Federal Reserve scraps old crypto policy, opens access to digital asset activities

The United States Federal Reserve has withdrawn old guidance that prevented certain banks, including uninsured state institutions, from engaging with crypto-facing activities under the same conditions as federally insured counterparts.

- The Federal Reserve has rescinded its 2023 guidance that prevented uninsured state-chartered banks from engaging in crypto-related activities under Federal Reserve supervision.

- New guidance offers crypto-native banks a formal route to join the Fed and settle payments directly, without relying on intermediaries.

According to the Fed, the decision to rescind the 2023 policy was grounded in the view that it was outdated and that both the financial system and the Board’s understanding of innovative products and services had “evolved” over the years.

“The new policy statement creates an avenue for both insured and uninsured Board-supervised state member banks to engage in certain innovative activities,” the Fed wrote in its Wednesday guidance, allowing such institutions to participate in areas including cryptocurrencies, provided they meet supervisory expectations.

Under the 2023 framework, uninsured banks that were primarily engaged in activities not permissible for national banks had to follow the same restrictions as insured institutions, even while their own charters allowed otherwise. As such, these institutions were effectively locked out of Fed membership and critical payment infrastructure.

Fed governor criticized

This guidance was also why Custodia Bank’s bid for a master account was denied, according to Custodia Bank CEO Caitlin Long, who welcomed the latest decision as a long-overdue correction and criticized Fed Governor Michael Barr, who dissented the updated guidance.

Custodia Bank, which specializes in crypto custody and does not carry FDIC insurance, applied for a Fed master account back in 2020. However, at the time, a U.S. District Court for the District of Wyoming dismissed Custodia’s case after the Fed cited the very guidance that has now been rescinded.

Barr, in a separate statement released today, defended the 2023 policy, arguing that equal treatment across banks “helps to level the competitive playing field” and mitigate regulatory arbitrage.

“I cannot agree to rescind the current policy statement and adopt a new one that would, in effect, encourage regulatory arbitrage, undermine a level playing field, and promote incentives misaligned with maintaining financial stability,” he said.

Long hit back, stating that the Fed “broke the law by citing this guidance” during the Custodia denial process, noting that the guidance had not even become official at the time.

“Per insiders, we now know that Barr directed Fed staff to find something to deny Custodia at the time, which was around two weeks after FTX failed — and the now-rescinded guidance was part of what he and his team found to deny Custodia,” Long said.

Fed warming up to crypto

Uninsured banks, under the new policy, can now apply for Federal Reserve membership without being automatically disqualified based on their primary business models, which would give them direct access to central bank payment systems and allow them to settle transactions without relying on intermediary institutions.

“New technologies offer efficiencies to banks and improved products and services to bank customers,” said Vice Chair for Supervision Michelle W. Bowman.

“By creating a pathway for responsible, innovative products and services, the Board is helping ensure that the banking sector remains safe and sound while also modern, efficient, and effective,” she said.

In related news, earlier this month, Bowman said she would be pushing for new regulations that would govern both banks and stablecoin issuers to create a more competitive and accountable environment.

“As a regulator, it is my role to encourage innovation in a responsible manner, and we must continuously improve our ability to supervise the risks to safety and soundness that innovation presents,” Bowman said, adding that she would work with other agencies to develop capital and diversification standards under the GENIUS Act.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

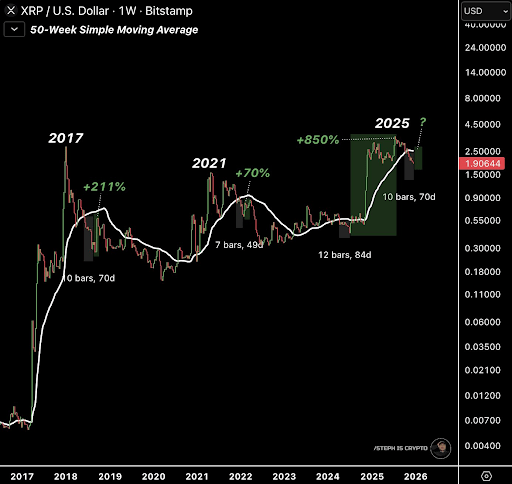

XRP Enters Historical Window That Has Previously Led To Triple-Digit Rallies

Which Cryptocurrency Has the Most Active Wallets? The List is Out, and Bitcoin Isn’t Number One

Leading Solana treasury Forward Industries tokenized FWDI stock via Superstate

Forward Industries brings FWDI shares to Solana: a revolution for decentralized finance