Bitcoin Spot ETF Net Inflow Reaches $457.3M as BlackRock and Fidelity Drive Demand; Ethereum Spot ETF Posts $22.4M Outflow

According to Farside Investors’ monitor, COINOTAG News reports a net inflow of $457.3 million into the US Bitcoin spot ETF for the session. Within the ledger, issuer activity showed: BlackRock IBIT +$1.112 billion, Fidelity FBTC +$3.915 billion, while Bitwise BITB (-$8.4 million) and ARK ARKB (-$37 million) trimmed positions.

Separately, the US Ethereum spot ETF posted a net outflow of $22.4 million. The reads show BlackRock ETHA -$19.6 million and Fidelity FETH -$2.8 million, illustrating a selective rotation away from some ETH-focused products.

These flows underscore ongoing investor discernment in crypto ETF markets, with Bitcoin exposures drawing stronger inflows from top custodians while Ethereum vehicles experience mixed liquidity. Market participants should weigh issuer-specific momentum against broader regulatory and macro drivers as part of disciplined risk management.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

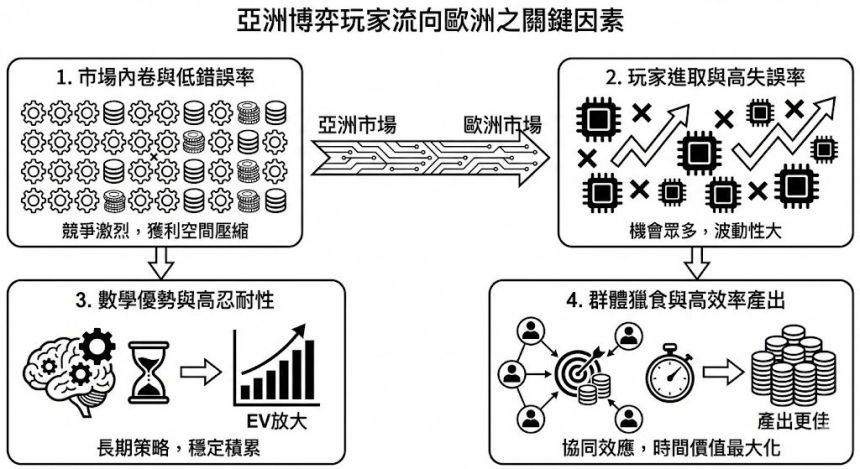

德州撲克趨勢|亞洲高級玩家轉戰歐洲撲克網內幕

BTC Rises Above $87,000: A Stunning Surge and What It Means for You

How is Crypto VC Investment Trending in a Bearish Market?