Hyperliquid Whale Game: Some Make a Comeback Against the Odds, Others Lose Momentum

Author: Frank, PANews

Original Title: Hyperliquid Whale Chronicles: Some Turn Their Fortunes Overnight, Others Die by Obsession

The whales on Hyperliquid have become the focus of on-chain trading. Here, stories of overnight riches and total wipeouts play out every day.

Diving deep into on-chain data, these whales display a myriad of styles: some are “contrarian indicators” who hold large sums but repeatedly lose, some are “snipers” who lurk for half a year for a single kill, and others are “cold-blooded machines” that use algorithms to harvest retail traders every second.

Data strips away the mystery of these big players. PANews selected the five most representative addresses on Hyperliquid: including the famous “Maji Big Brother,” a mysterious figure suspected of having insider information, a market maker with billions in capital, as well as the recent “comeback legend” and the “iron-headed bull.” Through their thousands of trading records, we may find a reflection of ourselves in these portraits.

Maji Big Brother: Wins Like “Bird Feed,” Loses Like a “Crash”

Speaking of Maji Big Brother, he seems to have become a contrarian indicator in the current market, from huge losses on Friend.tech to now massive contract losses. His trading operations are almost a negative example for crypto industry practitioners or investors. But even negative examples are lessons.

Since entering Hyperliquid, Maji Big Brother’s losses have reached $46.5 million. He ranks among the top in Hyperliquid’s trading loss leaderboard. From his trading style, Maji exhibits the classic traits of a high win rate but low risk-reward ratio. His overall win rate is 77%, but his risk-reward ratio is 1:8.6. Additionally, his average holding time for profitable trades is 31 hours, but for losing trades, it’s 109 hours. This shows he tends to take profits quickly but often holds onto losing trades until the losses are huge or the position is liquidated.

Overall, his short-term market judgment is indeed accurate, but his trading strategy always risks losing $8.6 to win $1.

However, in actual trading, before the market crash on October 11, his overall position was still at a profit of $15 million. After the crash on October 11, due to liquidations of multiple orders such as XPL and ETH, his overall profit turned into a loss of over $11 million. Subsequently, with more operations, he drifted further from breaking even.

Analyzing the root causes of Maji’s losses, two characteristics became his fatal flaws.

First is being a “die-hard bull.” In all his trades, 94% were long positions and only 6% were shorts. He lost $46.88 million on longs but made $380,000 on shorts. In a falling market, this one-sided style is deadly. Second is averaging down on losses without stop-losses. In many of his large losing trades, when his orders were close to liquidation, his first choice was often to add margin rather than stop out. This led to ever-increasing losses. Overall, Maji Big Brother’s profits are like “bird feed,” while his losses are like a “crash.” From a trading psychology perspective, he has obvious flaws in loss aversion, refusal to admit mistakes, and sunk cost fallacy—traits not to be emulated.

10.11 Insider Short “Big Boss”: The Cold-Blooded Sniper

If Maji Big Brother is a hot-blooded warrior spraying bullets with a machine gun, this big boss is a sniper who lies in wait for three days just to pull the trigger once.

His trading frequency is extremely low, with only 5 trades in half a year, but a win rate of 80% and a staggering $98.39 million in profits. Unlike Maji, who keeps depositing, this whale is constantly withdrawing.

His most famous trade was on October 11, when he deposited $80 million to short BTC, and five days later withdrew over $92 million in profit. After that sensational trade, he didn’t linger but remained restrained. On October 20, he shorted again for a $6.34 million profit. Although he lost $1.3 million on a long position on November 8, it was negligible compared to previous profits. Currently, his account still holds an ETH long worth $269 million, with an unrealized profit of about $17.29 million. From his trading characteristics, this figure—believed to have insider information—resembles a lurking crocodile: he rarely moves, but when he does, he bites off the biggest chunk of the market and then disappears.

$1 Billion Capital Market Maker: Ruling the Market with Algorithms

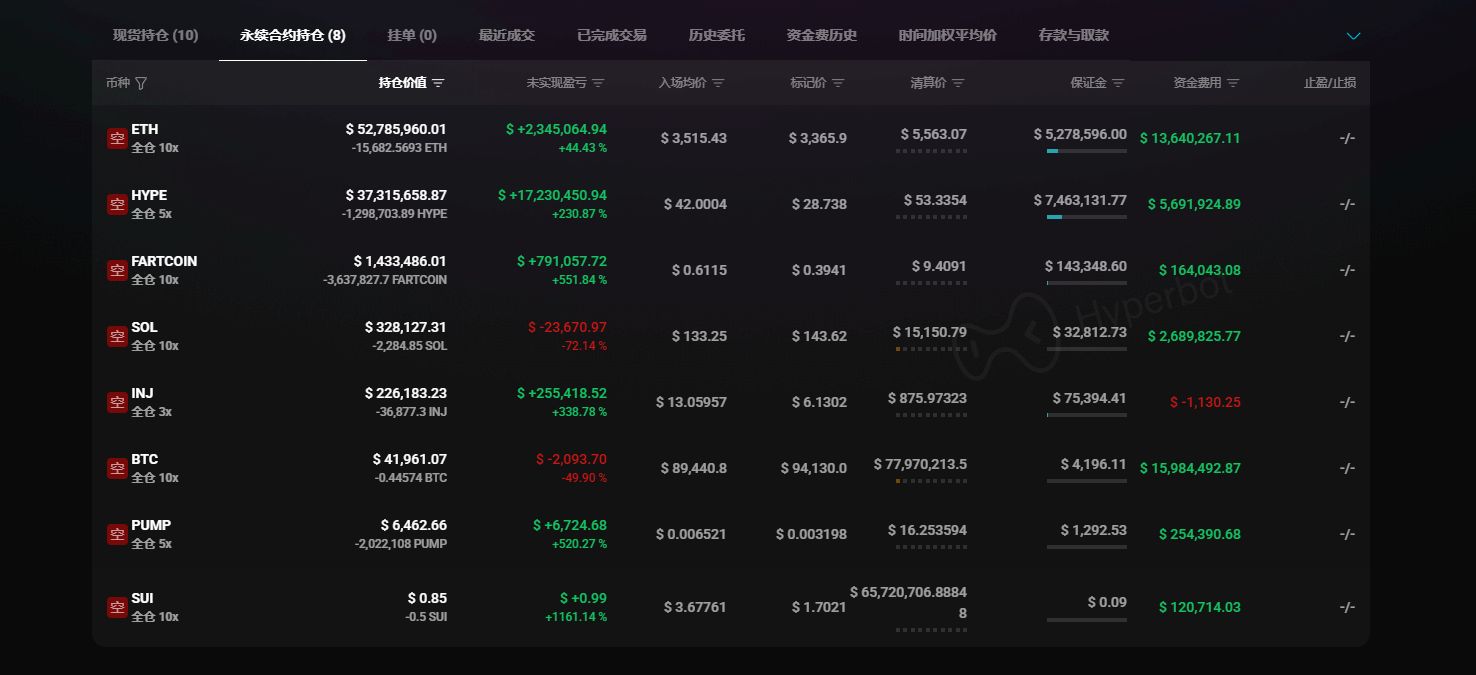

The address 0x5b5d51203a0f9079f8aeb098a6523a13f298c060 is currently the top-earning address on Hyperliquid. If the previous two are “gamblers” and “hunters,” this one is a market-maker-level super whale. So far, this address has deposited a total of $1.11 billion into Hyperliquid and withdrawn $1.16 billion. The current unrealized profit is about $143 million.

His strategy is to first open several massive base positions, such as current shorts in ETH and other tokens. Then, through algorithmic frequent position adjustments, he profits in two ways: first, by earning from trend shorts, and second, by high-frequency trading to capture arbitrage opportunities in the market.

Upon closer analysis, not only is the top-earning address this type of trader, but the second and third ranked addresses are also whales arbitraging in this way.

Take the second-ranked address as an example: 51% of his trades are limit orders, placing buy and sell orders above and below the order book to profit from tiny price fluctuations. Although each trade is small—only $733 per order—he completed 1,394 token orders in a single day, accumulating tens of thousands of dollars in daily profit.

However, this kind of whale operation is almost meaningless for retail traders, as whales not only have fee advantages but also high-speed quantitative programs and hardware support.

Highest Weekly Profit: Climbing Up Step by Step

This address doesn’t really qualify as a whale, but its extremely high weekly return caught PANews’ attention.

In terms of capital, this address had previously invested a total principal of about $46,000, looking just like an ordinary retail trader. From past trading results, until the end of November, his account balance kept shrinking, with a loss rate of 85%. At this stage, he was a typical loser, trading chaotically and stubbornly holding small-cap tokens.

However, after December 2, he seemed like a changed person, or perhaps found a trading “holy grail.” By December 9, he had won 21 consecutive trades, growing his principal from $129 to $29,000 in an exponential curve.

On December 3, he tentatively opened a position, 1 ETH, earning $37. On December 5, feeling confident, he increased to 5-8 ETH per trade, earning about $200 per trade. On December 7, he raised his position to 20 ETH, with single-trade profits reaching $1,000. On the 8th, he increased to 50-80 ETH, with single-trade profits of $4,000. On December 9, his position reached 95 ETH, with a single-trade profit of $5,200.

The above summarizes his recent trading process. During this period, he made several changes. First, he stopped trading everything and focused solely on ETH. Previously, he traded over 10 different tokens. Second, he stopped stubbornly holding losing positions and switched to a quick-in, quick-out style. His previous average holding time was about 33.76 hours, but in the past week, it dropped to 4.98 hours. He seemed to have abandoned loss-holding and switched to taking profits quickly. Third, his position sizing changed from random to a “rolling position” model, a common method for rapid small-capital growth.

However, while his profits grew faster, his leverage also increased. Previously, his average leverage was 3.89x, recently rising to around 6.02x. This also amplified his trading risk. As of writing, his latest ETH position has already lost over $9,000 due to a rapid market rally, wiping out nearly half his profits. His profit curve changed from exponential growth to a cliff-like drop.

In summary, this shift in trading style has indeed made him stronger, but also more fragile. Whether he can recover his losses depends on how he handles losing trades and maintains a high win rate.

Iron-Headed Bull: The Lament of a Die-Hard Bull

Compared to the traders above, this whale’s style is more like a staunch bull believer and also a “victim” of SOL.

This whale’s total entry capital reached $236 million, with 86.32% of his trades being longs—over 650 out of 700 trades were long positions. He lost over $5.87 million on longs, but made $1.89 million on shorts. Although his overall loss was over $5 million, compared to his $200 million+ turnover, this drawdown (about 2.4%) is still within a controllable range. But his biggest problem lies in his position structure.

His loss structure is very peculiar: almost all his profits were wiped out by a single token—SOL. Among the tokens he traded, FARTCOIN and SUI each brought in over $1 million in profit, and ETH and BTC profits were close to $1 million each. But a single loss on SOL reached $9.48 million. If you exclude the SOL loss, he would actually be an excellent trader (other tokens’ cumulative profit is about $4 million). But he seems to have an obsession with SOL, stubbornly holding long positions and repeatedly getting wiped out by SOL’s bearish trend.

From his trading, we can draw the following lesson: even if you have over $100 million, if you develop an “emotional attachment” or “obsession” with a particular token, it can easily destroy you—especially if you go against the trend.

In conclusion, in this deep sea where whales, algorithms, and insider information intertwine, there is no so-called “sure-win holy grail.” For ordinary investors, most whale operations are impossible to replicate. The only thing we might learn from them is not how to make $100 million, but how to avoid becoming a “bag-holding” loser like Maji Big Brother, and not to challenge tireless algorithmic machines with our limited funds and speed.

Respect the market, respect the trend—perhaps that is the most valuable lesson the market can offer us.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.

Elon Musk at the Center of an Unprecedented Showdown with the EU

Stablecoin Payments: Stripe’s Tempo Blockchain Launches Public Testnet

Trump Launches Fed Auditions: Who Will Replace Powell?