What Do Onchain Data Show for Ethereum (ETH)? CryptoQuant Analyst Answers, Sharing the Historical Signal!

While 2025 was set to be a record year for Bitcoin (BTC), the same was not true for Ethereum (ETH). Ethereum, albeit with difficulty, broke its 2021 all-time high in August, but has been on a downward trend ever since.

However, the time for Ethereum to hit rock bottom may have arrived.

According to an analysis by a CryptoQuant analyst, retail investor demand for Ethereum has weakened significantly recently.

According to the analysis, a decrease in individual investor activity and a drop in the number of active sender addresses on Ethereum were observed.

Historically, the exit of individual investors from the market has also served as a signal of structural dips, and these periods have often been followed by accumulation by large investors.

According to the data, the number of active sender addresses on Ethereum has recently dropped to 170,000. This suggests that retail investors have either already exited the market or are currently showing little willingness to transact.

The analyst also noted that the decrease in individual investor activity generally coincides with periods when selling pressure has subsided. However, according to the analyst, individual investor participation is still lacking, which could limit the upside potential in the short term.

“Since private funds primarily provide the necessary momentum during the recovery phase, the lack of individual investor participation could limit Ethereum’s upside potential in the short term.”

However, periods of declining individual investor activity in the past have often coincided with times when large, long-term investors began accumulating wealth.

Finally, the analyst suggested that the decrease in the number of active addresses could also be a significant indicator of a future Ethereum price recovery. The analyst added, “The current situation clearly indicates short-term weakness and retail investors exiting the market, but this type of environment has historically been observed mostly near structural bottoms.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Spot gold has seen a sharp short-term pullback and is currently trading at $4,326 per ounce.

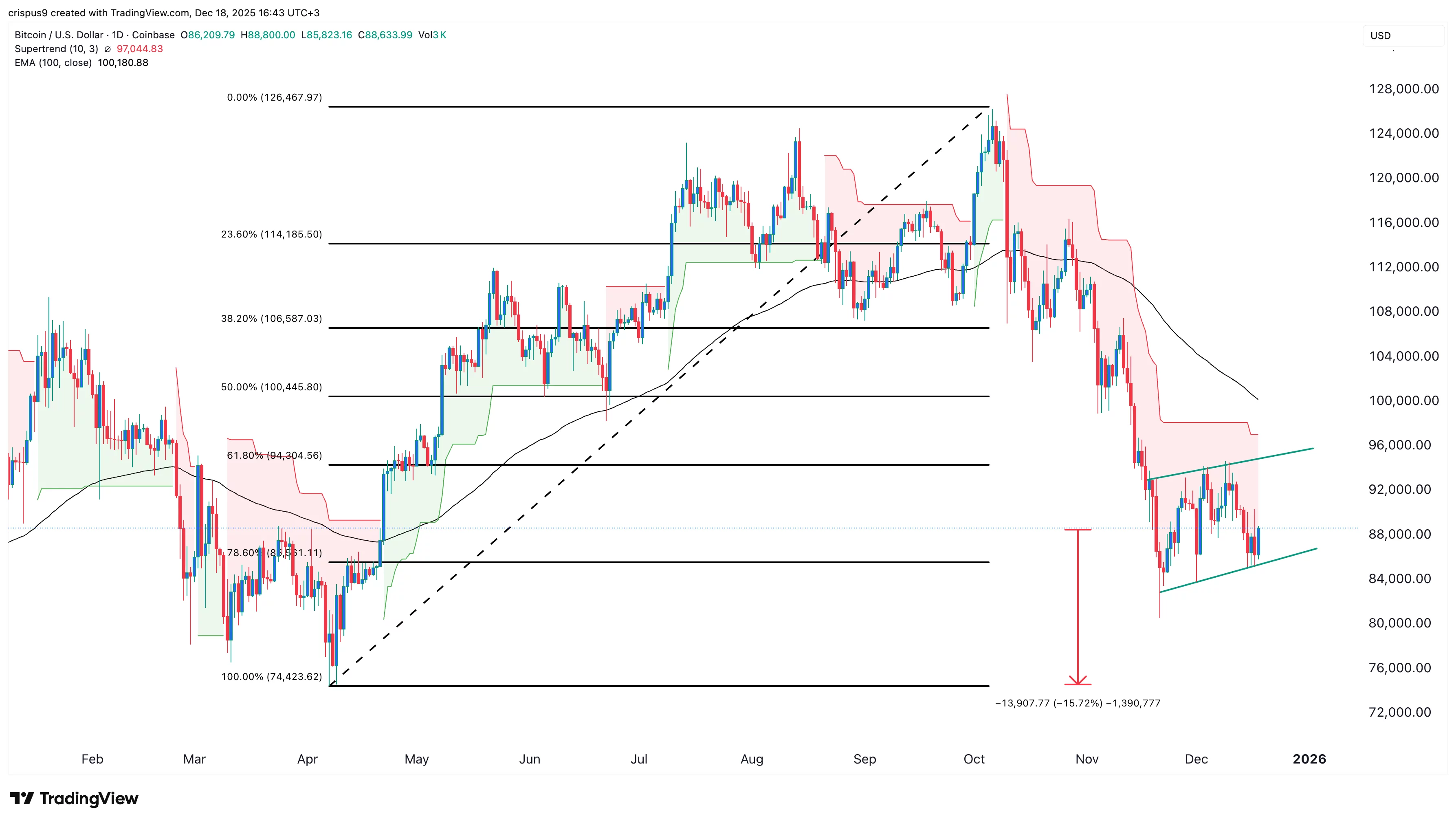

Will Bitcoin price rise or fall after the BoJ rate decision on Dec. 19?

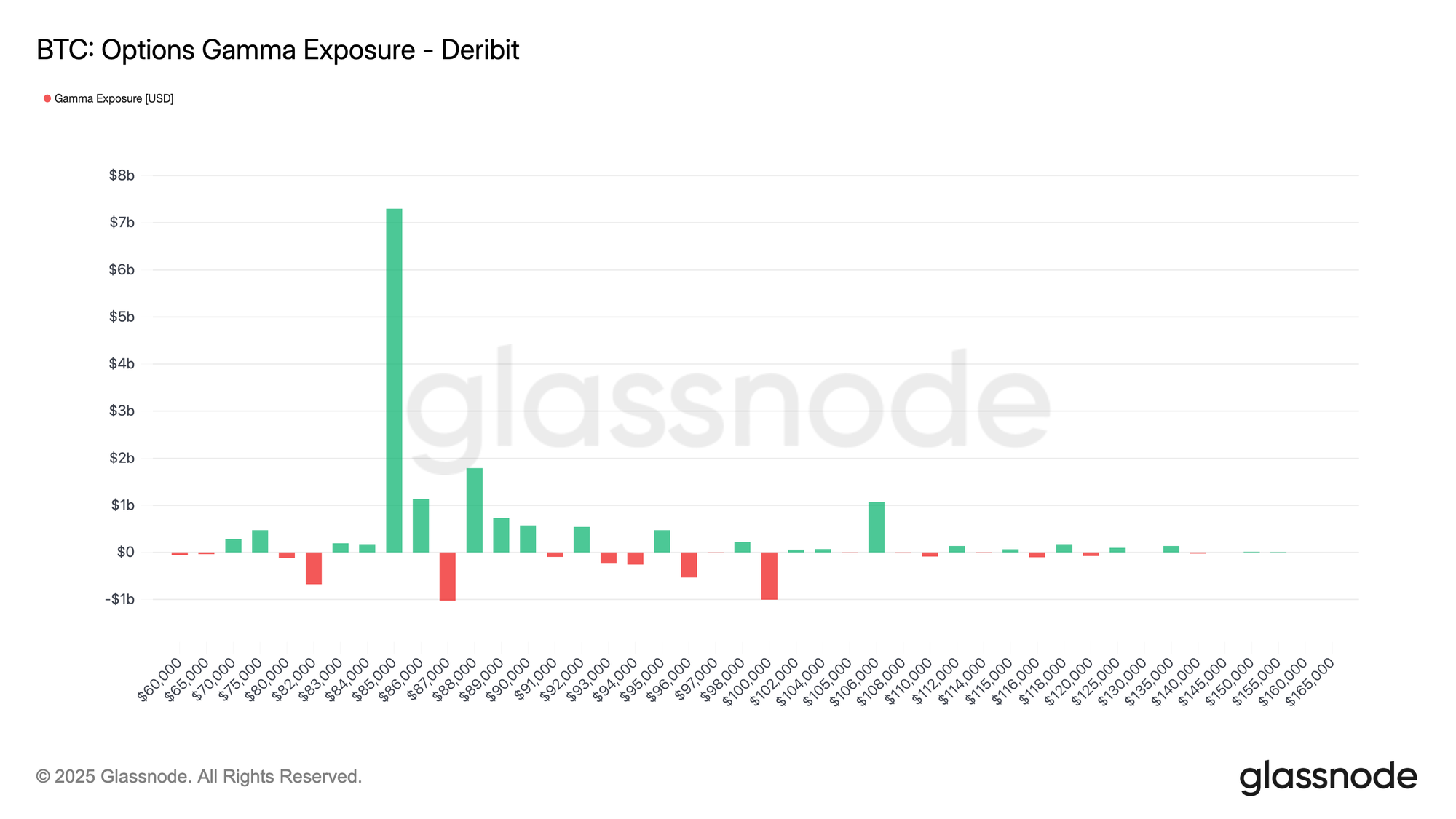

Introducing: Taker-Flow-Based Gamma Exposure