Hyper Foundation proposes removing $1 billion worth of HYPE tokens from circulating supply by zeroing out Hyperliquid's Assistance Fund

The Hyper Foundation has submitted a proposal that could remove nearly $1 billion worth of HYPE tokens from the circulating supply.

On Tuesday evening, the organization posted a Discord message asking for a vote on whether HYPE tokens held in the Assistance Fund should be "recognized … as burned" and removed "permanently from the circulating and total supply."

The Assistance Fund is a core protocol-level mechanism for Hyperliquid that automatically converts a significant portion of the blockchain's trading fees into native HYPE tokens through an embedded process in the L1 execution layer.

In practice, the fund, managed by the Hyper Foundation, functions like a continuous buyback-and-burn system, putting deflationary pressure on HYPE's supply. The system was intentionally designed without a private key or any control mechanisms, meaning they are “mathematically irretrievable without a hard fork,” the foundation noted.

However, the tokens remain part of HYPE’s measurable supply, perhaps distorting metrics like market capitalization. About 37 million HYPE tokens are currently in the Assistance Fund, representing over 13% of HYPE’s 270 million circulating supply, according to The Block’s data.

"By voting ‘Yes,’ validators agree to treat the Assistance Fund HYPE as burned. No onchain action is required, as the tokens are already in a system address with no private key. This vote is binding social consensus to never authorize a protocol upgrade to access this address," the foundation wrote.

On Discord, most validators have signalled that they intend to vote “Yes” on the proposal. The vote will remain open until Dec. 21 at 04:00 UTC, at which point the result will be confirmed based on stake-weighted consensus.

HYPE is down over 8% on the day to trade below $25, according to The Block’s price page.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

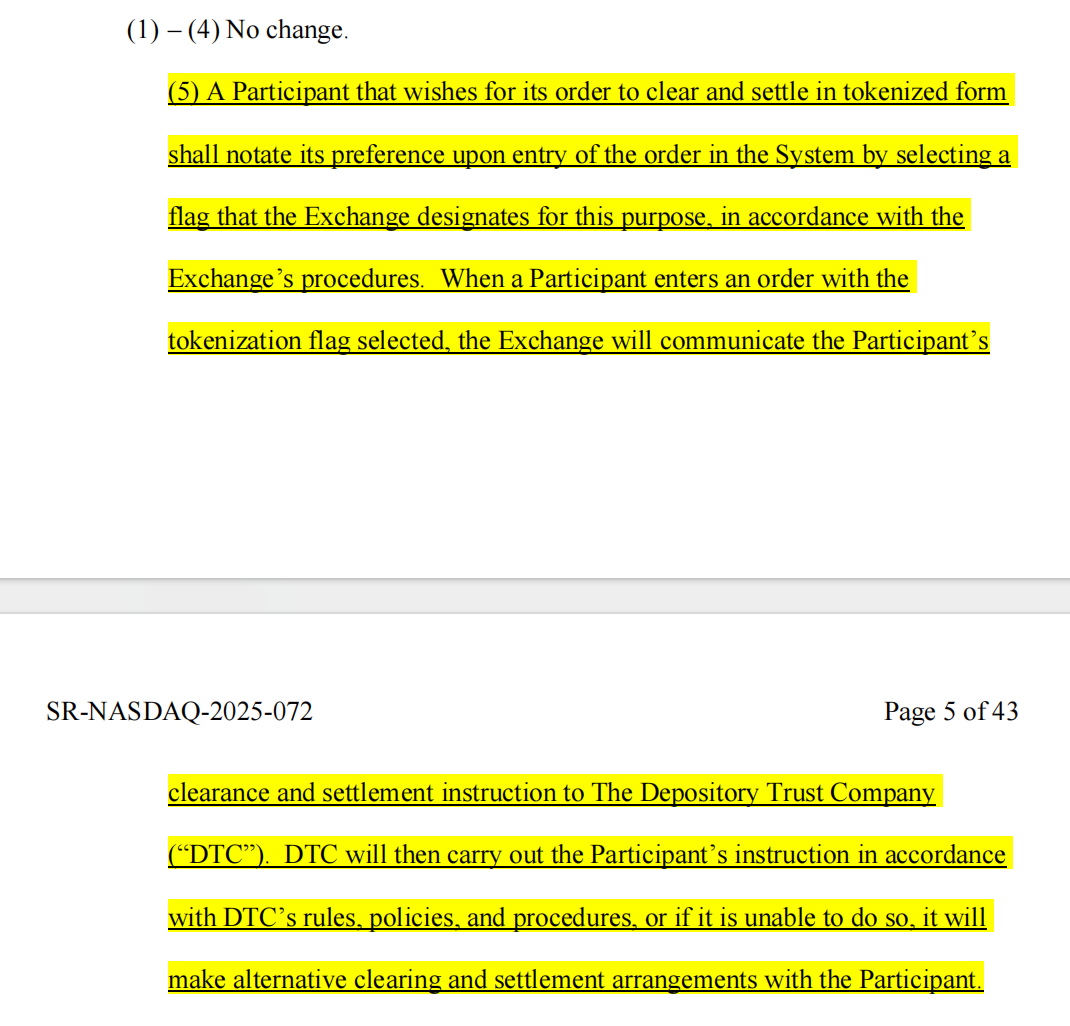

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Why did the "Insider King" fall into his own trap on October 11?

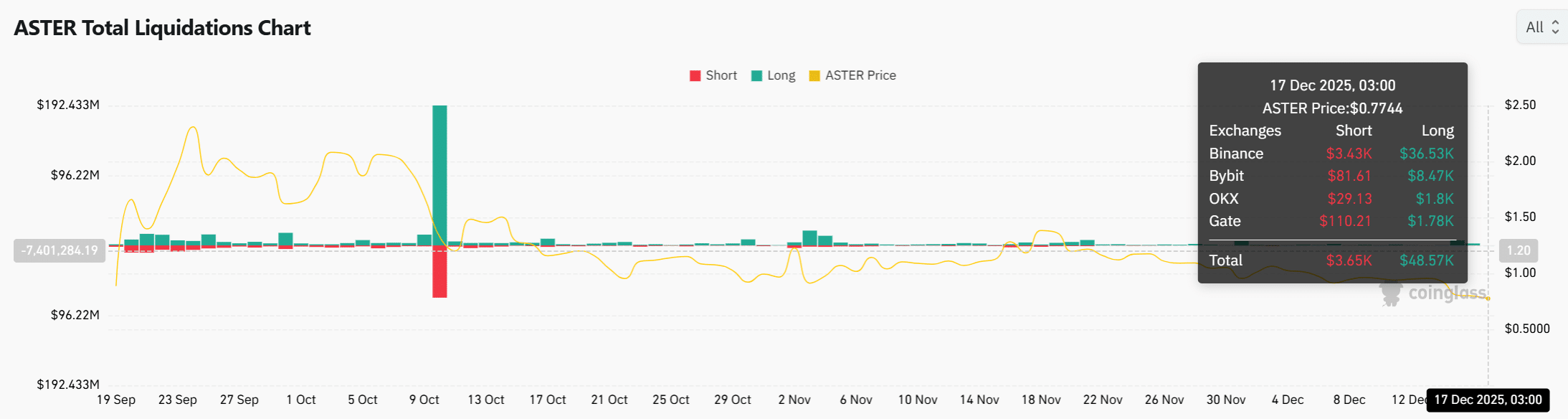

ASTER price sinks as whale losses deepen – Is $0.6 next?