Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why

Amid a steady price rebound in the Bitcoin (BTC) market, popular market analyst with the X username KillaXBT is predicting another significant correction in the forthcoming days.

Bitcoin Historical Data Reveals Recurring Monthly 8% Price Decline

In an X post on December 12, KillaXBT outlines a cautious market insight that suggests Bitcoin is headed for a price pullback. According to the renowned analyst, the premier cryptocurrency has consistently recorded an 8% price decline after the 14th day of the last five months. KillaXBT describes this observation as the 14th Pivot, which now holds important implications for Bitcoin in the short term. Since hitting a price bottom of $80,000 in late November, BTC has formed an ascending channel, recording a steady series of higher lows and higher highs.

Source: @KillaXBT on X

Source: @KillaXBT on X

However, KillaXBT’s projection is expected to break this channel, potentially halting the nascent uptrend. Going by the recurring price pattern, the analyst states Bitcoin investors should anticipate a minimum 5% price decline after the 14th of December, hinting at a potential retest of the 85,000-$86,000 price zone.

Given the asset’s broader bullish market structure, such a move may represent nothing more than a short-term pullback. However, the prolonged correction seen earlier in Q4 has already set a precedent, leaving room for another phase of deeper downside should momentum weaken.

BTC To Bottom Below $50,000?

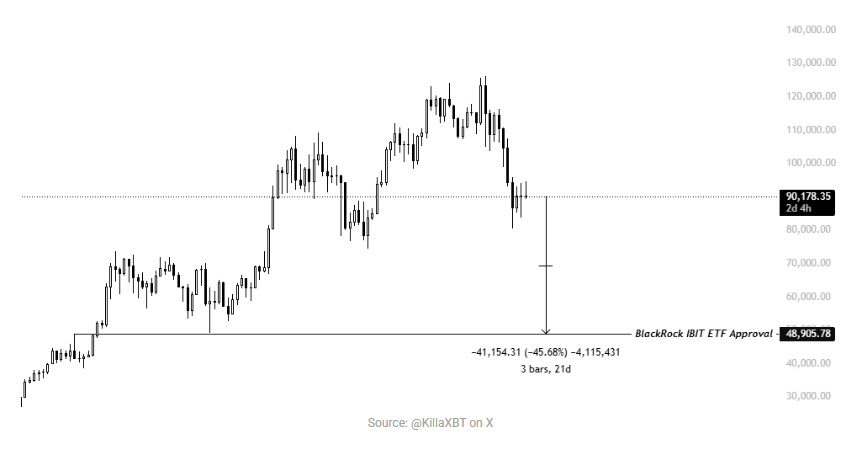

In another X post, KillaXBT shares more bearish projections of the Bitcoin market. This time, the seasoned analyst predicts the crypto market leader will hit a price bottom of $48,905 despite recent price gains. KillaXBT’s bottom target represents Bitcoin’s price as of the approval of the BlackRock IBIT ETF, alongside 11 other Bitcoin Spot ETFs in January 2024. This projection is likely due to the common rationale that the present bullish run has been heavily supported by institutional inflows.

Source: @KillaXBT on X

Source: @KillaXBT on X

Notably, the Bitcoin Spot ETFs have been central to these institutional inflows, boasting total net assets of $119.18 billion. The BlackRock IBIT holds over half of this traction as the undisputed market leader with $71.03 billion in net assets and $62.68 billion in cumulative net inflows.

If Bitcoin were to return to its pre-ETF approval price levels, it would imply an estimated 46% decline from current market prices. Such a move would likely signal a sharp reversal in institutional positioning, suggesting that sustained ETF outflows, rather than retail capitulation, could emerge as the primary catalyst for a renewed crypto winter.

At press time, Bitcoin continues to trade at $90,348, reflecting a 2.18% decline.

Featured image from Pexels, chart from Tradingview

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investing in People: Maximizing Returns from Higher Education in a Tech-Focused Economy

- Higher education ROI is shifting as tech-driven economies prioritize vocational training for faster, lower-cost career pathways. - Certificate programs show short-term financial gains over bachelor's degrees, but long-term returns favor traditional degrees according to Utah Foundation data. - Corporations now treat human capital as a strategic asset, investing in AI-driven training to bridge skill gaps in emerging fields like cybersecurity. - Macroeconomic growth relies on aligning education with tech de

Evaluating the Expansion Opportunities for EdTech within STEM and Technical Disciplines

- Global EdTech market grows to $907.7B by 2034 as STEM workforce gaps drive demand for AI, cybersecurity, and engineering skills. - Traditional academic programs struggle with declining enrollments and outdated curricula, while private-sector EdTech fills gaps through AI/VR training tools. - Investors target ETFs like EDUT/VGT and startups like Protege, leveraging federal grants and industry-academia partnerships to address 3.5M cybersecurity job shortages. - Underfunded academic programs and policy shift

Hyperliquid (HYPE) Price Rally: Unpacking the Institutional Liquidity Transformation in DeFi

- Hyperliquid (HYPE) drove 2025 DeFi institutional adoption via HIP-3 upgrades, slashing fees 90% and boosting TVL to $2.15B. - Strategic partnerships with Anchorage Digital and USDH stablecoin integrations enhanced institutional confidence in HYPE's compliance and liquidity. - Deflationary tokenomics (97% fee buybacks) and $340M buyback programs stabilized HYPE amid November 2025 price drops to $27.43. - Macroeconomic risks and token unlocks challenge HYPE's momentum, but USDH auctions and $1B public offe

PEPE Holds Tight Range Near $0.054 as Support and Resistance Limit Price Movement