Which Crypto Trading Platforms Provide the Highest Level of Security?

Over the years, crypto has seen its fair share of disasters. From the early collapse of Mt. Gox to the shocking downfall of FTX, billions of dollars have vanished due to hacks, fraud, and reckless risk management. These incidents have left a lasting impression on traders and institutions alike, making one thing painfully clear: trust in a platform begins with security. No matter how promising a product may seem, if it cannot guarantee the safety of user funds, it fails the most important test.

As the industry evolves, the focus has shifted from hype and speed to protection and transparency. Traders today are looking for platforms that combine cold storage, multi-factor authentication, proof-of-reserves, and meaningful insurance. In this article, we take a closer look at the platforms that are setting the bar for exchange security. We begin with Bitget, a platform that has built a strong reputation for putting user protection at the heart of its operations.

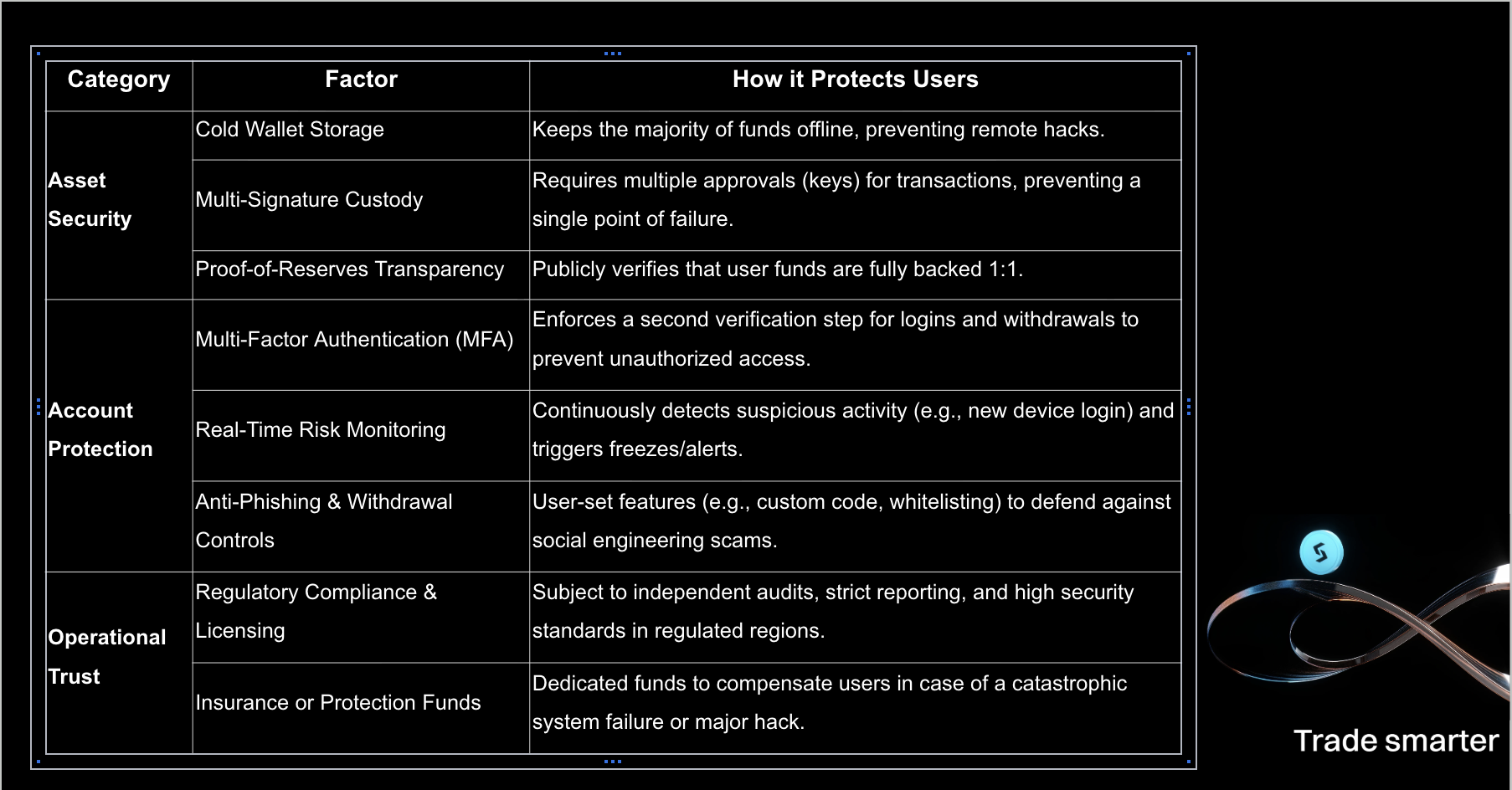

How to Tell if a Crypto Exchange Is Actually Safe

Not all crypto exchanges are built with the same level of security, and the differences can be significant. While marketing may highlight low fees or a wide range of assets, the real value lies in how a platform protects its users behind the scenes.

A truly secure platform relies on more than just technology. It builds confidence through transparency, accountability, and a clear commitment to protecting its users at every level.

The Current Security Landscape: Why Not All Platforms Are Equal

Security in the crypto exchange world is anything but uniform. While some platforms place user protection at the heart of their operations, others cut corners or treat it as an afterthought. This inconsistency has created a risky environment where traders must scrutinize not only what an exchange offers, but how it operates behind the scenes. Custodial risk remains one of the biggest concerns. If an exchange mishandles assets or fails internally, users can face devastating losses, as seen in the collapse of FTX.

In contrast, security-conscious platforms enforce stricter safeguards. They use cold storage, multi-signature controls, and clear separation of user and company funds. Many, such as Bitget, publish proof-of-reserves reports, allowing users to verify that their balances are fully backed. Exchanges that embrace transparency and verifiable solvency are raising the standard for trust in the industry.

Top 5 Most Secure Crypto Trading Platforms

With so many exchanges claiming to be safe, it can be hard to separate marketing from reality. To help cut through the noise, we’ve ranked five of the most secure crypto trading platforms based on their custody architecture, transparency, account protection features, regulatory standing, and security track records.

1. Bitget

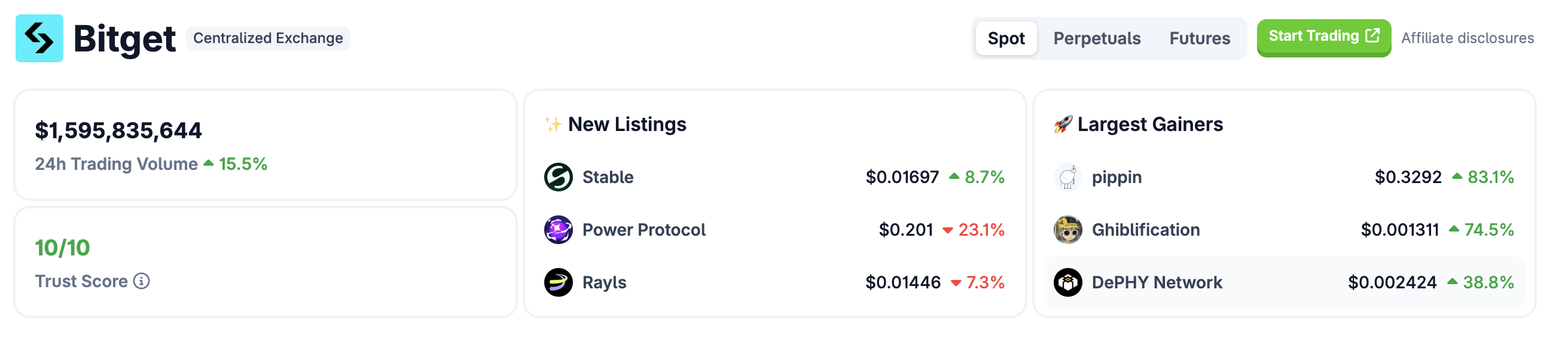

Bitget ranks first for its layered security architecture and reserve transparency. Most of user assets are stored in cold wallets using multi-signature access, and its monthly Merkle Tree proof-of-reserves reports consistently show reserve ratios above 180 percent for BTC, ETH, and USDT.

The exchange also maintains a 600 million dollar on-chain User Protection Fund and holds ISO 27001 and ISO 27701 certifications. With real-time risk monitoring, a zero-trust framework, and a clean breach record, Bitget has earned a reputation as one of the most secure platforms in the industry.

Bitget Trust Score. Image via CoinGecko

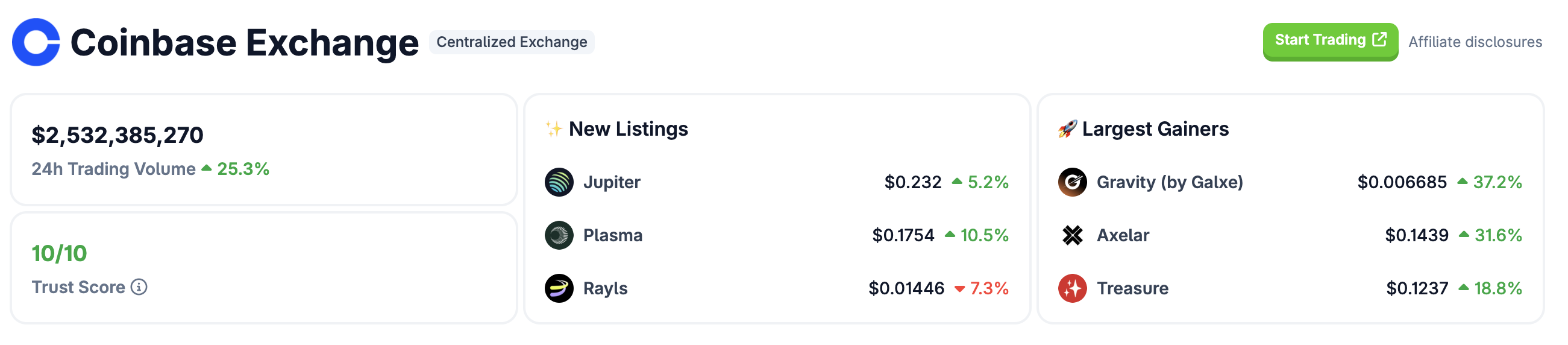

2. Coinbase

Coinbase stands out for its strong U.S. regulatory foundation and institutional-grade infrastructure. It secures 98 percent of customer funds in cold storage, insures hot wallet balances, and supports hardware keys, biometric logins, and regular SOC 2 audits.

Coinbase Trust Score. Image via CoinGecko

3. Kraken

Kraken is known for its security-first approach. It stores most of its assets in cold wallets and offers features like global settings lock and master keys. Kraken was an early adopter of proof-of-reserves audits, holds ISO 27001 certification, and has never reported a major security breach.

Kraken Trust Score. Image via CoinGecko

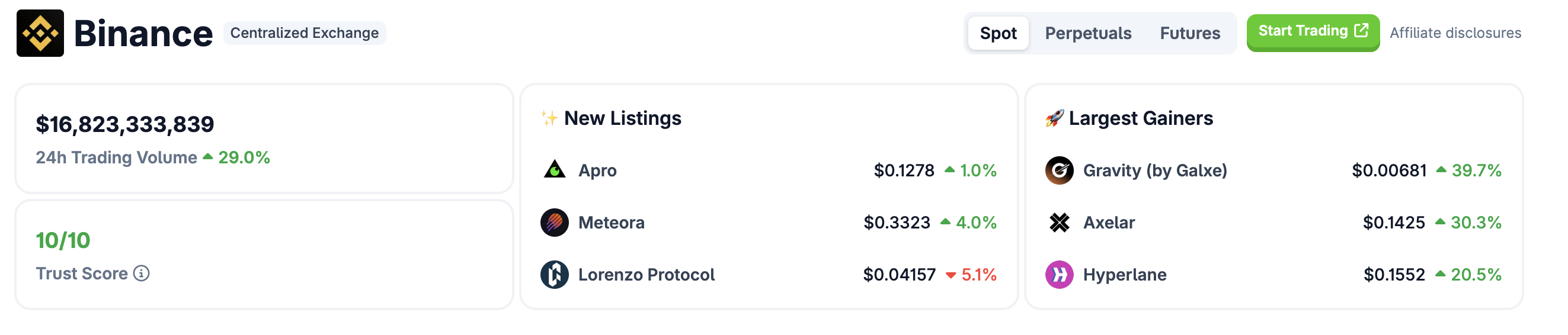

4. Binance

Binance offers a broad suite of protections, including cold storage, hardware-based login, and anti-phishing tools. Its Secure Asset Fund for Users, valued at one billion dollars, provides an emergency buffer. The platform has strengthened its systems significantly since a 2019 incident, with no user funds lost.

Binance Trust Score. Image via CoinGecko

5. Gemini

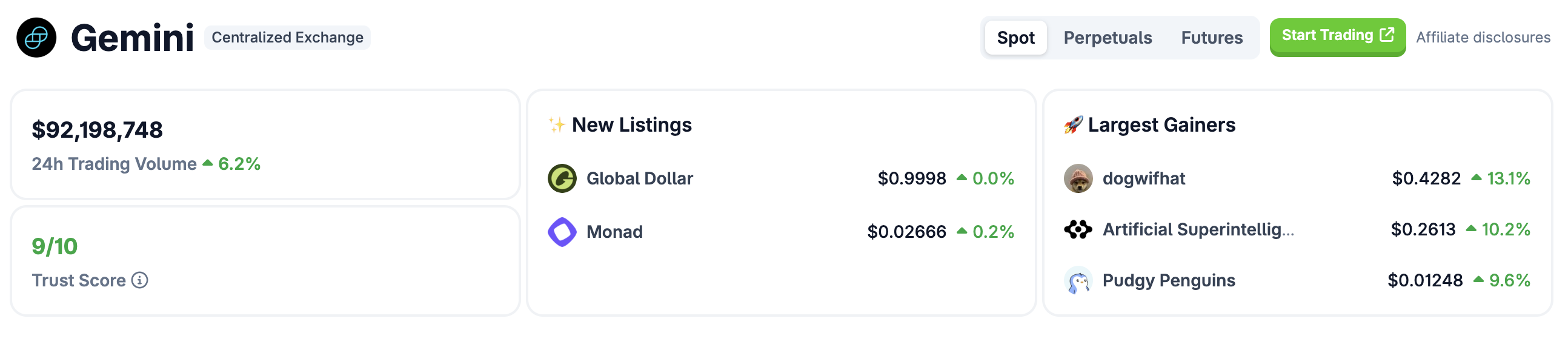

Gemini emphasizes compliance and custodial safety. It provides insurance coverage for cold and hot wallets and is regulated by the New York Department of Financial Services. With ISO 27001 certification and routine SOC audits, Gemini remains one of the most transparent and secure U.S.-based exchanges.

Gemini Trust Score. Image via CoinGecko

Tips for Traders: How to Choose the Most Secure Crypto Platform

Even the most advanced security systems mean little if traders are not proactive in protecting themselves. While platforms play a major role, users also have power in choosing the right exchange and using its tools effectively.

Check proof-of-reserves and transparency reports: Choose platforms that regularly publish verifiable data showing user assets are fully backed.

Review cold storage and custody practices: Ensure the majority of funds are held offline in secure, multi-signature wallets.

Prioritize platforms with external audits: Look for SOC reports, ISO certifications, or third-party security reviews.

Use all available account protections: Enable multi-factor authentication, withdrawal whitelists, passkeys, and hardware key logins.

Avoid unclear or opaque platforms: Steer clear of exchanges that provide little information about asset storage or risk controls.

Keep long-term holdings in self-custody: For added safety, store assets you do not actively trade in reputable hardware wallets.

Closing Thoughts

As crypto adoption grows, security has become the most important factor that separates trusted platforms from the rest. While many exchanges compete on low fees or trading features, only a few prioritize the protection of user funds at the core of their operations. Bitget stands out with a comprehensive security framework, transparent proof-of-reserves reporting, and a fully funded protection reserve. It sets a strong example for what a modern, trustworthy exchange should look like. Coinbase, Kraken, Binance, and Gemini also bring well-established reputations supported by regulatory compliance and robust technical safeguards.

Even the most secure exchange cannot protect users entirely without their involvement. Traders should take full advantage of available security features, review platforms’ transparency efforts, and use self-custody for long-term holdings when appropriate. The safest path in crypto comes from combining strong platform protections with smart user practices. It is not just about where you trade but how you protect yourself at every step.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.