Retail Is Staring At XRP Price Chart. Institutions Are Staring at D.C

The crypto market has always rewarded those who look beyond surface-level price action. Yet, in moments of uncertainty, most eyes inevitably return to charts, support levels, and short-term volatility.

What often goes unnoticed is that the most powerful market shifts rarely begin on trading screens. They start in regulatory chambers, policy drafts, and closed-door discussions that quietly redefine the rules of participation.

That deeper layer of market reality is what X Finance Bull highlights in a recent post, drawing attention to a widening gap between retail focus and institutional priorities.

Traders debate whether XRP’s latest pullback signals weakness or opportunity. Meanwhile, institutions are keeping an eye on Washington, D.C., where regulators are shaping the future of cryptocurrency.

Retail is staring at the $XRP price chart. Institutions are staring at D.C 🚨🚨🚨

Ripple just sat down with lawmakers to shape the crypto market structure bill.

The Treasury is clearing the runway.

The Clarity Act is coming.

2026 is the window.And XRP is already ahead of the…

— X Finance Bull (@Xfinancebull) December 19, 2025

Washington, Not the Charts, Is Driving the Next Phase

Institutions are monitoring developments in Washington, D.C., as regulators shape the rules that will define the next phase of crypto growth. These discussions coincide with intensifying efforts by U.S. regulators to address long-standing uncertainties around blockchains, stablecoins, and payment infrastructure.

An embedded video clip referenced in the post captures this shift in tone. The speaker emphasizes a renewed commitment to reviewing regulatory barriers that restrict innovation, while considering reforms designed to unlock the full potential of American capital markets.

Importantly, the message centers on building a financial system that serves everyday Americans, not just institutions—an angle that aligns closely with blockchain-based payment efficiency and real-time settlement.

The Clarity Act and the Treasury’s Role

Momentum around comprehensive crypto legislation is building, with the proposed Clarity Act emerging as a focal point of market attention. While still in development, the bill aims to establish clear regulatory boundaries, jurisdictional oversight, and compliance pathways for digital assets operating in the United States.

Parallel efforts by the U.S. Treasury to formalize stablecoin frameworks suggest that regulatory coordination is accelerating rather than stalling.

This environment supports the idea that 2026 represents a critical window. By then, institutional capital is expected to move decisively toward assets that already align with regulatory expectations, rather than those still seeking legal validation.

— TimesTabloid (@TimesTabloid1) June 15, 2025

Why XRP Is Structurally Ahead of the Market

XRP’s positioning in this unfolding landscape is not accidental. Its legal status has been materially clarified through U.S. court rulings, removing a level of uncertainty that continues to suppress institutional participation across much of the crypto sector.

From a compliance standpoint, XRP operates within a framework that aligns with commodities-style oversight, reinforcing its relevance in regulated financial systems.

Ripple’s RLUSD stablecoin initiative further strengthens this alignment, arriving at a time when dollar-backed digital assets are becoming a central focus of U.S. policy discussions.

At the same time, institutional exposure to XRP-linked products is gradually expanding, and real-world banking integrations are already live, supporting cross-border settlement and liquidity management today—not in theory.

Compliance, Not Hype, Is the Real Catalyst

As X Finance Bull suggests, the current market dip may one day be remembered less as a technical correction and more as a moment of widespread misinterpretation.

Regulatory clarity does not arrive with fireworks; it comes through legislation, regulatory approvals, and institutional readiness. When U.S. banks receive explicit authorization to tokenize assets and settle across interoperable chains, the assets already built for that environment will not need to scramble.

In that sense, XRP’s story is shifting away from speculative narratives and toward structural inevitability. The chart may capture attention, but the real signal is unfolding in Washington—and it is moving faster than many realize.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What are Intent Based Architectures?

Bitcoin could face severe headwinds amid macroeconomic growth warnings, analyst says

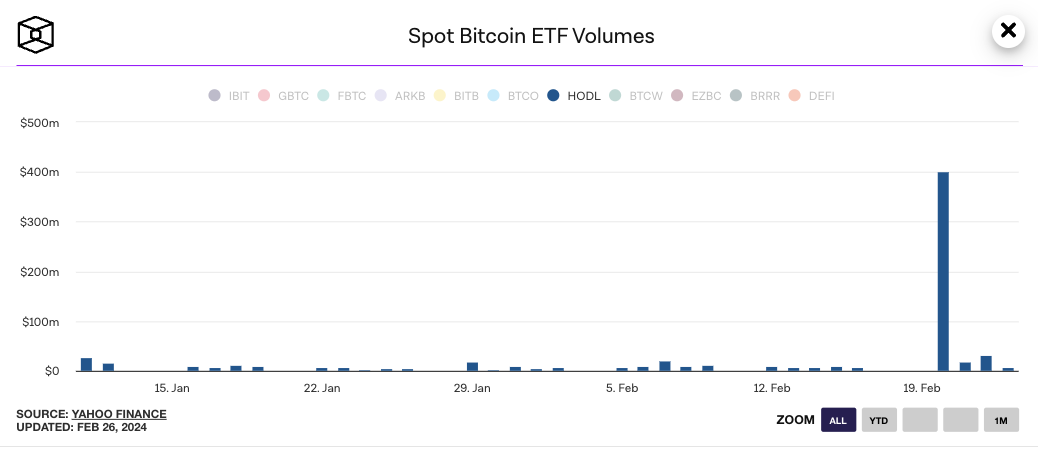

Spot bitcoin ETF volume spike may be due to high-frequency trading, CoinShares says

'Sloppy' US crypto mining survey put on pause by Texas judge