Overview of Major Overnight Developments on December 13

21:00-7:00 Keywords: Powell, Trump, Oracle 1. Powell: AI is a "partial reason" for the deterioration of employment in the United States; 2. Trump is inclined to choose Warsh or Hassett to lead the Federal Reserve; 3. The yield on the 30-year US Treasury bond has risen to its highest level since September; 4. Standard Chartered Bank has expanded its institutional digital asset service cooperation with a certain exchange; 5. The yield on the 10-year US Treasury bond rose by about 5 basis points during the "Fed rate cut week"; 6. Oracle responded: It will not delay the construction of data centers related to OpenAI; 7. Bank of America: US money market rates will not return to normal until December 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

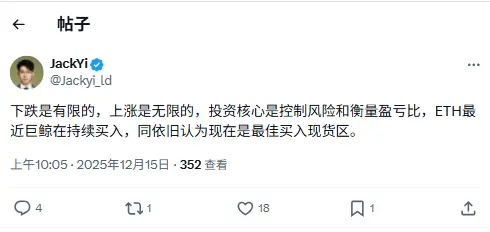

Yilihua: ETH whales are continuing to buy, and I still believe now is the best time to buy spot.

Eric Trump: Bitcoin Has No "Management," No Issues of Corruption, Fraud, or Abuse

Data: Hyperliquid platform whales currently hold $5.517 billions in positions, with a long-short ratio of 0.93.

AI blockchain security platform TestMachine completes $6.5 million financing, led by BlockChange Ventures and others