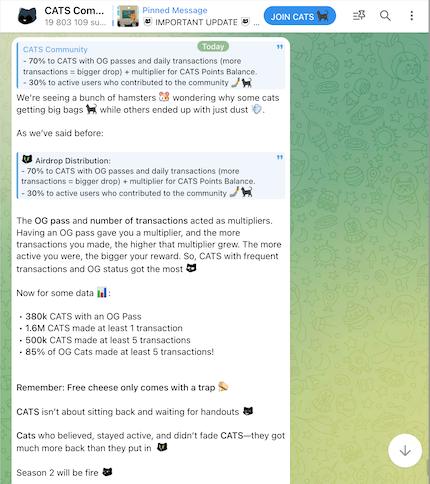

CATS on why some cats getting big bags while others ended up with just dust

We’re seeing a bunch of hamsters wondering why some cats getting big bags while others ended up with just dust.

As we’ve said before:

Airdrop Distribution:

- 70% to CATS with OG passes and daily transactions (more transactions = bigger drop) + multiplier for CATS Points Balance.

- 30% to active users who contributed to the community

The OG pass and number of transactions acted as multipliers. Having an OG pass gave you a multiplier, and the more transactions you made, the higher that multiplier grew. The more active you were, the bigger your reward. So, CATS with frequent transactions and OG status got the most

Now for some data :

• 380k CATS with an OG Pass

• 1.6M CATS made at least 1 transaction

• 500k CATS made at least 5 transactions

• 85% of OG Cats made at least 5 transactions!

Remember: Free cheese only comes with a trap

CATS isn’t about sitting back and waiting for handouts

Cats who believed, stayed active, and didn’t fade CATS—they got much more back than they put in

Season 2 will be fire

P.S. We know that a small group of CATS still has issues with uncounted OG passes or transactions, even though most of the problems were handled and solved before the airdrop. We want to ensure that no cat receives fewer CATS than they deserve

Soon, we’ll be opening a CATS hotline for airdrop/balance issues to make sure every cat is taken care of

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Key Bitcoin price levels to watch ahead of 2025’s last FOMC meeting

Navigating the Fluctuations of Bitcoin in Late 2025: Adaptive Risk Management Approaches for an Evolving Cryptocurrency Landscape

- Bitcoin's November 2025 price swung between $80,553 and $91,000, eroding 25% of value amid macroeconomic and regulatory pressures. - Volatility stemmed from technical breakdowns, leveraged liquidations, and market makers' gamma exposure shifts below $85,000. - U.S. GENIUS Act and EU MiCA framework provided regulatory clarity, boosting institutional adoption through compliant ETPs and stablecoins. - Investors adopted risk-rebalance strategies: options hedging, macro-adjusted DCA, and diversified crypto tr

Bitcoin Experiences Steep Drop: What Causes the Sudden Sell-Off?

- Bitcoin plummeted 30% in November 2025, erasing $1 trillion in market cap amid macroeconomic pressures and institutional profit-taking. - Central bank uncertainty (Fed, ECB) and leveraged liquidations amplified the selloff, with ETF outflows exceeding $3.79 billion. - Bitcoin's 0.90 correlation with the S&P 500 highlighted its shift from "digital gold" to risk-on asset, contrasting gold's 55% surge. - On-chain metrics revealed structural weaknesses: hash rate declines, miner revenue drops, and divergent

PENGU USDT Sell Alert and Stablecoin Price Fluctuations: Evaluating Algorithmic Dangers Amid Changing Cryptocurrency Markets

- PENGU USDT's 2025 volatility reignited debates on algorithmic stablecoin fragility amid regulatory uncertainty and post-UST market skepticism. - Technical analysis showed conflicting signals: overbought MFI vs bearish RSI divergence, with critical support/resistance levels at $0.010-$0.013. - $66.6M team wallet outflows and 32% open interest growth highlighted liquidity risks, while UST's collapse legacy exposed algorithmic design flaws. - Investors increasingly favor fiat-backed alternatives like USDC ,