MSTR at a Crossroads: CEO Hints at Bitcoin Selloff and What It Means for MSTR Stock, Shareholders, and the Market

TL;DR:

-

MSTR CEO Phong Le has signaled that the company could sell part of its Bitcoin holdings if financial pressures mount—a historic shift from its previous “never sell” strategy.

-

The announcement triggered immediate volatility in MSTR stock, with prices dropping sharply as investors reacted to the new risk landscape.

-

If Bitcoin’s price falls below $23,000, MSTR could face insolvency, but levels above $80,000 are currently seen as safe for the company.

-

Most of MSTR’s debt comes due in 2028; the ability (or inability) to refinance will decide both the company’s survival and could impact Bitcoin’s price if a large BTC selloff happens.

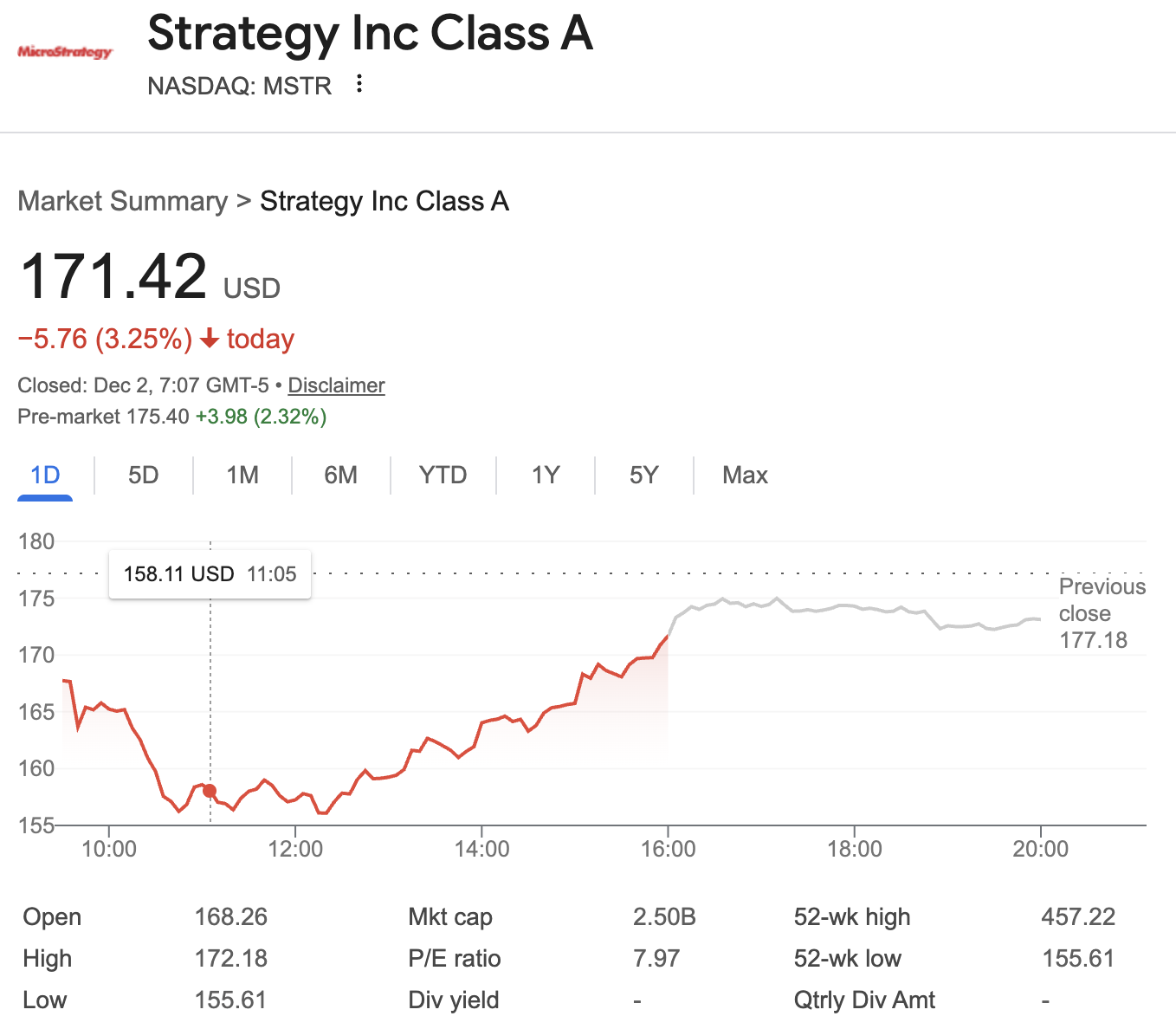

In a pivotal shift for the cryptocurrency and equity markets, Strategy Inc., listed under the ticker MSTR, is under the spotlight after its CEO suggested for the first time that the company could sell part of its massive Bitcoin (BTC) reserves. This move marks a significant deviation from Strategy’s steadfast “buy and hold” approach, fueling immediate volatility in MSTR stock and igniting broader discussions about the future of institutional Bitcoin holders. As the company navigates new risks and changing market realities, understanding the interplay between MSTR, its stock price, and Bitcoin price trajectory has rarely been more crucial.

Source: Google Finance

MSTR CEO’s Bitcoin Warning: A Turning Point for the Company

For years, Strategy Inc. (MSTR) and its Executive Chairman Michael Saylor represented the ultimate Bitcoin HODLers. The corporate strategy was simple yet aggressive: leverage debt and equity to purchase and hold Bitcoin long-term. However, a recent podcast appearance by CEO Phong Le redefined the narrative. Le openly acknowledged that, if financial ratios deteriorate and capital markets close, MSTR may resort to selling Bitcoin to maintain operations and meet obligations.

This declaration is more than a passing comment—it signals the possibility of Bitcoin no longer serving solely as a strategic reserve, but becoming a liquid asset for survival. The market’s reaction was instant, with investors interpreting the statement as a profound change in risk tolerance.

Market Reactions: How MSTR Stock Responds to Bitcoin and Strategy Shifts

Immediately following the CEO’s hint at a possible Bitcoin liquidation, MSTR stock experienced significant volatility. Shares tumbled as much as 12.2% intraday, reflecting widespread investor concern about the sustainability of MSTR’s “Bitcoin-fueled” business model. The stock’s trajectory has become tightly coupled to both the company’s Bitcoin reserves and management’s evolving stance.

In recent quarters, MSTR stock has been buffeted by factors including:

-

The diminishing premium on MSTR compared to its Bitcoin net asset value (mNAV)

-

Heavy selling by institutional investors such as BlackRock, Vanguard, and Capital International, who've begun rotating towards spot Bitcoin ETFs

-

Threats of index removal due to a high ratio of crypto assets on MSTR’s balance sheet—currently 77%, well above the threshold for remaining in some equity indices

This sensitivity underscores how updates from Strategy Inc. now have the power to move not just MSTR stock, but broader crypto and equity markets.

Is MSTR Stock Safe if Bitcoin Falls under $80,000? Understanding the Financial Break-even Point

MSTR’s financial model is now inextricably linked to Bitcoin’s price. The company’s ongoing accumulation, funded by a mix of convertible bonds, preferred stock, and at-the-market equity issuance, has steadily elevated the financial break-even point.

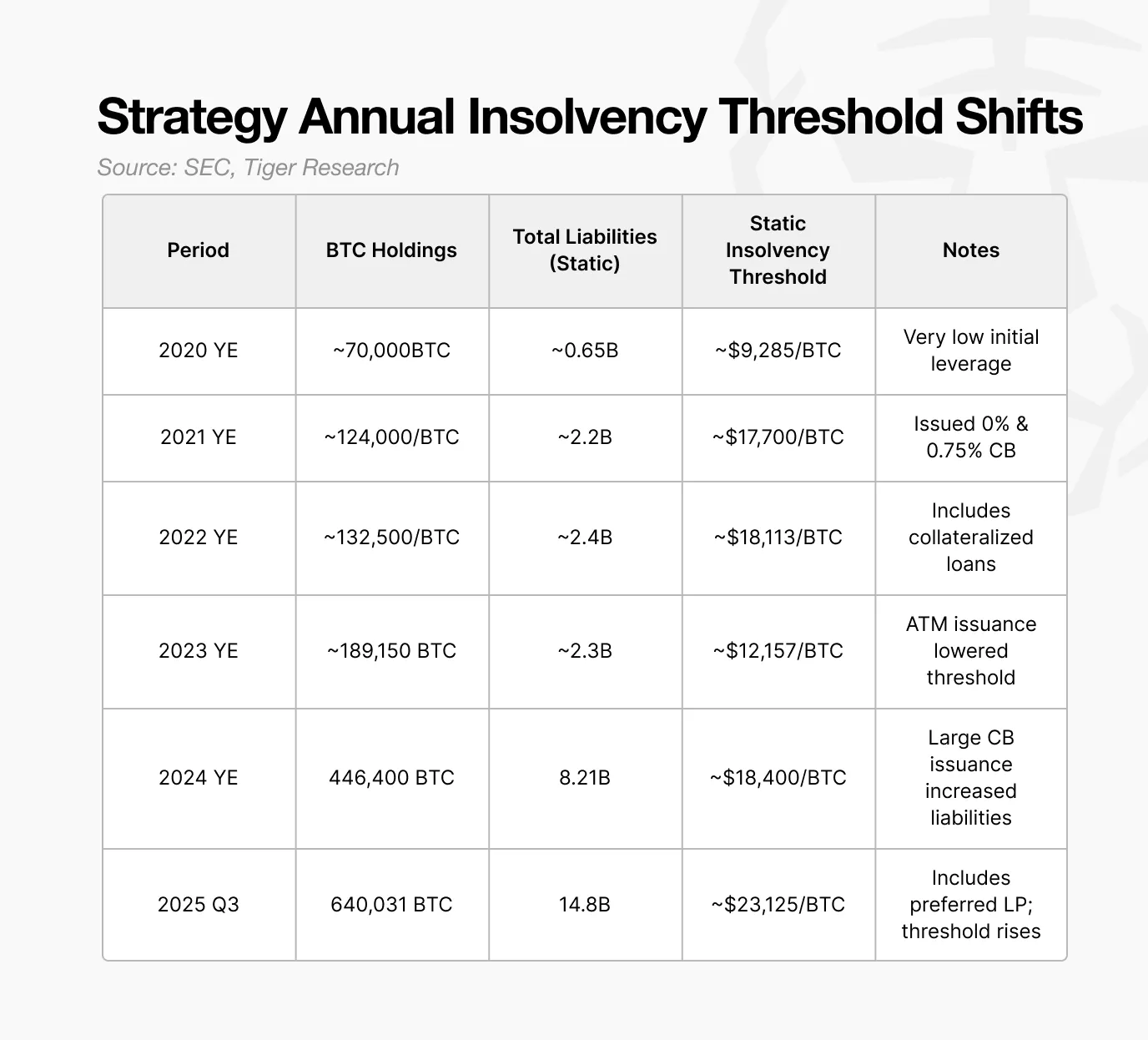

In 2025, MSTR’s static bankruptcy threshold—the Bitcoin price where its holdings no longer cover its debts—has risen to approximately $23,000, up from $12,000 in 2023 and $18,000 in 2024. This upward trend is the direct result of increased leverage.

Key considerations:

-

At or above $80,000 per Bitcoin, MSTR remains solidly solvent with significant surplus.

-

If Bitcoin price plunges below $30,000, MSTR’s risk profile accelerates sharply.

-

Sub-$23,000 Bitcoin would result in the company’s liabilities exceeding Bitcoin asset value, potentially triggering forced asset sales or insolvency.

The growing break-even price highlights why the CEO’s recent warning to consider liquidating Bitcoin is both prudent and necessary.

Debt, Dilution, and the 2028 Challenge: What’s Next for MSTR and Its Bitcoin Holdings

MSTR’s capital structure has transformed, with a sharp increase in debt and complex instruments like convertible bonds and high-yield preferred shares. While these measures allowed MSTR to amass over 650,000 Bitcoins, they have also set a ticking clock.

Most convertible bonds will mature or may be put back by holders in 2028. A critical danger looms: if Bitcoin stagnates or declines and capital markets tighten, MSTR may be forced to sell a significant portion of its Bitcoin holdings to meet obligations, potentially up to 71,000 BTC (a figure that could account for 20%-30% of daily spot market volume at $90,000 per BTC). Such an event could not only depress Bitcoin’s price sharply but also trigger a negative feedback loop of further selling and financial contagion.

To buy time, MSTR recently amassed $1.44 billion in cash reserves, signaling intent to cover near-term liabilities and dividends. Yet, this safety net is a costly measure that dilutes existing shareholder value, reflecting a sober shift from the company’s earlier “Bitcoin perpetual motion machine” narrative.

The End of an Era: Why the Old MSTR Stock and Bitcoin Growth Model Is Over

The earlier bull-market-era logic was simple: issue MSTR stock, buy Bitcoin, watch both rise in tandem, and repeat. But as spot Bitcoin ETFs arrived and mNAV premiums on MSTR stock collapsed, this flywheel came to a halt. With institutional investors pivoting away and stock issuances now diluting returns without generating incremental value, market enthusiasm waned.

Moreover, credit agencies have downgraded MSTR to junk status (S&P B–), and MSTR stock faces possible exclusion from major indices due to its non-operating, “fund-like” status. Index removal could spark billions in forced selling, deepening liquidity challenges.

MSTR’s fate is now irrevocably tied not only to Bitcoin’s trajectory but also to its capital management and regulatory perception.

Could MSTR Bankruptcy Crash Bitcoin Pirce? Exploring the Real Risks

Should 2028 refinancing efforts fall short, MSTR would have little choice but to liquidate a substantial proportion of its Bitcoin holdings. The crypto market could reel from such a sale, igniting a self-reinforcing spiral of price pressure, shaken investor confidence, and regulatory scrutiny. This is why analysts, regulators, and competitors all closely monitor MSTR’s moves—the company has become a bellwether for the sustainability of leveraged corporate Bitcoin adoption.

What MSTR’s Bitcoin Strategy Teaches About Risk and Opportunity

MSTR is no longer merely a proxy for indirect Bitcoin exposure. Its story illustrates a broader evolution: from idealistic “all-in” speculation to a more conservative stance featuring reserve buffers and active risk management. While this approach introduces short-term pain—shareholder dilution, loss of the growth flywheel, and greater transparency—it is a pragmatic adaptation to a maturing crypto-financial ecosystem.

The shift also serves as a template for other public companies contemplating large-scale Bitcoin strategies, emphasizing the need for robust financial engineering and contingency planning in a market notorious for volatility.

Conclusion

The latest move by Strategy Inc.’s CEO to consider a Bitcoin selloff signals a new era for both MSTR and the wider world of institutional crypto adoption. For MSTR stock investors, understanding the intricate relationship between the company’s financial obligations and Bitcoin’s price has never been more critical. As the 2028 refinancing window approaches, MSTR’s evolving risk management will shape not only its own destiny, but potentially the stability and reputation of Bitcoin itself. Staying informed about these developments is essential for anyone with exposure to MSTR stock, Bitcoin, or the intersection of traditional finance and digital assets.