Date: Thu, Dec 04, 2025 | 04:10 AM GMT

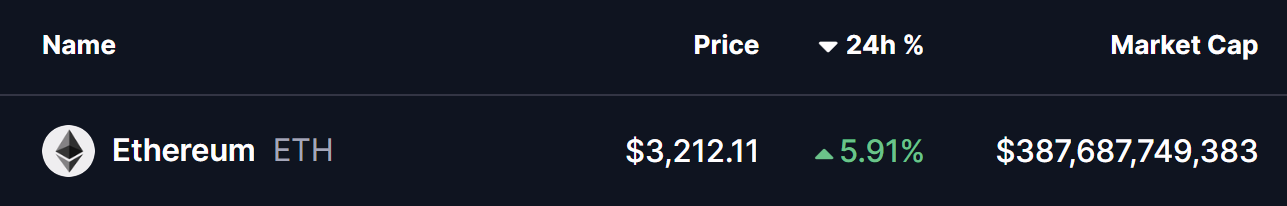

The broader cryptocurrency market is showing notable upside momentum as Ethereum (ETH) surges over 5% in the last twenty-four hours. More importantly, ETH’s 4-hour chart is flashing a well-defined harmonic structure — a formation that often signals strong trend continuation before a potential reversal. And this time, the setup points to further upside in the short term.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

On the 4H timeframe, ETH has shaped a clean Bearish Bat harmonic pattern. Despite the name, this pattern typically includes a strong bullish rally during the CD leg as the price travels toward the Potential Reversal Zone (PRZ).

The structure initiated from Point X near the $3,657 level before dropping sharply into Point A. ETH then bounced into Point B and retraced again toward Point C around $2,716 — a zone that triggered a strong reaction from buyers. From that point, ETH began accelerating upward, reclaiming the 100-hour moving average at $3,048, highlighting renewed control from bulls and a shift in short-term market sentiment.

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

At present, ETH is trading around $3,211 and is inching closer to its next critical barrier — the 200-hour moving average at $3,405. This level now acts as the gateway for a potential extension of the bullish move.

What’s Next for ETH?

If ETH maintains its strength above the 100 MA and successfully breaks through the 200 MA, the chart suggests a continuation toward the harmonic PRZ. This target zone sits between $3,538.65 (0.886 Fibonacci) and $3,657.05 (the full extension), marking the potential completion area of the Bearish Bat pattern. Historically, this region acts as a significant decision point where price may face heavier resistance.

However, if ETH loses the 100-hour MA or shows hesitation before reaching the 200 MA, the market could slip into a minor pullback or sideways phase. Such a move would likely give bulls time to build renewed momentum before attempting another breakout.

For now, ETH’s market structure is improving rapidly. Higher lows, reclaiming moving averages, and a clearly progressing harmonic pattern all point to the possibility of additional upside in the near term.