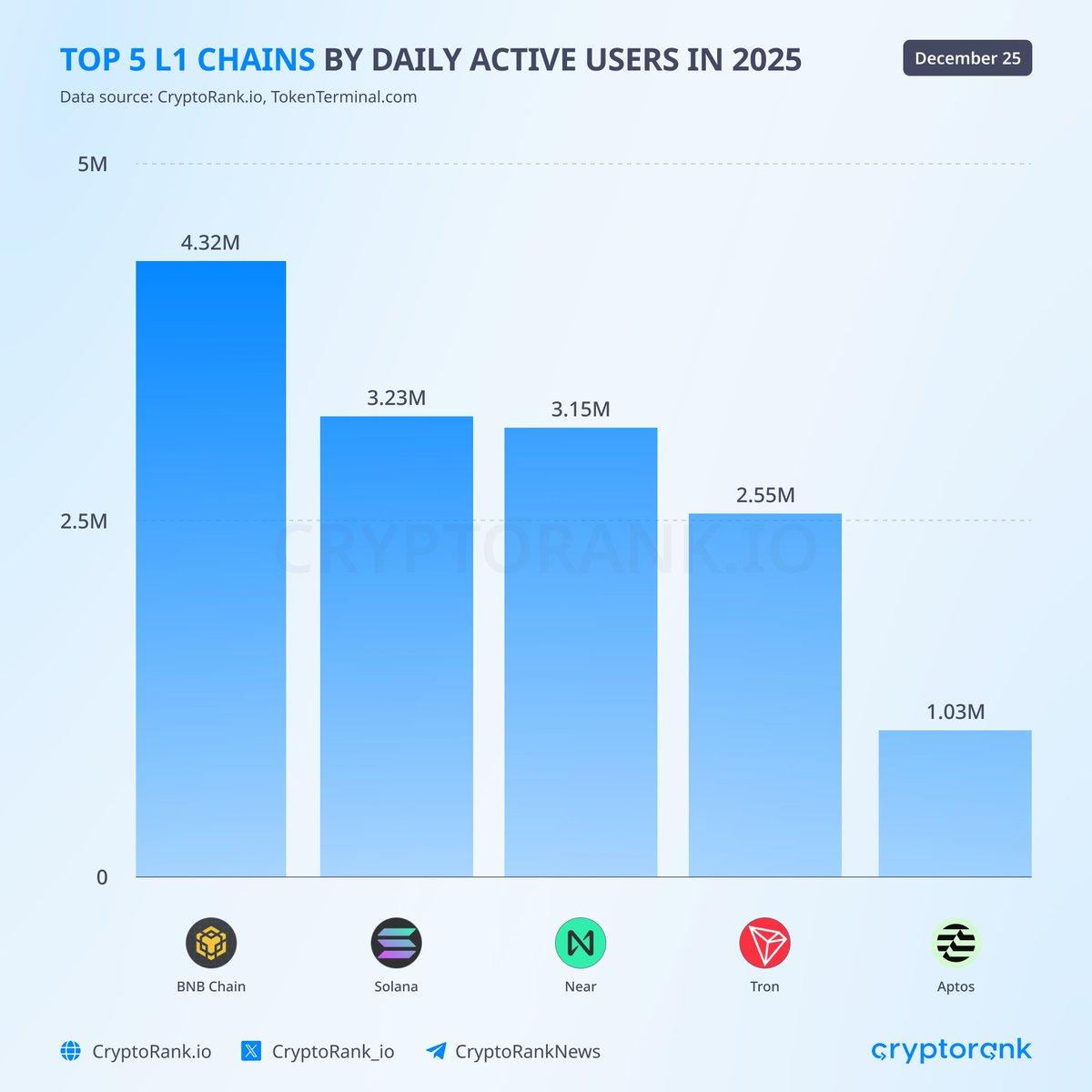

2025 L1 daily active user ranking: BNB Chain tops the list with 4.32 million

Whale 0x46DB bought 5,500 ETH worth $16.09 million within two hours.